Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

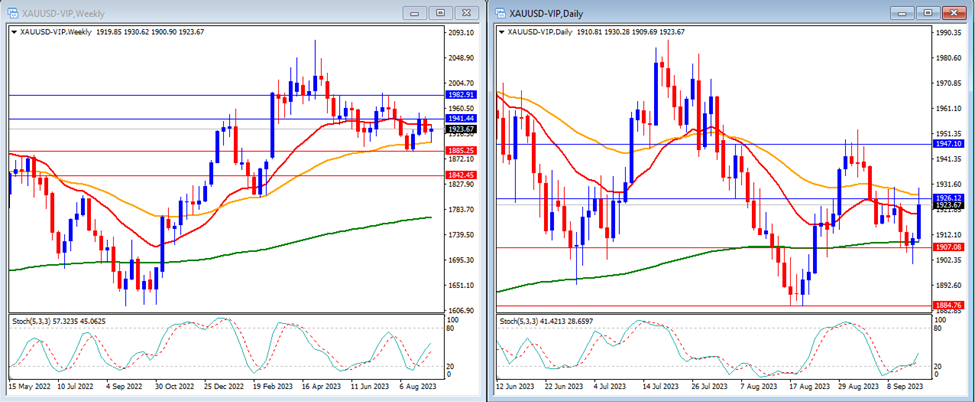

Last week, gold remained flat and kept moving between our support and resistance levels. Gold closed the week at $1,923.

On the weekly timeframe, we can observe that the Stochastic Indicator is ascending in the middle. The gold price is trading below the 20-period moving average and above the 50- and 200-period moving averages.

Our weekly resistance levels are at $1,941 and $1,982, with support levels at $1,885 and $1,842.

On the daily timeframe, the Stochastic Indicator is moving higher after exiting the oversold area, while the price is currently trading below the 50-period moving average but above the 20- and 200-period moving averages.

Our daily resistance levels are at $1,926 and $1,947, with support levels at $1,907 and $1,884.

Conclusion: We will have some high-impact data from the US this week. We could see a positive sentiment for gold as the market expects the Fed to maintain its interest rates. Our expectation is for gold to move higher, with an attempt to reach our resistance level at $1,947.

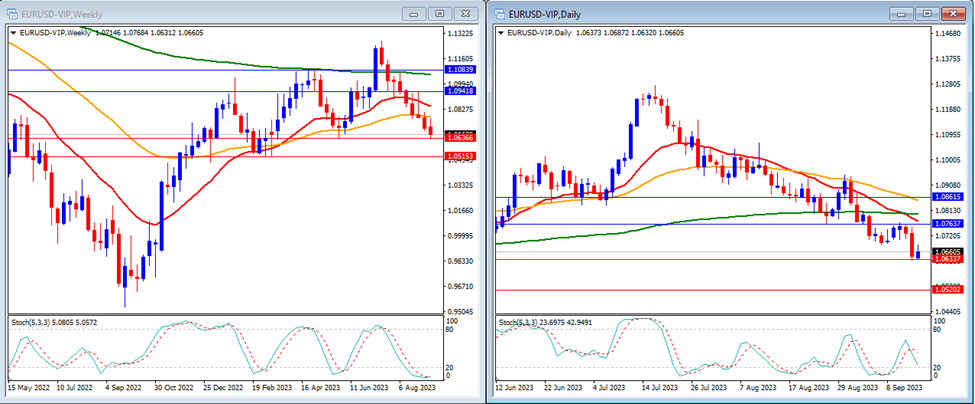

Last week, EURUSD moved lower and reached our support levels. EURUSD closed the week at 1.0660.

On the weekly timeframe, the Stochastic Indicator is within the oversold area. The price is trading below the 20-period, 50-period, and 200-period moving averages.

Our weekly resistance levels are at 1.0941 and 1.1083, with support levels at 1.0636 and 1.0515.

On the daily timeframe, the Stochastic Indicator is moving lower in the middle, while the price is moving below the 20, 50 and 200-period moving averages.

Our daily resistance levels are at 1.0763 and 1.0861, while the support levels are at 1.0633 and 1.0520.

Conclusion: This week, we anticipate high volatility for EURUSD due to the impact of the Fed and BoE interest rate decisions. The current market sentiment is not favouring the EUR, but we may see a slight positive movement as the Fed’s decision could weaken the USD. We expect EURUSD to experience a slight upward movement for this week and reach our resistance level at 1.0763.

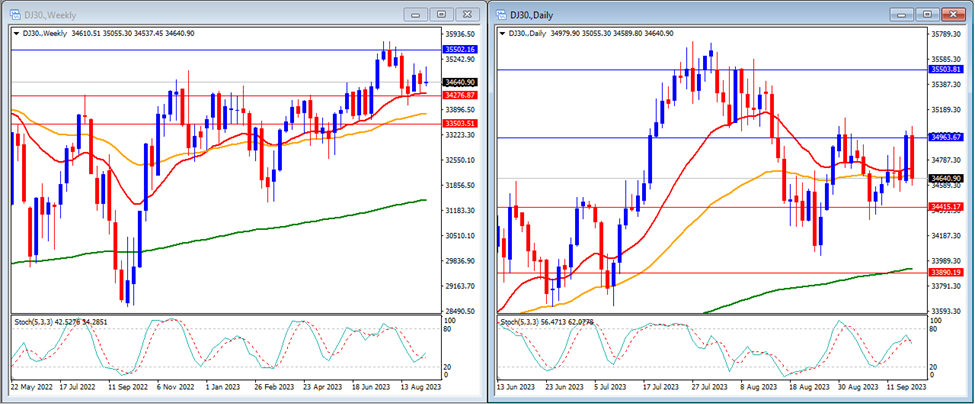

Last week, the DJ30 traded flat and kept moving between our support and resistance levels. The DJ30 closed the week at 34,640.

On the weekly timeframe, we can observe that the Stochastic Indicator is attempting to make a bullish crossover just above the oversold area. The price is trading above the 20-period, 50-period, and 200-period moving averages.

Our weekly resistance levels are at 35,502 and 36,465, with support levels at 34,276 and 33,503.

On the daily timeframe, we can see that the stochastic indicator is trying to cross back lower just below the overbought area. The price is moving below the 20 and 50, but still above the 200-period moving averages.

Our daily resistance levels are 34,963 and 35,503, with support levels at 34,415 and 33,890.

Conclusion: The US stock market is expected to face a week of high volatility due to the upcoming interest rate decision from the Fed. We might witness a slight downward movement in the DJ30, potentially reaching our support level of 34,415.

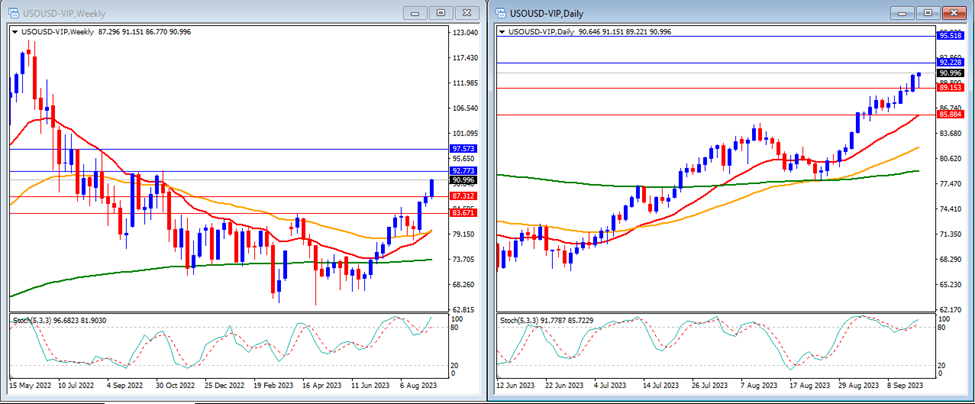

Last week, USOUSD (Oil) moved higher and broke above our resistance levels. The pair closed the week at 90.99.

On the weekly timeframe, we can observe that the Stochastic Indicator is ascending near the overbought area. The price is trading above the 20-period, 50-period, and 200-period moving averages.

Our weekly resistance levels are 92.77 and 97.57, with support levels at 87.31 and 83.67.

On the daily timeframe, the Stochastic Indicator is situated within the overbought area. The price is trading above the 20-period, 50-period, and 200-period moving averages.

Our daily resistance levels are at 92.22 and 95.51, while support levels are at 89.15 and 85.88.

Conclusion: We anticipate another significant movement in USOUSD based on the latest sentiment surrounding it. There’s a possibility of an upward movement, with the potential for USOUSD to reach our next resistance level at 92.22.

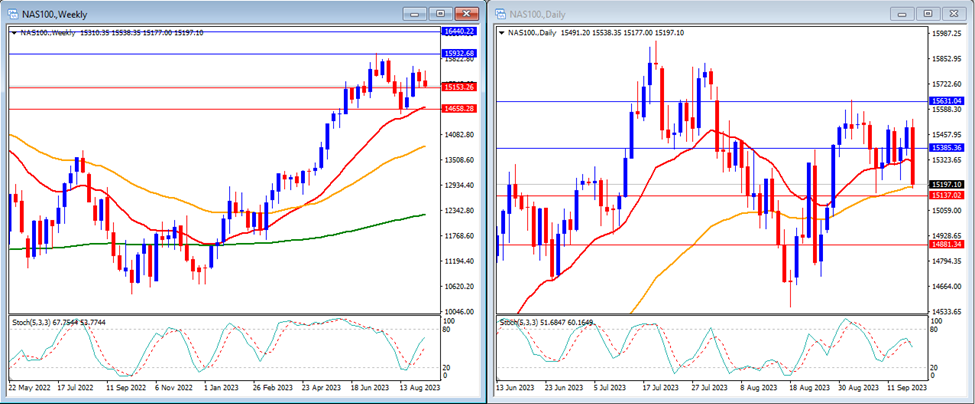

Last week, the NAS100 moved slightly lower and reached our support level. The NAS100 closed the week at a lower level of 15,197.

On the weekly timeframe, we can see that the Stochastic Indicator is moving higher in the middle. The price is currently above the 20, 50, and 200-period moving averages.

Our weekly resistance levels are 15,932 and 16,440, with support levels at 15,153 and 14,658.

On the daily timeframe, the stochastic indicator is moving lower in the middle. The price is now moving below the 20, but still above the 50 and 200-period moving averages.

Our daily resistance levels are currently at 15,385 and 15,631, while support levels are at 15,137 and 14,881.

Conclusion: The US stock market is expected to face a week of high volatility due to the upcoming interest rate decision from the Fed. We might witness a slight downward movement in the NAS100, potentially reaching our support level at 15,137.

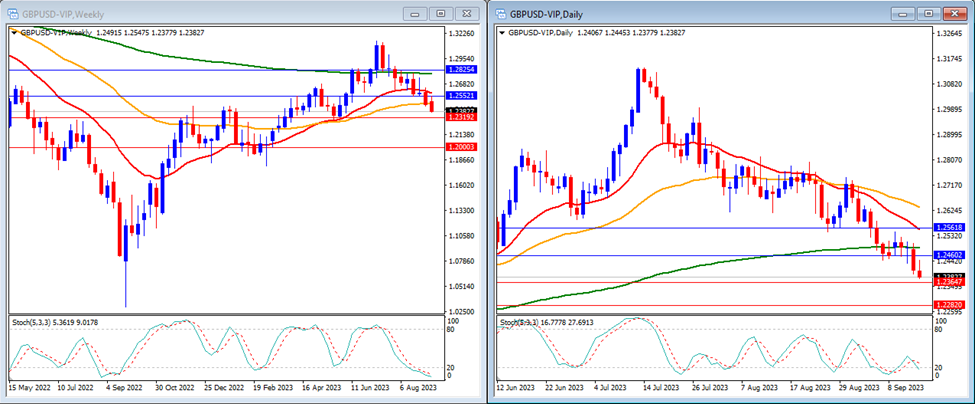

Last week, GBPUSD moved lower and broke below our support levels. GBPUSD closed the week at 1.2382.

On the weekly timeframe, the Stochastic Indicator is situated within the oversold area. The price is trading below the 20-period, 50-period, and 200-period moving averages.

Our weekly resistance levels are at 1.2552 and 1.2825, while support levels are at 1.2319 and 1.2000.

On the daily timeframe, our stochastic indicator is moving lower just above the oversold area. The price is below the 20, 50, and 200-period moving averages.

Our daily resistance levels are now at 1.2460 and 1.2561, while support levels are at 1.2364 and 1.2282.

Conclusion: This week, we anticipate high volatility in GBPUSD due to the interest rate decisions from the Bank of England and the Fed. We expect the possibility of upward movement, with GBPUSD potentially reaching our resistance level at 1.2460.

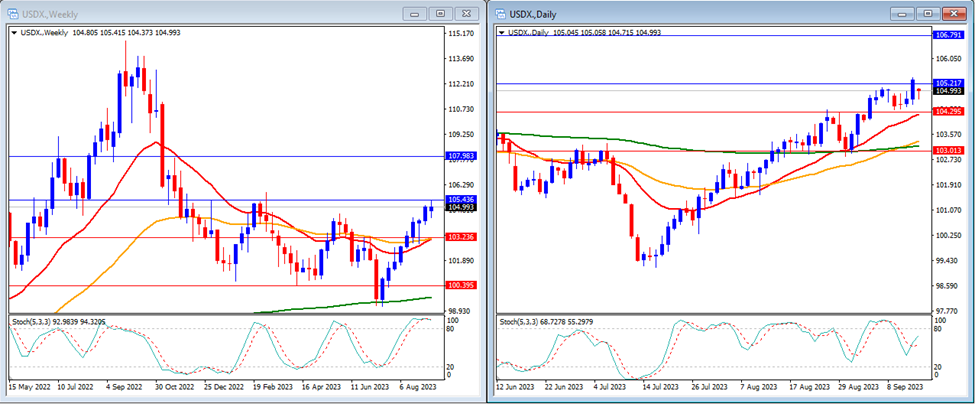

Last week, the USD Index traded flat but reached our resistance levels. The USD Index closed the week at 104.99.

On the weekly timeframe, we can see that the Stochastic Indicator is moving inside the overbought area. The price is currently above the 20, 50, and 200-period moving averages.

Our weekly resistance levels are 105.43 and 107.98, with support levels at 103.23 and 100.39.

On the daily timeframe, the Stochastic Indicator is trying to cross back higher in the middle. The price is now above the 20, 50, and 200-period moving averages.

Our daily resistance levels are 105.21 and 106.79, with support levels at 104.29 and 103.01.

Conclusion: This week, we expect high volatility in the USD Index due to the interest rate decision from the Fed. We anticipate a potential downward movement in the USD Index, with the possibility of reaching our support level at 104.29.

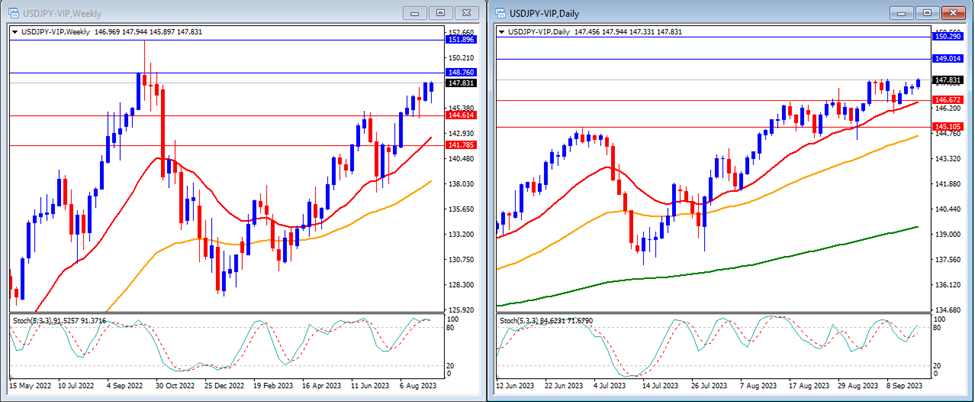

Last week, USDJPY traded flat and continued to move within our support and resistance levels. USDJPY closed the week at 147.83.

On the weekly timeframe, we can observe that the Stochastic Indicator is situated within the overbought area. The price is trading above the 20-period, 50-period, and 200-period moving averages.

Our weekly resistance levels are 148.76 and 151.89, with support levels at 144.61 and 141.78.

On the daily timeframe, the stochastic indicator is moving higher targeting the overbought area. The price is now above the 20, 50, and 200-period moving averages.

Our daily resistance levels are currently at 149.01 and 150.29, while the support levels are at 146.67 and 145.10.

Conclusion: We expect a week of high volatility for USDJPY, as the market awaits the interest rate decisions from both the Bank of Japan and the Fed. Additionally, the market remains watchful for any potential intervention by the Bank of Japan in the currency market. We anticipate the pair to move lower, possibly reaching our support level at 146.67.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.