Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

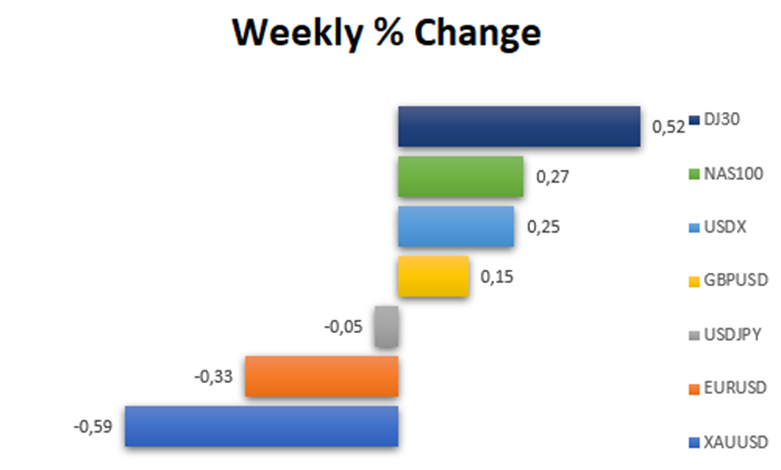

Last week, the Dollar Index witnessed a marginal decline, down by 0.25%, amidst a broader trend of gains over the past month. Influenced by recent U.S. inflation data showing a modest rise but an overall stabilizing trend, market expectations for the Federal Reserve’s monetary policy have shifted. The likelihood of near-term interest rate cuts has reduced, with the rate futures market now indicating about a 47% chance of a cut by March, and a stronger expectation of a cut by May. These developments, coupled with disinflationary pressures and global central bank stances, suggest a limited scope for a significant strengthening of the dollar in the coming months.

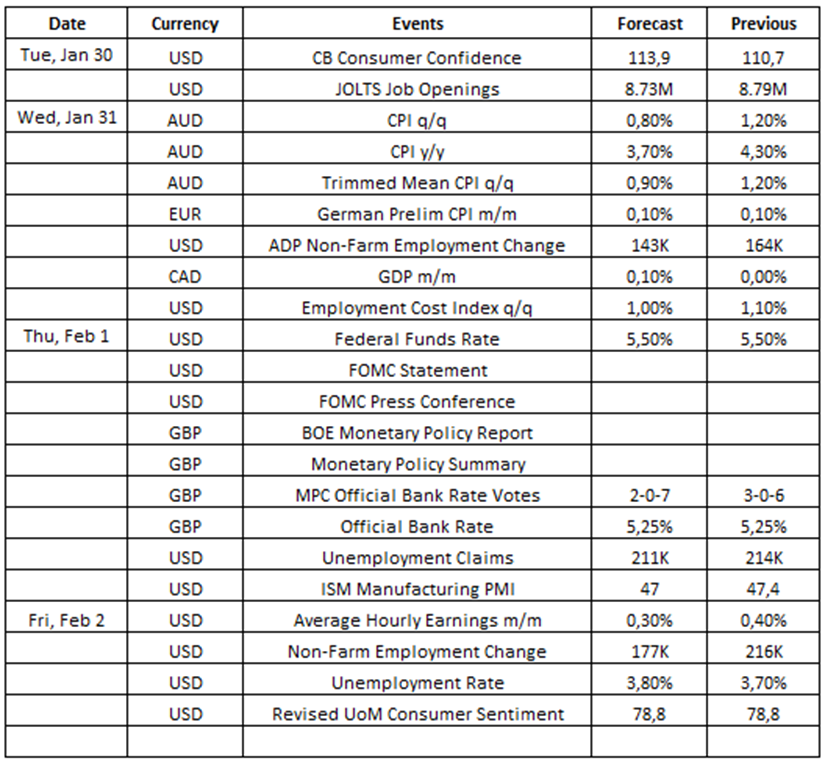

Source: VT Markets Economic Calendar

As we move from the end of January to the beginning of February 2024, people who trade and invest money are preparing for a busy week. This week will have a lot of important economic news and information. These events will play a big role in deciding how markets behave, with special attention on topics like rising prices, how fast the economy is growing, and what the central banks are planning to do. Let’s look at the most important pieces of information that will affect the financial markets.

After a decrease in the year-on-year CPI from 4.9% in October 2023 to 4.3% in November 2023, market participants are closely watching the upcoming CPI data. The forecast suggests a higher monthly CPI of 3.7% for December 2023. This inflation indicator is crucial as it could influence the Reserve Bank of Australia’s monetary policy decisions, potentially impacting the Australian Dollar.

Takeaway: Australia’s CPI data is a crucial economic indicator eagerly anticipated by traders. This data usually has a direct impact on AUD currency pairs. According to the provided information, we expect this data release to potentially strengthen the Australian Dollar.

The Canadian economy has shown stability over the past few months, with no significant changes recorded in October 2023. The forthcoming GDP data, expected to show a growth of 0.1%, will be a key indicator of Canada’s economic health. This release is particularly significant for traders focusing on the Canadian Dollar and could provide insights into the Bank of Canada’s future monetary policy.

Takeaway: Canada’s GDP data is a crucial economic indicator eagerly anticipated by traders. This data usually has a direct impact on CAD currency pairs. According to the provided information, we expect this data release to potentially strengthen the Canadian Dollar.

After maintaining the federal funds rate at 5.50% since December 2023, the Federal Reserve’s upcoming interest rate decision is highly anticipated. Despite previous indications of potential rate cuts in 2024, analysts expect the Fed to hold the rate steady. This decision is critical for the US Dollar and could significantly influence the equity and bond markets.

Takeaway: This will be the first Fed’s Interest Rate Decision in 2024 and will be closely watched by traders. According to the provided information, we anticipate that this data release could potentially weaken the US Dollar unless there are other impactful statements from the Fed.

The Bank of England has kept its benchmark interest rate at a 15-year high of 5.25% since December 2023. The upcoming decision, widely expected to be a hold, will be crucial for the GBP. Given the divided vote in the previous meeting, any shifts in the voting pattern could provide insights into the central bank’s future policy direction.

Takeaway: This will be the first Bank of England’s (BOE) Interest Rate Decision in 2024 and will be closely watched by traders. According to the provided information, we anticipate that this data release could potentially weaken the British Pound (GBP) unless there are other impactful statements from the BOE.

The US jobs market has been a point of focus, with 216,000 jobs added in December 2023 and an unemployment rate holding steady at 3.7%. The January 2024 report, forecasted to show an addition of 173,000 jobs with a steady unemployment rate, will be a key indicator of the US economic health. This data is highly influential for the US Dollar and overall market sentiment, especially in the context of the Federal Reserve’s monetary policy.

Takeaway: The US Jobs report such as non-farm employment change and unemployment rate is a crucial economic indicator eagerly anticipated by traders. This data usually has a direct impact on USD currency pairs. According to the provided information, we expect this data release to potentially strengthen the US Dollar.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.