Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

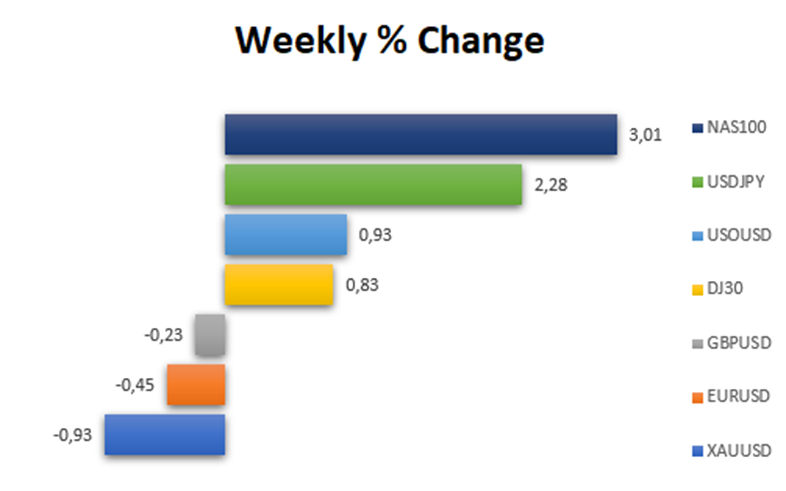

On Friday, the U.S. dollar paused its five-session winning streak, experiencing a slight decline but remaining poised for a weekly climb. The dip was influenced by recent economic indicators and Federal Reserve statements, which tempered expectations of rapid interest rate cuts. Initially strengthening on positive data, such as the University of Michigan’s consumer sentiment index reaching 78.8, the highest since July 2021, the greenback showed resilience despite earlier strong labor market and retail sales figures, indicating ongoing economic robustness. However, the probability of a 25 basis point cut in March, as indicated by CME’s FedWatch Tool, dropped below 50%, with May emerging as a more likely month for a potential rate cut announcement.

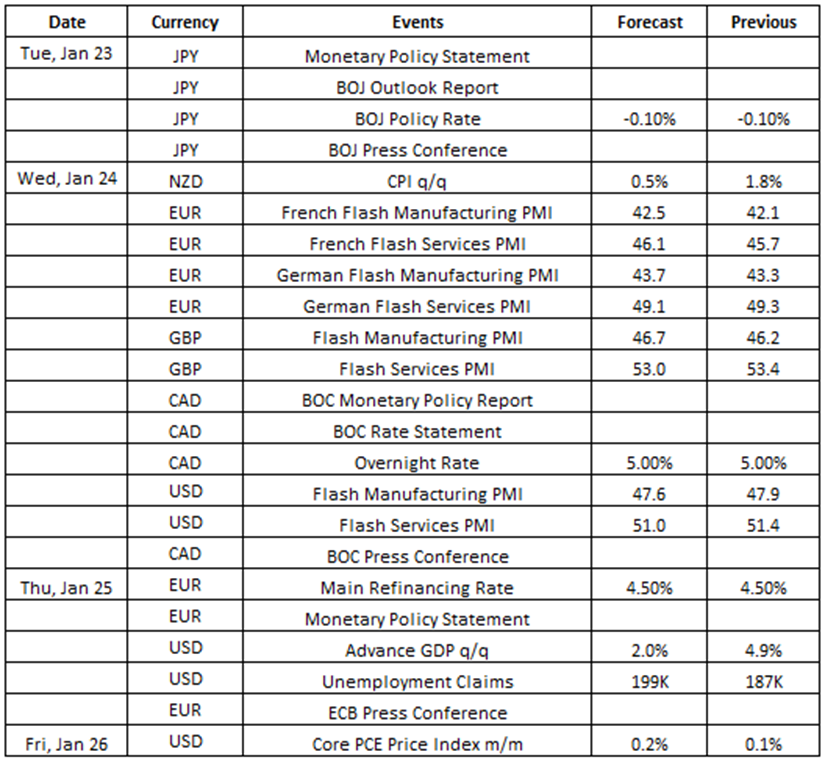

Source: VT Markets Economic Calendar

Navigating the economic landscape, recent decisions by central banks have shaped the trajectory of global markets. In December 2023, the Bank of Japan (BoJ) and the Bank of Canada maintained their key interest rates, setting the tone for upcoming meetings. Meanwhile, the European Central Bank (ECB) sustained multi-year high interest rates to counter inflation. Analysts anticipate the continuation of these measures in the upcoming sessions. Against this backdrop, manufacturing and services sector data and GDP and inflation figures provide a comprehensive snapshot of economic health. These developments offer crucial insights into the near-term outlook for financial markets.

In the final meeting of the year, the Bank of Japan (BoJ) unanimously decided to maintain its key short-term interest rate at -0.1% and 10-year bond yields at around 0%. Analysts anticipate that the central bank will continue with the current interest rate levels in its upcoming meeting on January 23, 2024.

Takeaway: This will be the first Bank of Japan’s (BOJ) Interest Rate Decision in 2024 and will be closely watched by traders. According to the provided information, we anticipate that this data release could potentially weaken the Japanese Yen (JPY) unless there are other impactful statements from the BOJ.

Moving to Canada, in December 2023, the Bank of Canada maintained its target for the overnight rate at 5%, marking the third consecutive meeting with unchanged rates. Analysts are projecting a continuation of the current interest rate levels at the central bank’s upcoming meeting on January 24, 2024.

Takeaway: This will be the first Bank of Canada’s (BOC) Interest Rate Decision in 2024 and will be closely watched by traders. According to the provided information, we anticipate that this data release could potentially weaken the Canadian Dollar (CAD) unless there are other impactful statements from the BOC.

In the European Union, the European Central Bank (ECB) sustained interest rates at multi-year highs for the second consecutive meeting in December 2023. This included signaling an early conclusion to its remaining bond purchase scheme as part of efforts to combat high inflation. Analysts are expecting the maintenance of these interest rate levels at the ECB’s upcoming meeting on January 25, 2024.

Takeaway: This will be the first European Central Bank’s (ECB) Interest Rate Decision in 2024 and will be closely watched by traders. According to the provided information, we anticipate that this data release could potentially weaken the EURO (EUR) unless there are other impactful statements from the ECB.

Turning to economic indicators, Germany’s manufacturing Purchasing Managers’ Index (PMI) increased from 42.6 to 43.3 between November and December 2023. In contrast, the UK and the US saw decreases in manufacturing PMIs, from 47.2 to 46.2 and 49.40 to 47.90, respectively. Forecasts for January 24, 2024, indicate anticipated manufacturing PMIs of 43.7 for Germany, 46.7 for the UK, and 47.6 for the US.

Takeaway: The Flash Manufacturing PMI data is a crucial economic indicator to show the latest updates regarding the manufacturing industry in the country and is highly anticipated by traders. According to the provided information, we expect that any data released below 50 will potentially weaken the country’s currencies.

Shifting to the services sector, Germany experienced a decline in its PMI from 49.6 to 49.3 between November and December 2023. In the same period, the UK’s services PMI increased from 50.9 to 53.4, and the US witnessed a rise in its services PMI from 50.8 to 51.4. Forecasts for January 24, 2024, suggest expected services PMIs of 49.1 for Germany, 53.0 for the UK, and 51.0 for the US.

Takeaway: The Flash Services PMI data is a crucial economic indicator to show the latest updates regarding the services industry in the country and is highly anticipated by traders. According to the provided information, we expect that any data released above 50 will potentially strengthen the country’s currencies.

In the United States, the American economy expanded at an annualized rate of 4.9% in the third quarter of 2023, slightly below the 5.2% second estimate but matching the initially reported 4.9% in the advance estimate. Looking ahead to the advance GDP release for the fourth quarter on January 25, 2024, analysts expect a slower growth rate of 2%.

Takeaway: The US advance GDP data is a crucial economic indicator eagerly anticipated by traders. This data usually has a direct impact on USD currency pairs. According to the provided information, we expect this data release to potentially weaken the US Dollar.

Finally, in the realm of inflation, Core PCE prices in the U.S., excluding food and energy, recorded a 0.1% increase from the previous month in November 2023. With data for December 2023 set to be released on January 26, 2024, analysts are forecasting a growth of 0.2%.

Takeaway: The US core PCE price index data is a crucial economic indicator eagerly anticipated by traders. This data usually has a direct impact on USD currency pairs. According to the provided information, we expect this data release to potentially strengthen the US Dollar.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.