Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

On Monday, the stock market experienced a downturn, with the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average all closing lower, moving away from recent record highs. This shift comes as investors brace for a slew of economic data, including a crucial inflation measure and updates on consumer spending, which could impact Federal Reserve policy decisions. The market’s focus is particularly on the upcoming personal consumption expenditures price index, a preferred inflation indicator by the Fed. Additionally, Amazon’s inclusion in the Dow signifies a shift toward tech and consumer retail sectors, despite a slight dip in its shares. With Treasury yields rising and various economic indicators on the horizon, investors remain cautious amid an uncertain longer-term outlook, even as currency markets react to potential monetary policy adjustments in the U.S. and Europe.

On Monday, the S&P 500 saw a decline, moving away from the record high it reached the previous Friday, as the market anticipated upcoming inflation data. The index fell by 0.38% to 5,069.53, while the Nasdaq Composite dropped by 0.13%, ending the day at 15,976.25. The Dow Jones Industrial Average also experienced a downturn, losing 62.30 points, or 0.16%, to close at 39,069.23. Notably, Amazon was added to the Dow, replacing Walgreens Boots Alliance, which is expected to heighten the index’s focus on the tech and consumer retail sectors, even as Amazon’s shares dipped slightly by 0.15%. Additionally, Treasury yields rose, exerting further pressure on the stock market.

The market’s recent performance has been bolstered by strong earnings from companies like Nvidia, propelling the S&P 500 and the Dow to record highs at the end of the previous week. However, investors remain cautious, looking ahead to several economic indicators due to be released, including the personal consumption expenditures price index, a key measure of inflation favored by the Federal Reserve. Meanwhile, new home sales for January fell short of expectations amid high mortgage rates, underscoring the ongoing economic challenges. This week will also see the release of data on durable orders, wholesale inventories, consumer spending, and PCE numbers, all of which could significantly influence market sentiment.

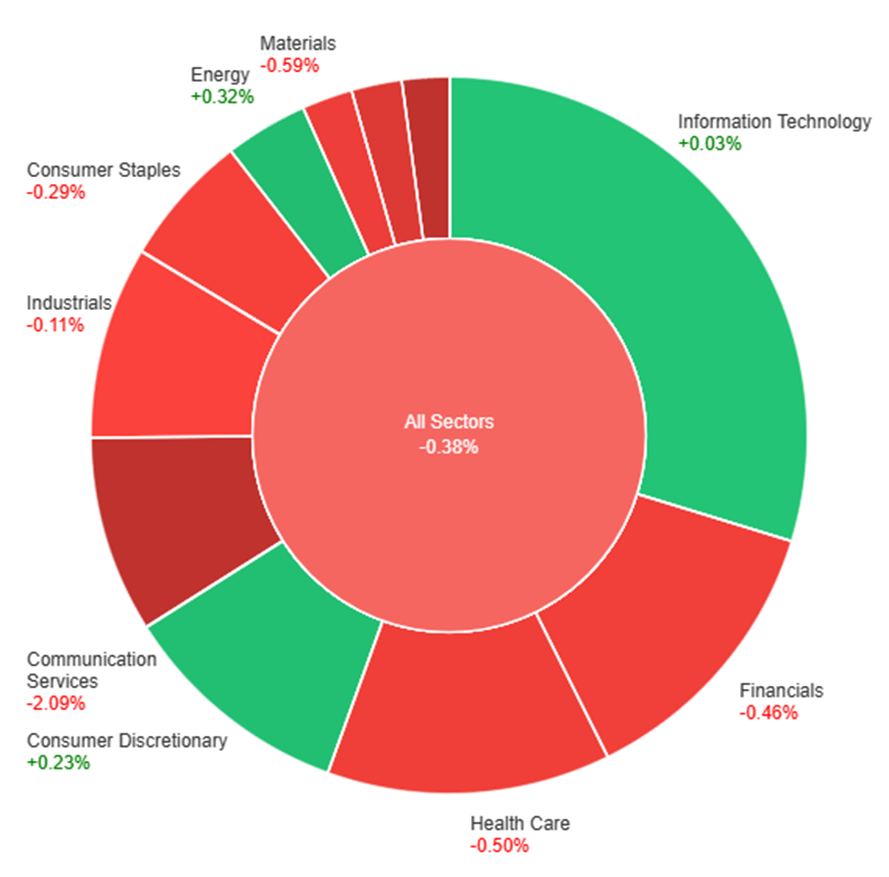

Data by Bloomberg

On Monday, the market showed a mixed performance across various sectors. While the overall sectors declined by 0.38%, Energy (+0.32%), Consumer Discretionary (+0.23%), and Information Technology (+0.03%) sectors experienced gains, indicating some areas of strength in the market. However, most sectors saw declines, with Utilities (-2.10%) and Communication Services (-2.09%) facing the steepest drops, followed by significant downturns in Real Estate (-1.14%), Materials (-0.59%), Health Care (-0.50%), and Financials (-0.46%). Industrials and Consumer Staples also saw modest declines, underscoring a generally bearish sentiment across the broader market.

In recent currency market updates, the dollar index experienced a slight decline of 0.1%, influenced primarily by gains in the EUR/USD pair, as investors awaited crucial inflation data from both the U.S. and the eurozone. This upcoming data is expected to provide insights into the future of the narrowing gap between bund and Treasury yields observed since mid-February. The anticipation around this data release stems from its potential to either confirm or alter the current expectations regarding monetary policy adjustments by the Federal Reserve and the European Central Bank (ECB), especially in light of recent economic indicators. The dollar, meanwhile, saw an uptick against traditionally lower-yielding currencies like the yen, as well as risk-sensitive currencies such as the Australian dollar and the yuan, amidst speculations on the Federal Reserve’s interest rate decisions following a strong U.S. jobs report and inflation figures that surpassed forecasts.

Investor focus is particularly honed in on the upcoming core PCE reading, February ISMs, and the March 8 employment report, with the outcomes likely to influence Federal Reserve policy discussions significantly. Despite the current market pricing, which reflects a cautious stance on the pace and extent of Fed rate cuts, the longer-term economic outlook remains uncertain. This uncertainty is exacerbated by persistent high-interest rates and a stock market buoyed by a limited number of companies, raising concerns over potential underperformance in U.S. economic data relative to expectations. Meanwhile, in Europe, inflation data releases are poised to further clarify the ECB’s stance on interest rates, amidst statements from President Christine Lagarde indicating sustained wage growth. Additionally, Japan’s inflation figures and the potential implications for the Bank of Japan’s policy direction add another layer to the global currency market dynamics, with significant attention also being paid to the British pound’s movements against the backdrop of the Bank of England’s anticipated policy decisions.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| USD | Durable Goods Orders m/m | 21:30 | -4.9% |

| USD | CB Consumer Confidence | 23:00 | 114.8 |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.