Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

Stocks faced a decline on Monday as Treasury yields surged, reflecting investor concerns over the Federal Reserve’s interest rate strategies and disappointing performances from major companies like McDonald’s. The Dow Jones dropped by 0.71%, the S&P 500 by 0.32%, and the Nasdaq by 0.2%, with the 10-year Treasury note yield climbing significantly. This market sentiment was influenced by Fed Chair Jerome Powell’s hints at maintaining current rates, reducing hopes for an imminent rate cut. Mixed earnings reports, particularly McDonald’s 3.7% drop post-earnings, and setbacks for Boeing and Tesla further dampened market spirits. Meanwhile, the dollar index rose sharply, influenced by strong ISM services data and inflation concerns, affecting major currency pairs and reflecting a cautious outlook on Federal Reserve rate decisions, amidst a backdrop of global economic and monetary policy uncertainties.

Stocks experienced a downturn on Monday, driven by a significant rise in Treasury yields amid concerns over the Federal Reserve’s potential rate cut adjustments, alongside an underwhelming performance from McDonald’s. The Dow Jones Industrial Average fell by 274.30 points or 0.71%, closing at 38,380.12, while the S&P 500 and Nasdaq Composite also saw declines, dropping 0.32% and 0.2% to close at 4,942.81 and 15,597.68, respectively. The surge in yields, with the 10-year Treasury note jumping over 13 basis points to 4.166%, reflects investor recalibration of expectations regarding the Fed’s policy direction, amidst strong economic data suggesting prolonged high rates.

This market sentiment was further influenced by Fed Chair Jerome Powell’s recent comments, implying that a rate cut in March was unlikely, which has led to a reduction in expectations for such cuts. Additionally, the earnings season has brought mixed results, with McDonald’s falling 3.7% after its earnings report, amplifying concerns about the performance of non-tech companies. Moreover, companies like Boeing and Tesla also faced setbacks, with Boeing’s shares dropping due to ongoing issues with its 737 Max and Tesla’s shares falling by 3.7% amid increasing competition and pricing pressures, adding to the broader market’s challenges.

Data by Bloomberg

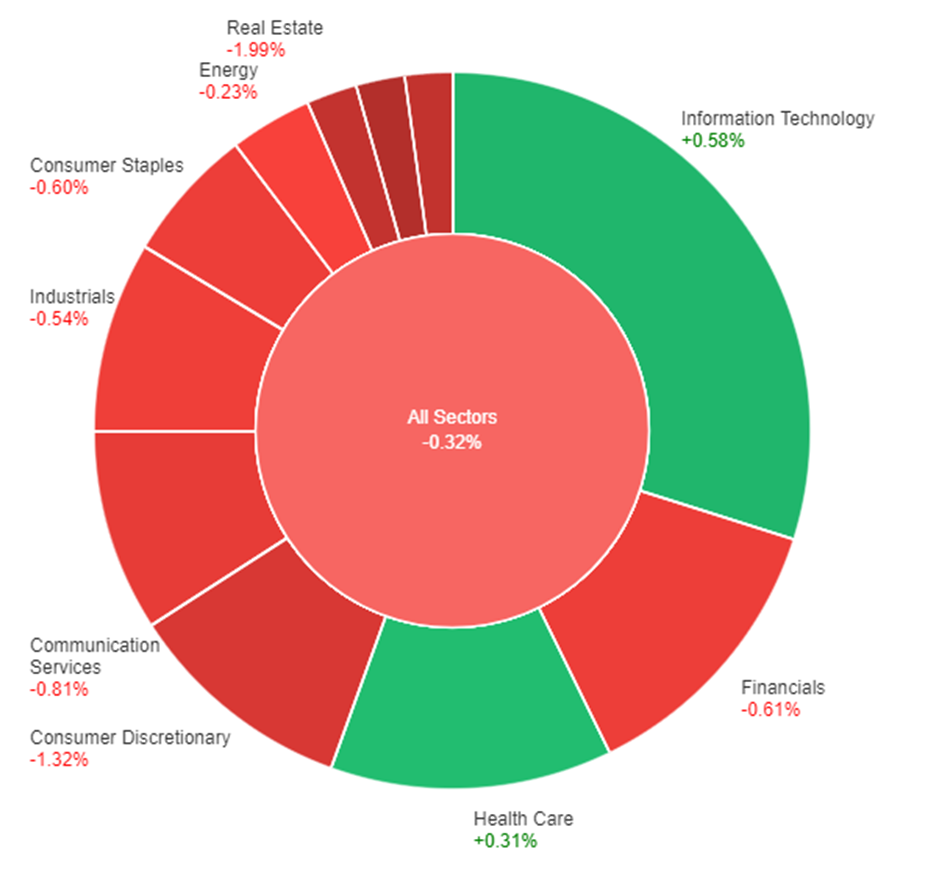

On Monday, the market experienced a mixed performance across various sectors. Information Technology and Health Care sectors saw positive movements, gaining 0.58% and 0.31% respectively, indicating some investor confidence in these areas. However, the broader market trended downwards, with all sectors combined showing a decline of 0.32%. Notably, sectors such as Real Estate, Utilities, and Materials faced significant losses, dropping by 1.99%, 2.03%, and 2.52% respectively. This suggests a shift away from more traditionally stable sectors, possibly due to changing market sentiments or economic outlooks. Consumer Discretionary and Communication Services also saw notable declines, indicating a potential pullback in spending or investor concern in these areas. Overall, the market’s mixed performance reflects varying investor confidence and sector-specific challenges.

In recent currency market updates, the dollar index experienced a notable surge, climbing 0.50% to reach its highest level since November 16, fueled by unexpectedly strong ISM services data and concerns over inflation, which also pushed Treasury yields higher and dampened expectations for imminent Federal Reserve rate cuts. This increase in the dollar’s strength has significantly impacted major currency pairs, most notably the EUR/USD, which fell 0.45% to approach the December swing low of 1.0723. This movement was exacerbated by a quicker rise in Treasury yields compared to German bund yields, amid disappointing economic indicators from the eurozone, including sharp declines in German exports and imports and a stagnant composite PMI for January, in stark contrast to a relatively stable U.S. composite PMI.

Moreover, the currency market is closely monitoring the Federal Reserve’s future interest rate decisions, with futures markets not anticipating a rate cut until at least May, reflecting a cautious stance echoed by Fed Chair Jerome Powell and other Federal Reserve officials who advocate for more data and patience before any rate adjustments. This sentiment has led to uncertainty about the Fed’s rate cut trajectory for the year, with speculation ranging from the three cuts projected in the Fed’s last dot plots to more aggressive predictions. Meanwhile, other major currencies such as the sterling and the Australian dollar faced declines amid a shifting landscape of risk sentiment and monetary policy expectations, with the sterling notably affected by risk-off flows and the Aussie dollar impacted by steady Reserve Bank of Australia policy expectations. The USD/JPY pair saw a modest increase, reflecting ongoing speculation about Bank of Japan policy adjustments, while the USD/CNY pair rose slightly amidst continued efforts by the Chinese government to contain financial risks.

| Currency | Data | Time (GMT + 8) | Forecast |

| AUD | Cash Rate | 11:30 | 4.35% (Actual) |

| AUD | RBA Rate Statement | 11:30 | |

| AUD | RBA Press Conference | 12:30 |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.