Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

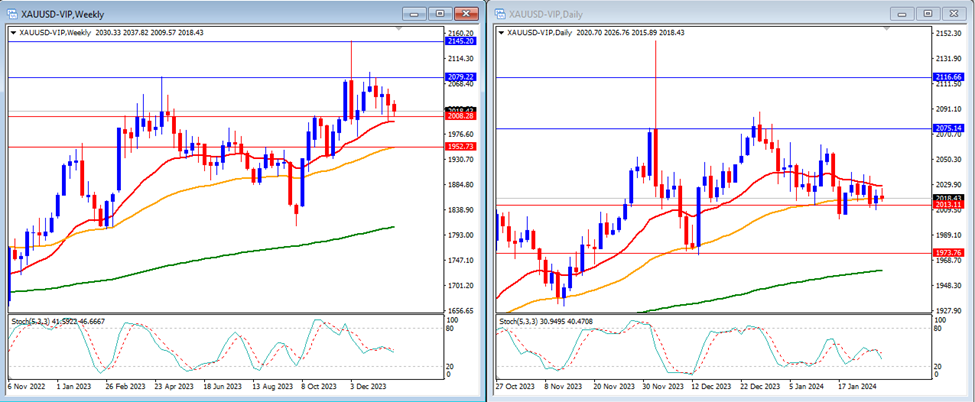

Last week, gold prices fell slightly and closed the week at $2,018.

On the weekly timeframe, the Stochastic Indicator suggests a consolidating movement in the middle. Currently, gold is trading above the 20, 50, and 200-week moving averages.

Weekly resistance levels: $2,079 and $2,145.

Weekly support Levels: $2,008 and $1,952.

On the daily timeframe, the Stochastic Indicator is moving lower, nearing the oversold area. Gold’s price is currently below the 20-day but remains above the 50 and 200-day moving averages.

Daily resistance levels: $2,075 and $2,116.

Daily support levels: $2,013 and $1,973.

Conclusion: This week, we anticipate high volatility due to high-impact data releases from the US, such as the Fed rate decision and non-farm employment change, which may directly affect the gold price. Our analysts predict a potential upward trend for Gold this week, leading it to possibly reach our resistance level at $2,075.

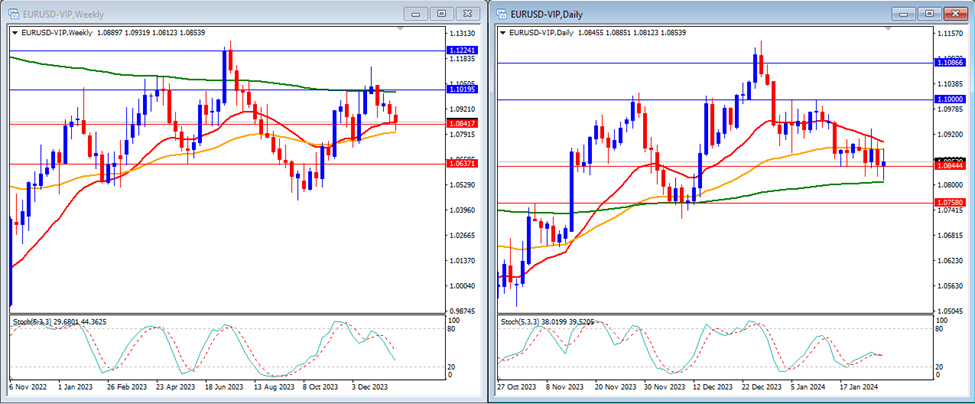

Last week, EUR/USD prices fell slightly and closed the week at 1.0853.

On the weekly timeframe, the Stochastic Indicator is moving lower in the middle. Currently, the price trades above the 20 and 50-week moving averages but below the 200-week moving average.

Weekly resistance levels: 1.1019 and 1.1224.

Weekly support Levels: 1.0841 and 1.0637.

On the daily timeframe, the Stochastic Indicator is nearing the oversold area. Currently, the EUR/USD price stands below the 20 and 50-day moving averages but remains above the 200-day moving average.

Daily resistance levels: 1.1000 and 1.1086.

Daily support levels: 1.0844 and 1.0758.

Conclusion: This week, we anticipate high volatility due to upcoming high-impact data releases from the US, including the Fed rate decision and non-farm employment change. Our analysts predict a potential upward trend for EUR/USD this week, possibly leading it to reach our resistance level at 1.1000.

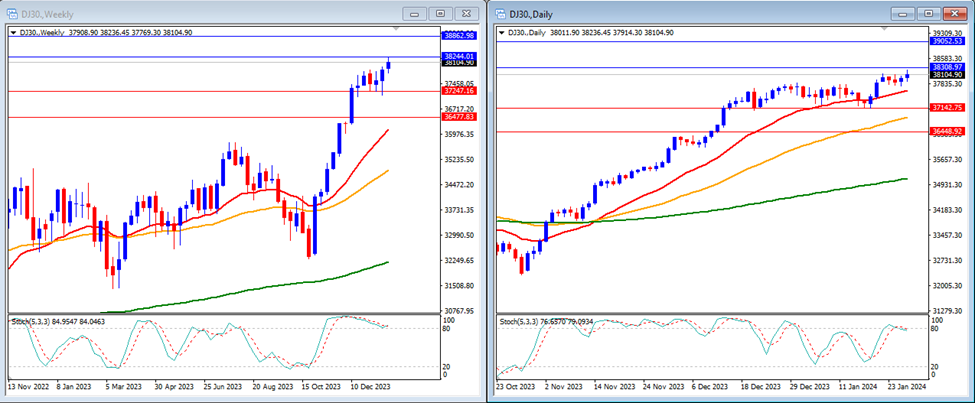

Last week, DJ30 prices rose slightly and closed the week at 38,104.

On the weekly timeframe, the Stochastic Indicator consolidated within the overbought area. Currently, the indices trade above the 20, 50, and 200-week moving averages.

Weekly resistance levels: 38,244 and 38,862.

Weekly support Levels: 37,247 and 36,477.

On the daily timeframe, the Stochastic Indicator is moving higher, targeting the overbought area. Currently, the price is above the 20, 50, and 200-day moving averages.

Daily resistance levels: 38,308 and 39,052.

Daily support levels: 37,142 and 36,448.

Conclusion: This week, we anticipate high volatility due to upcoming high-impact data releases from the US, including the Fed rate decision and non-farm employment change. Our analysts predict a potential upward trend for the DJ30, possibly reaching our resistance level at 38,308.

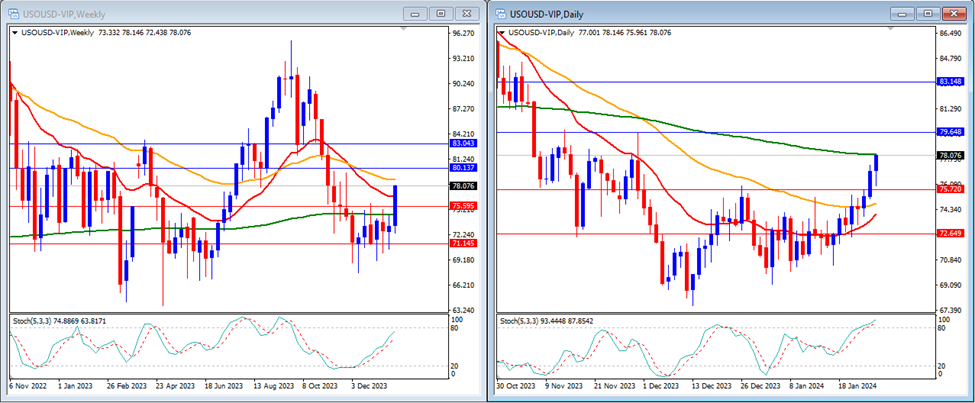

Last week, USO/USD prices rose strongly and closed the week at 78.07.

On the weekly timeframe, the Stochastic Indicator indicates an upward movement targeting the overbought area. The price is now above the 20 and 200-week moving averages but remains below the 50-week moving average.

Weekly resistance levels: 80.13 and 83.04.

Weekly support Levels: 75.59 and 71.14.

On the daily timeframe, the Stochastic Indicator is moving higher, entering the overbought area, and the price is currently above the 20 and 50-day moving averages but still below the 200-day moving average.

Daily resistance levels: 79.64 and 83.14.

Daily support levels: 75.72 and 72.64.

Conclusion: This week, we anticipate high volatility due to upcoming high-impact data releases from the US, including the Fed rate decision and non-farm employment change. Additionally, we must remain vigilant regarding any updates on tensions in the Middle East. Our analysts foresee potential upward momentum for USO/USD this week, possibly driving it toward our next resistance level at 79.64.

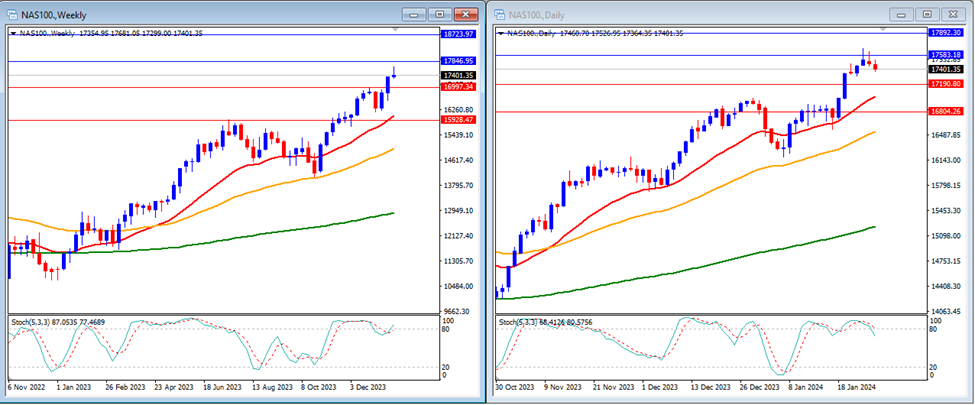

Last week, NAS100 prices rose slightly and closed the week at 17,401.

On the weekly timeframe, the Stochastic Indicator is attempting to cross back higher, just below the overbought area, while the price continues to trade above the 20, 50, and 200-week moving averages.

Weekly resistance levels: 17,846 and 18,723.

Weekly support Levels: 16,997 and 15,928.

On the daily timeframe, the Stochastic Indicator is crossing back lower, attempting to exit the overbought area. Currently, the price is above the 20, 50, and 200-day moving averages.

Daily resistance levels: 17,583 and 17,892.

Daily support levels: 17,190 and 16,804.

Conclusion: This week, we anticipate high volatility due to upcoming high-impact data releases from the US, including the Fed rate decision and non-farm employment change. Our analysts predict a potential upward trend for NAS100, possibly reaching our resistance level at 17,583.

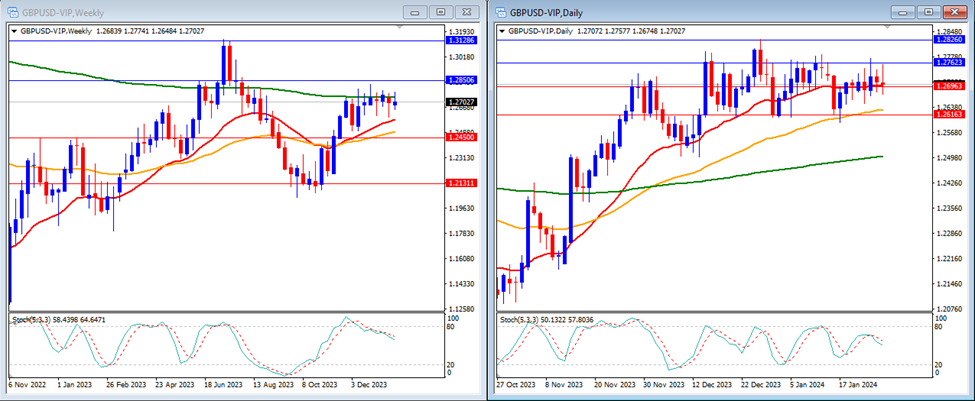

Last week, GBP/USD prices rose slightly and closed the week at 1.2702.

On the weekly timeframe, the Stochastic Indicator is moving lower after exiting the overbought area. The price is trading above the 20 and 50-week moving averages and below the 200-week moving average.

Weekly resistance levels: 1.2850 and 1.3128.

Weekly support Levels: 1.2450 and 1.2131.

On the daily timeframe, the Stochastic Indicator is moving in the middle. Currently, the price is trading above the 20, 50, and 200-day moving averages.

Daily resistance levels: 1.2762 and 1.2826.

Daily support levels: 1.2696 and 1.2616.

Conclusion: This week, we anticipate high volatility due to upcoming high-impact data releases from the US, including the Fed and Bank of England rate decisions and non-farm employment change. Our analysts foresee a potential upward trend for GBP/USD, potentially reaching our resistance level at 1.2850.

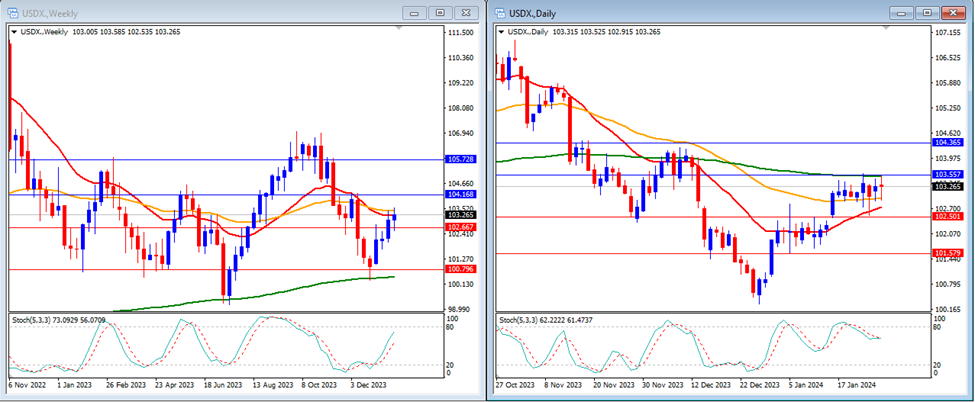

Last week, USDX prices rose and closed the week at 103.26.

On the weekly timeframe, the Stochastic Indicator is moving higher, targeting the overbought area. Currently, the price is trading below the 20 and 50-week moving averages but remains above the 200-week moving average.

Weekly resistance levels: 104.16 and 105.72.

Weekly support Levels: 102.66 and 100.79.

On the daily timeframe, the Stochastic Indicator is moving lower after exiting the overbought area. The price is currently trading above the 20 and 50-day moving averages but remains below the 200-day moving averages.

Daily resistance levels: 103.55 and 104.36.

Daily support levels: 102.50 and 101.57.

Conclusion: This week, we anticipate high volatility due to upcoming high-impact data releases from the US, including the Fed rate decision and non-farm employment change. Our analysts foresee a potential downward trend for the USD Index, potentially reaching our support level at 102.50.

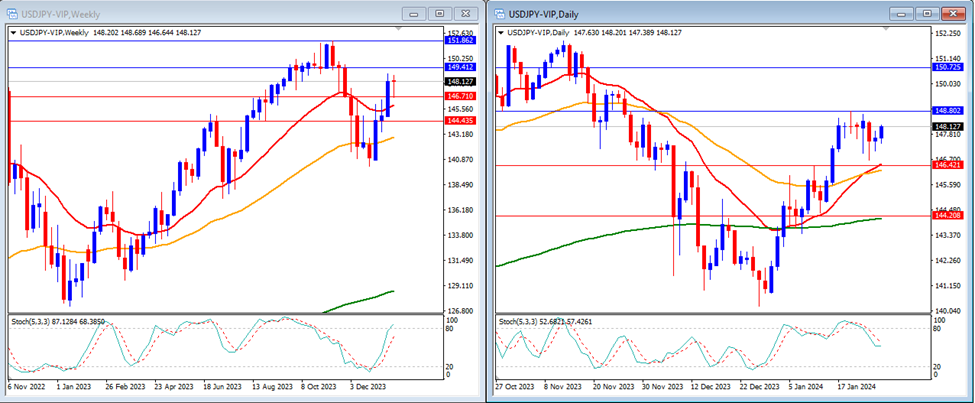

Last week, USD/JPY prices were flat and closed the week at 148.12.

On the weekly timeframe, the Stochastic Indicator is moving higher, targeting the overbought area. The price is currently trading above the 20, 50, and 200-week moving averages.

Weekly resistance levels: 149.41 and 151.86.

Weekly support Levels: 146.71 and 144.43.

On the daily timeframe, the Stochastic Indicator is moving lower in the middle. Currently, the price is above the 20, 50, and 200-day moving averages.

Daily resistance levels: 148.80 and 150.72.

Daily support levels: 146.42 and 144.20.

Conclusion: This week, we anticipate high volatility due to upcoming high-impact data releases from the US, including the Fed rate decision and non-farm employment change. Our analysts foresee a potential downward trend for USD/JPY, potentially reaching our support level at 146.42.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.