Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

Following a five-week winning streak, stock markets experienced a decline, prompting investor worries about potential overvaluation. Major indices, including the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite, dropped due to selling pressure on Big Tech stocks. However, Bitcoin hit a 19-month high while gold reached unprecedented levels, benefiting companies like Marathon Digital, Riot Platforms, MicroStrategy, and Coinbase. The market shift away from tech shares, despite the S&P 500 hitting highs, led to speculation about future rate cuts from central banks, especially as Federal Reserve Chairman Jerome Powell attempted to moderate expectations. European and Asia-Pacific markets reflected mixed performances amid predictions of interest rate cuts in 2024. Currency markets saw significant movements, with the dollar index surging and the euro facing downward pressure against the dollar due to Treasury yield recoveries and market sentiment regarding potential ECB and Fed rate cuts. Meanwhile, gold prices dropped significantly following the resurgence in Treasury yields and a strengthening dollar.

Stocks experienced a dip after a continuous five-week winning streak, raising concerns among investors about potential overvaluation in the market. The Dow Jones Industrial Average closed with a 0.11% drop, the S&P 500 fell by 0.54%, and the Nasdaq Composite declined by 0.84%, attributed to the selling of Big Tech shares, which had been driving the market’s gains. Conversely, Bitcoin surged past $41,000, hitting a 19-month high, while gold reached its highest intraday level ever, leading to gains for companies like Marathon Digital, Riot Platforms, MicroStrategy, and Coinbase.

The pullback was marked by a shift away from sectors that had been driving market growth for almost a year, particularly technology shares. Despite this, the S&P 500 closed at its highest level since March 2022, with year-to-date gains nearing 20%. The Dow and Nasdaq also experienced significant increases in 2023. Speculation about future rate cuts from major central banks persisted, even as Federal Reserve Chairman Jerome Powell attempted to temper these expectations.

In Europe, markets saw a mixed performance, largely lower, reflecting a global pause in the recent rally amid predictions of interest rate cuts from major central banks in 2024. Gold prices surged, hitting a record high, attributed to geopolitical uncertainty, a potentially weaker U.S. dollar, and anticipated interest rate cuts in the coming year. In Asia-Pacific, markets were also mixed as investors awaited upcoming economic data and crucial inflation readings later in the week.

Data by Bloomberg

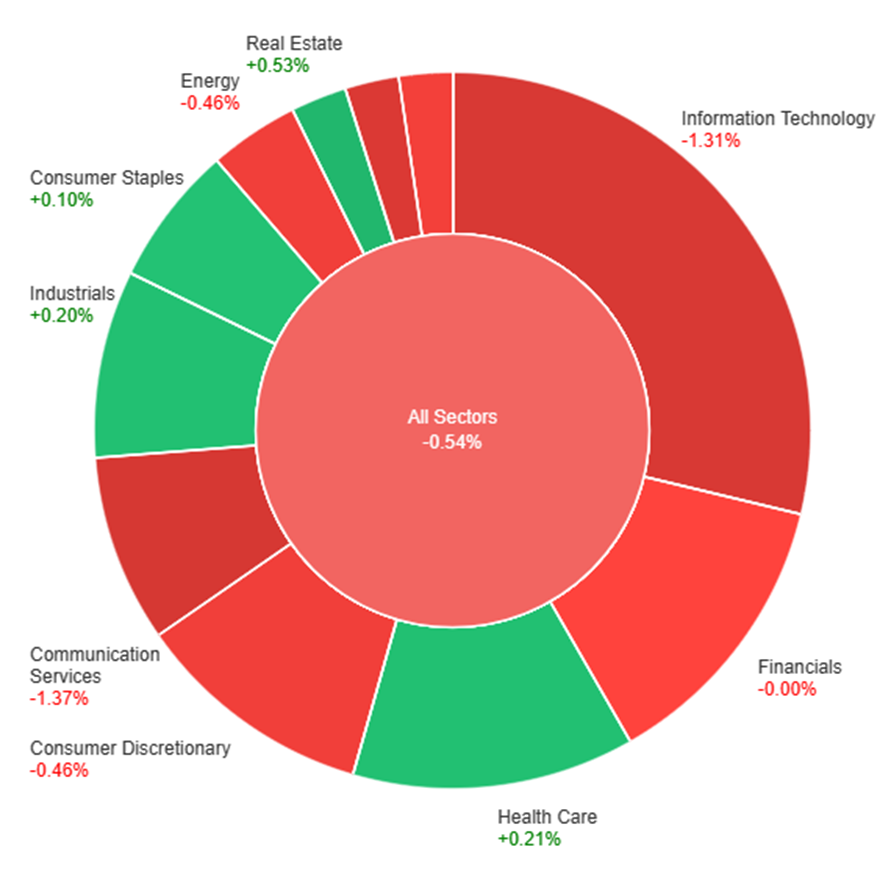

On Monday, the market experienced a slight overall decline of 0.54%. Real Estate stood out with a positive increase of 0.53%, followed by Health Care and Industrials with gains of 0.21% and 0.20%, respectively. Conversely, Materials took a significant hit, dropping by 1.19%, while Information Technology and Communication Services also experienced notable declines of 1.31% and 1.37%, respectively. Financials remained relatively stable, showing no change, and other sectors like Utilities, Energy, and Consumer Discretionary saw moderate decreases ranging from 0.39% to 0.46%.

The currency market experienced significant movements, particularly in the dollar index, which surged by 0.6%. This rise was attributed to the recovery of Treasury yields from their previous substantial decline in October and November. The upcoming release of crucial U.S. data, coupled with the anticipation of the Federal Reserve meeting, heightened market expectations regarding potential rate cuts by the European Central Bank (ECB) in the following year. Concerns persisted around the Eurozone’s largest economy due to a recent court ruling, further contributing to the speculation of potential ECB rate cuts. The dollar’s momentum was primarily driven by the rebound of 2-year Treasury yields, which recovered a portion of their previous decline, alongside market sentiments that favored possible Fed rate cuts in 2024 unless incoming U.S. economic data alters these expectations.

Meanwhile, the euro faced downward pressure, declining by 0.6% against the dollar, as increasing Treasury yields outweighed minimal gains in bund yields. The EUR/USD pair breached key support levels, including the 200-day moving average line, signaling potential further downside. Market indicators highlighted a decrease in overbought positions, but the expansion of speculative long positions in the market indicated a possibility of continued losses unless forthcoming U.S. data supported expectations of swift Federal Reserve intervention. Additionally, other currencies like the pound sterling saw a contrasting outlook compared to the ECB and Fed, with a potential rate cut by the Bank of England not expected until June, projecting a more conservative 2023 monetary policy. Lastly, gold prices experienced a significant drop, plunging from a record high to $2,020, paralleling the resurgence in Treasury yields and the strengthening dollar.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| AUD | Cash Rate | 11:30 | 4.35% |

| AUD | RBA Rate Statement | 11:30 | |

| USD | ISM Services PMI | 23:00 | 52.2 |

| USD | JOLTS Job Openings | 23:00 | 9.31M |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.