Spreads

Spreads

Spreads

Spreads

Spreads

US stocks were dragged lower for a second day, as stocks in Asia headed for declines on Wednesday with fresh concerns about the spread of Covid-19 from China unnerved investors. Market appetite for risk waned on news that the US would require inbound airline passengers from China to show a negative Covid-19 test before entry.

In Italy, health officials said they would test arrivals from China and said almost half of passengers on two flights from China to Milan were found to have the virus. However, Hong Kong removed limits on gatherings and testing for travellers in a further unwinding of its last major Covid rules, offering a boost to the global economy but sparking concerns it would amplify inflation pressures and prompt US policymakers to maintain tight monetary settings.

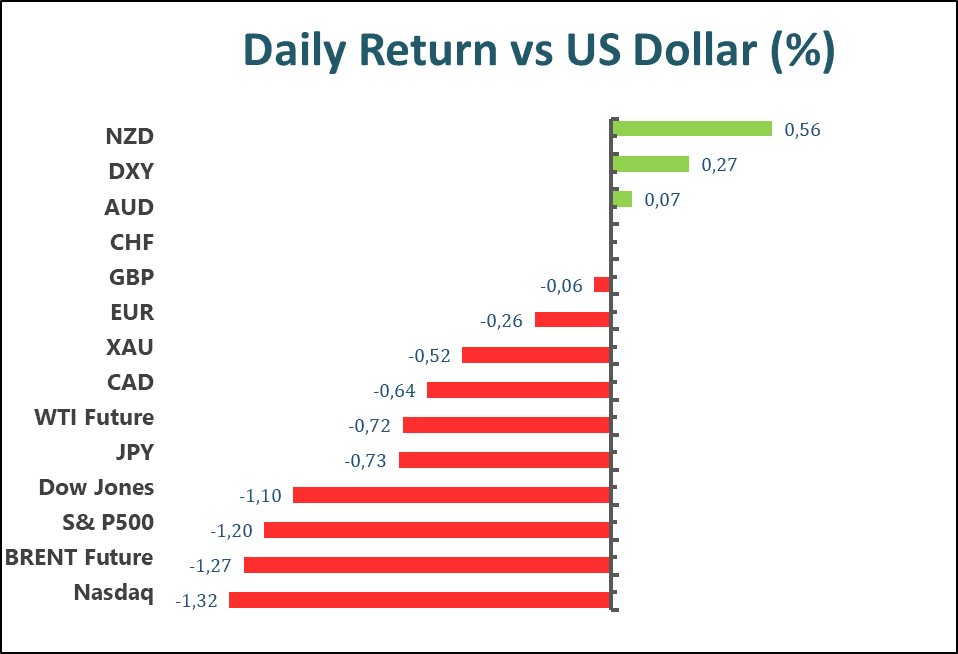

The benchmarks, the S&P500 dropped 1.2% for the day, to the lowest level in more than a month. All eleven sectors stayed in the negative territory, especially the Energy sector fell dramatically with 2.22% daily losses after the several-day surge. The tech-heavy Nasdaq 100 further declined by 1.3% daily, and the Dow Jones Industrial Average slid 1.10% on Wednesday.

Main Pairs Movement

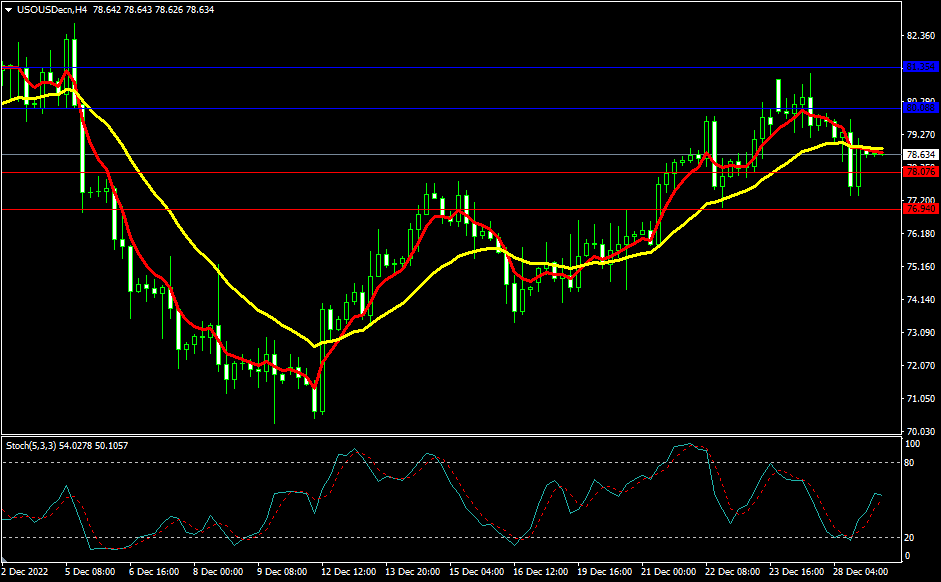

The US Dollar edged higher with a 0.27% daily gain on Wednesday, as the concerns about the outbreak of Covid-19 from China attracted some risk-aversion flow to the safe-haven greenback. The DXY index confronted some mild selling during the first half of Wednesday, then managed to rebound above the 104.4 level during the US trading session.

The GBPUSD has little change lower for the day, as the strong US Dollar is across the board. The cables dropped hugely during the early American trading session as the US administration announced mandatory Covid tests for travellers from China. In the meantime, EURUSD tumbled by almost 0.36% undermining market risk sentiment. The pair ended the day with 0.26% daily losses.

The Gold price remains defensive around the $1805 mark after printing the first daily negative closing in three, as the market’s fresh fears of inflation, emanating from China, as well as geopolitical tension surrounding Russia and Ukraine, which in turn provide support for US Treasury bond yields and the greenback. The XAUUSD slumped during the UK trading hour and once fell below the $1800 mark, then regain upside momentum and stand firmly around the $1805 mark.

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| USD | Initial Jobless Claims | 21:30 | 225K |