Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

On Thursday, the S&P 500 and Nasdaq Composite reached impressive new heights, largely driven by Nvidia’s remarkable quarterly earnings report. The S&P 500 surged by 2.11%, its best performance since January 2023, while the Nasdaq Composite soared by 2.96%, flirting with its all-time high, thanks to Nvidia’s 16.4% share price jump after reporting a 265% revenue increase from its thriving AI business. This surge highlighted Nvidia’s growing dominance in the tech sector and boosted confidence across the broader market, particularly in Big Tech stocks like Meta, Amazon, Microsoft, and Netflix. Concurrently, the U.S. economy showed signs of robust health with a significant drop in jobless claims and a surge in existing home sales, further fueling market optimism. Meanwhile, currency markets adjusted to the mixed global economic indicators and policy expectations, with the dollar stabilizing and the USD/JPY pair experiencing an uptick, reflecting the complex interplay of global economic trends and monetary policy anticipations.

On Thursday, the S&P 500 reached new heights, propelled by Nvidia’s unexpectedly strong quarterly earnings, which not only boosted the broader market but also significantly lifted the tech sector. The S&P 500 climbed 2.11% to close at 5,087.03, marking its most impressive performance since January 2023, while the Nasdaq Composite soared 2.96% to end the day at 16,041.62, nearing its all-time closing high. Meanwhile, the Dow Jones Industrial Average experienced a notable surge of 456.87 points or 1.18%, surpassing the 39,000 mark for the first time and closing at a new record of 39,069.11, reflecting widespread optimism in the financial markets.

Nvidia, a leading chipmaker, saw its shares jump 16.4% to an all-time high after announcing a staggering 265% increase in total revenue from the previous year, primarily fueled by its booming artificial intelligence business. This growth has positioned Nvidia as one of the largest U.S. companies by market capitalization, with expectations for continued revenue growth in the coming quarter. The enthusiasm around AI and Nvidia’s extraordinary performance has significantly influenced the rally in Big Tech stocks, including notable gains in shares of Meta, Amazon, Microsoft, and Netflix, thereby bolstering confidence in the tech space, and benefiting the broader stock market.

Data by Bloomberg

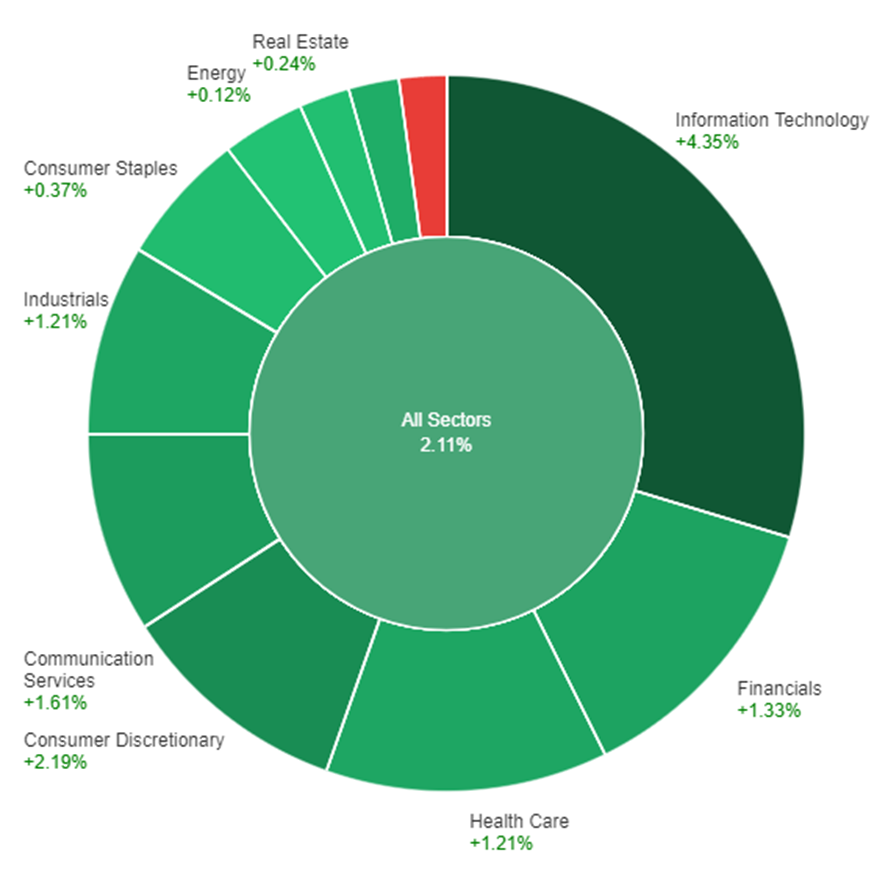

On Thursday, the stock market witnessed a positive trend across most sectors, with the overall sector experiencing a 2.11% increase in price. Information Technology led the gains with a significant rise of 4.35%, followed by Consumer Discretionary and Communication Services, which saw increases of 2.19% and 1.61%, respectively. Financial, Industrials and Health Care sectors also enjoyed gains, each increasing by over 1%. Materials, Consumer Staples, and Real Estate sectors saw modest rises, with Energy experiencing a slight increase of 0.12%. In contrast, Utilities were the only sector to decline, dropping by 0.77%.

The currency market has seen a notable shift as the dollar index stabilized from a three-week low, propelled by an unexpected drop in U.S. jobless claims which overshadowed the mixed performance in flash PMIs across major economies. Despite the composite PMI readings from the eurozone and the UK slightly surpassing forecasts, and a contraction in the U.S. figures, the market’s attention gravitated towards the robust U.S. jobless claims data, showcasing the lowest levels since before 2018 and comparable to figures last seen in 1969. Additionally, the U.S. housing market demonstrated resilience with existing home sales in January surging by 3.1%, marking the highest point since the previous August, suggesting a sensitivity to fluctuating mortgage rates. This economic optimism was further buoyed by stellar quarterly results from Nvidia, which underscored the rapid expansion of AI usage, influencing global equity markets positively.

Amid these developments, currency pairs reacted to the broader economic indicators and policy expectations. The Euro dipped to a flat position against the dollar, reflective of Germany’s PMI contraction and aligning with anticipations of the ECB’s rate cuts preceding those of the Federal Reserve. Meanwhile, the Sterling showed modest gains against the dollar, buoyed by promising UK PMIs, despite being significantly off its recent high. The USD/JPY pair experienced an uptick, driven by the widening yield spreads between U.S. Treasury and Japanese government bonds, and a general shift towards risk-off flows that placed more pressure on the yen. As the market anticipates upcoming U.S. economic reports, including the core PCE inflation data, income, and consumption figures, the currency landscape remains poised for further adjustments, with special attention to the potential impacts on USD/JPY’s trajectory toward its yearly highs and the looming possibility of Japanese intervention amidst speculations of policy normalization by the Bank of Japan.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.