Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

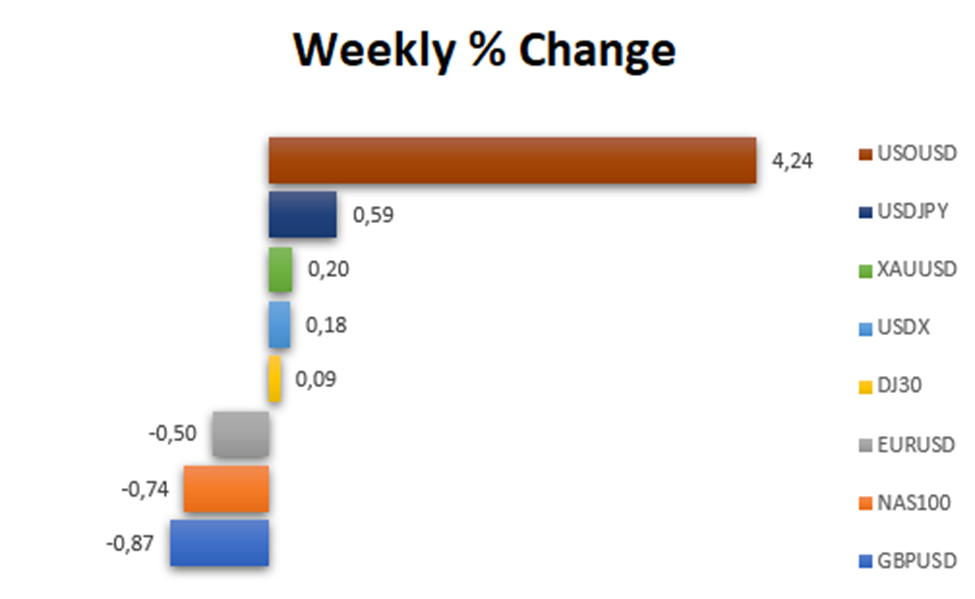

The US dollar embarked on a nine-week winning streak, driven by surging oil prices, concerns about inflation, and assertive statements from the Federal Reserve. This streak resulted in a 0.18% increase in the USD Index.

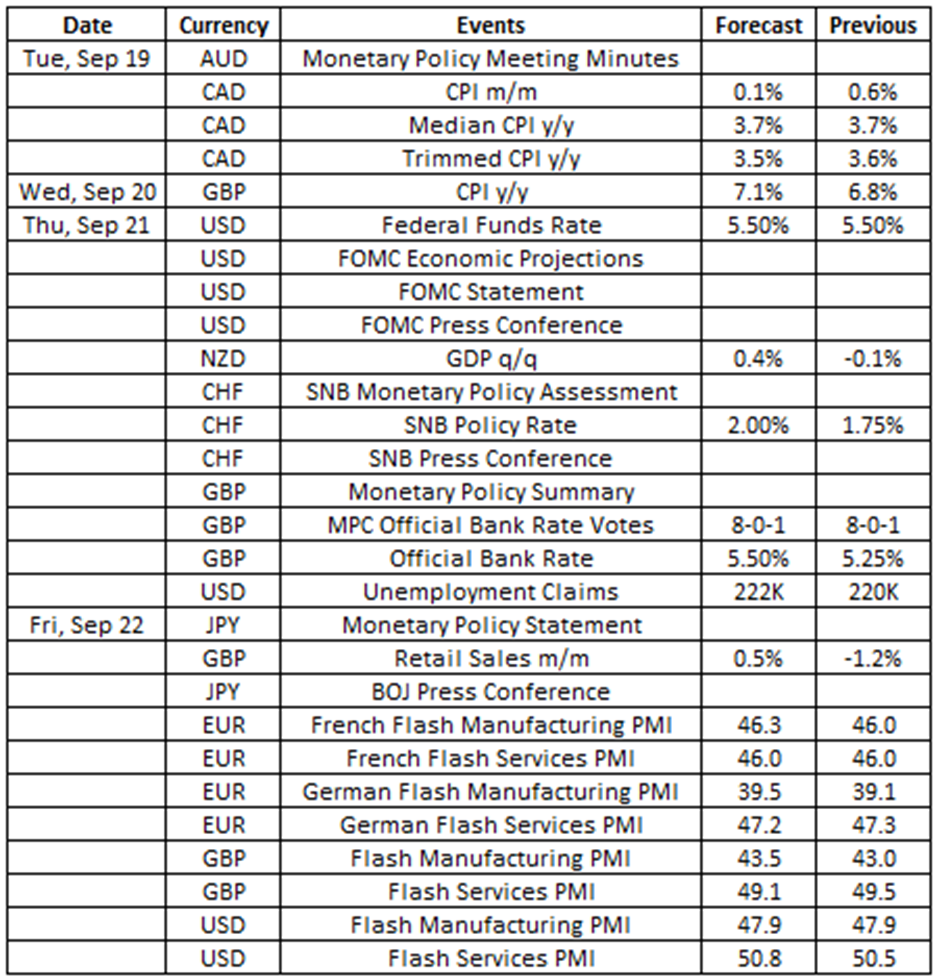

Source: VT Markets Economic Calendar

This week, traders are mainly focused on the rate decisions of major central banks, such as the Federal Reserve, Swiss National Bank (SNB), Bank of England (BOE), and Bank of Japan (BOJ). These decisions have the potential to influence the markets significantly. It’s advisable to exercise caution and stay informed about the latest developments to ensure a successful week of trading.

Here are some notable market highlights for this week:

Consumer prices in Canada rose 0.6% in July 2023, following a 0.1% gain in June 2023.

Analysts expect a 0.6% increase in the figures for August, which are set to be released on 19 September.

Takeaway: The upcoming release of Canada’s CPI data will provide insights into the state of inflation in the country and is poised to be a significant factor in influencing the movement of the Canadian Dollar. Based on the expected figures, there is potential for the Canadian Dollar to strengthen.

The Fed raised its funds rate target to 5.5% in July.

Analysts expect the Fed to keep interest rates at 5.5% following its upcoming meeting on 21 September.

Takeaway: We have the upcoming FOMC Meeting during which the Fed will make decisions regarding its interest rates. This event is expected to generate high volatility in the US Dollar. According to the forecasted numbers, there is a possibility that the US Dollar might weaken.

The SNB raised its policy interest rate by 25 bps to 1.75% during its June meeting. It also raised the possibility of further rate hikes in the future to ensure price stability over the medium term.

The next rate decision will be released on 21 September, with analysts expecting another increase of 25 bps to 2%.

Takeaway: This week, the Swiss Franc will be influenced by the SNB’s rate statement. If the SNB raises its interest rates, we can expect a high volatility movement for the currency.

The BOE raised its policy interest rate by 25 bps to 5.25% during its August 2023 meeting, marking the 14th consecutive increase.

Analysts expect the central bank to raise its rate by another 25 bps to 5.5% at its upcoming meeting on 21 September.

Takeaway: We are anticipating the interest rate decision statement from the Bank of England (BOE), which is expected to generate high volatility for the Great Britain Pound. This decision will offer insights into the economic conditions in the UK. According to the forecasted numbers, the market expects the BOE to raise the interest rate, potentially strengthening the GBP.

The BOJ unanimously decided to keep its key short-term interest rate at -0.1% and 10-year bond yields at 0% during its July 2023 meeting.

For the upcoming meeting on 22 September, analysts anticipate that the central bank will maintain the current interest rate levels.

Takeaway: We anticipate the BOJ Rate Statement this week, which is expected to lead to high volatility in the Japanese Yen. According to the forecasted numbers, there is a possibility that the JPY might weaken.

Germany’s manufacturing PMI increased to 39.1 in August 2023 from 38.8 in July 2023. Meanwhile, the UK’s manufacturing PMI for the same period fell from 45.3 to 43. Additionally, the US’ manufacturing PMI for the same period decreased from 49 to 47.9.

The next set of data will be released on 22 September. Analysts’ predicted manufacturing PMIs are 39 for Germany, 43.6 for the UK, and 48.8 for the US.

Takeaway: We anticipate the upcoming release of Manufacturing PMI data for Germany, the UK, and the US this week. Based on the projected data, we anticipate a potential weakening of their currencies, as the manufacturing sector has not shown signs of expansion.

Germany’s services PMI declined from 52.3 in July 2023 to 47.3 in August 2023. Similarly, the UK’s services PMI declined from 51.5 to 49.5 during this period, while the US’ services PMI also fell from 52.3 to 50.2 during the same period.

Analysts’ predicted services PMIs for September 2023 are as follows: Germany at 47.2, the UK at 49.1, and the US at 50.2.

Takeaway: The upcoming release of Services PMI data for Germany, the UK, and the US will provide insights into the current state of their service industries. Based on the projected data, we expect a potential weakening of their respective currencies, given that the services sector is currently showing signs of slowing down.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.