Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

(All data taken from MT4)

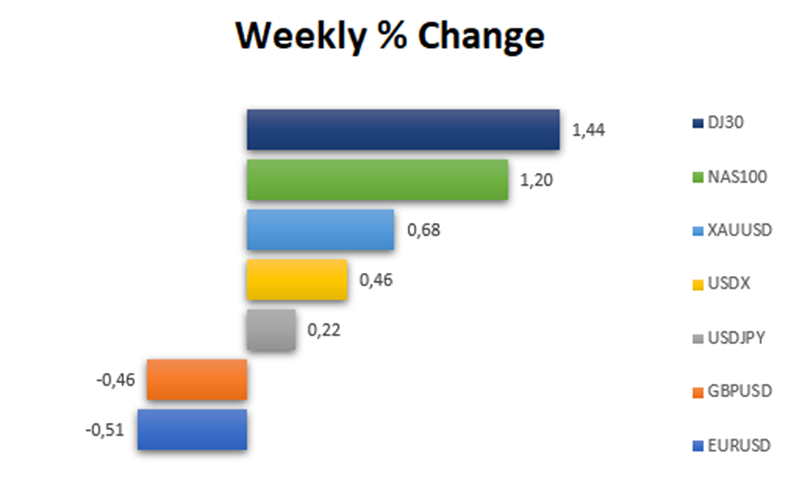

The U.S. dollar index surged to a seven-week high in a robust rally on Friday, driven by an impressive increase in nonfarm payrolls for January, exceeding expectations with a gain of 353,000 jobs. The upbeat economic data led to a notable strengthening of the dollar, with the dollar index reaching 104.04, its highest level since December 12. Analysts noted that the strong job report has diminished the likelihood of a near-term Federal Reserve interest rate cut, prompting a shift in market expectations. Traders, reflecting this sentiment, adjusted their forecasts, with the probability of a rate cut in March dropping from 38% to 21%, and a 75% probability for May, down from 94%, according to the CME Group’s FedWatch Tool.

What to focus on this week?

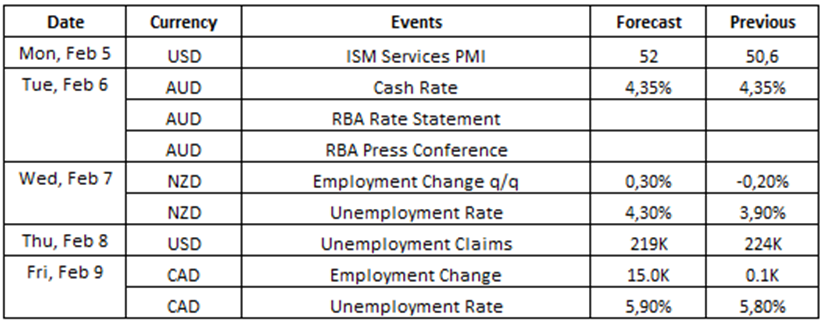

Source: VT Markets Economic Calendar

In the dynamic landscape of the global economy, investors and analysts remain vigilant, focusing on pivotal events to decipher the trajectory and well-being of diverse economies. Let’s delve into the significant economic indicators and upcoming decisions slated for February 2024.

Following an unexpected dip to 50.6 in December 2023, the US ISM Services Purchasing Managers’ Index (PMI) reflected its lowest point in seven months. Analysts are eyeing the January 2024 data, set to be unveiled on 5 February 2024, with expectations of a rebound to 52.0. This release will serve as a crucial gauge of the US services sector’s health and its potential repercussions on the broader economy.

Takeaway: US ISM Services PMI shows the latest condition regarding the services industry in the country. This positive forecast could have a positive effect on the US Dollar.

Having maintained cash rates at 4.35% in its final 2023 meeting, the Reserve Bank of Australia (RBA) is anticipated to uphold current interest rate levels on 6 February 2024. This decision will offer valuable insights into the central bank’s monetary policy stance and its evaluation of economic conditions in Australia.

Takeaway: The interest rate statement decision from the RBA this week will create high volatility for the Australian Dollar. Market experts expect the RBA to maintain the interest rate, which could potentially weaken the Australian Dollar.

After experiencing a 0.2% decline in Q3 2023, following a 1% surge in the preceding quarter, New Zealand’s employment landscape is under scrutiny. Analysts eagerly await the release of Q4 2023 employment data on 7 February 2024, anticipating a further decrease of 0.3%. This report will highlight trends in New Zealand’s labor market, providing crucial information for economic forecasts.

Takeaway: New Zealand’s quarterly employment change shows the latest condition regarding the labor condition in New Zealand. This negative forecast could have a negative effect on the New Zealand Dollar.

With employment in Canada edging up by 0.1K in December 2023, after a noteworthy 24.9K rise in November, the focus now shifts to the January 2024 employment data, expected on 9 February 2024. Analysts are predicting a decrease of 5K jobs, offering insights into the resilience of the Canadian labor market and its adaptability to economic conditions.

Takeaway: Canada employment change showing the latest condition regarding the labor condition in Canada. This data is usually released together with the unemployment rate data. This forecast may have a negative effect on the Canadian Dollar.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.