Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

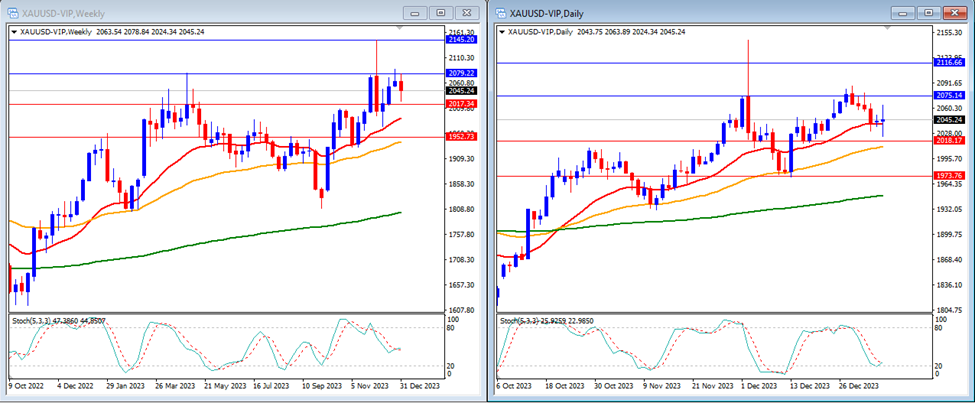

Last week, gold prices fell and closed the week at $2,045.

On the weekly timeframe, the Stochastic Indicator suggests a downward movement in the middle. Currently, gold is trading above the 20, 50, and 200-day moving averages.

Weekly resistance levels: $2,079 and $2,145.

Weekly support Levels: $2,017 and $1,952.

On the daily timeframe, the Stochastic Indicator moves lower near the oversold area. Gold’s price currently stands above the 20, 50, and 200-day moving averages.

Daily resistance levels: $2,075 and $2,116.

Daily support levels: $2,018 and $1,973.

Conclusion: This week, we anticipate high volatility due to some high-impact data releases from the US such as CPI and PPI data and may directly affect the gold price. Our analysts predict a potential upward trend for Gold this week, potentially leading it to reach our resistance level at $2,075.

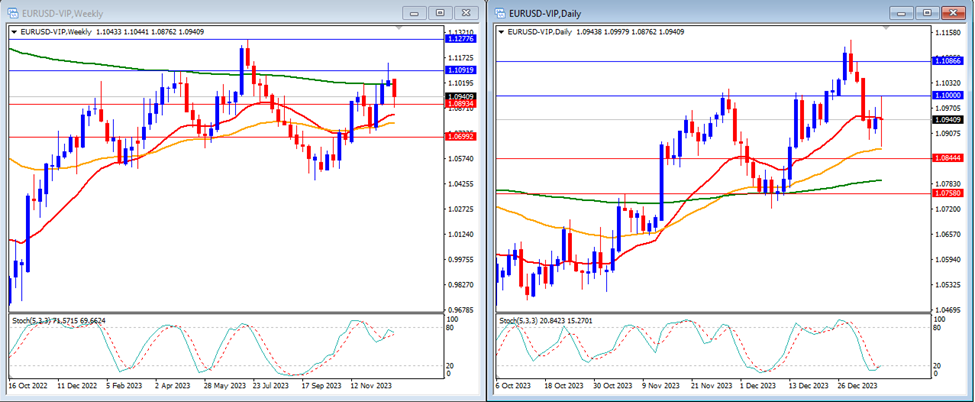

Last week, EUR/USD prices fell and closed the week at 1.0940.

On the weekly timeframe, the Stochastic Indicator is moving just below the overbought area. Currently, the price trades above the 20 and 50-week moving averages but below the 200-week moving average.

Weekly resistance levels: 1.1091 and 1.1277.

Weekly support Levels: 1.0893 and 1.0699.

On the daily timeframe, the Stochastic Indicator moves lower near the oversold area. Currently, the EUR/USD price stands around the 20-day moving average but above the 50, and 200-day moving averages.

Daily resistance levels: 1.1000 and 1.1086.

Daily support levels: 1.0844 and 1.0758.

Conclusion: This week, we anticipate high volatility due to some high-impact data releases from the US such as CPI and PPI PMI data. Our analysts predict a potential upward trend for EUR/USD this week to start the year 2024, potentially leading it to reach our resistance level at 1.1000.

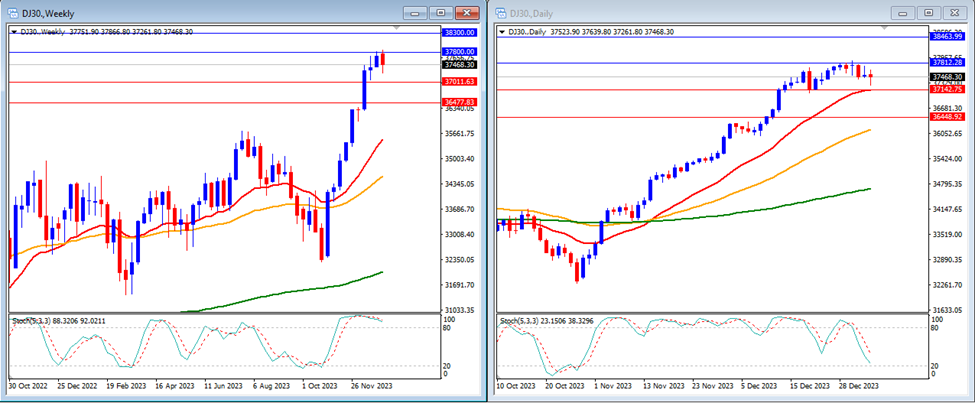

Last week, DJ30 prices fell and closed the week at 37,468.

On the weekly timeframe, the Stochastic Indicator indicates an upward trend by moving within the overbought area. Currently, the indices trades above the 20, 50, and 200-day moving averages.

Weekly resistance levels: 37,800 and 38,300.

Weekly support Levels: 37,011 and 36,477.

On the daily timeframe, the Stochastic Indicator moves higher targeting the overbought area. Currently, the price is still moving above the 20, 50, and 200-day moving averages.

Daily resistance levels: 37,812 and 38,463.

Daily support levels: 37,142 and 36,448.

Conclusion: This week, we anticipate high volatility due to some high-impact data releases from the US such as CPI and PPI data. Our analysts predict a potential upward trend for the DJ30, possibly reaching our resistance level at 37,800.

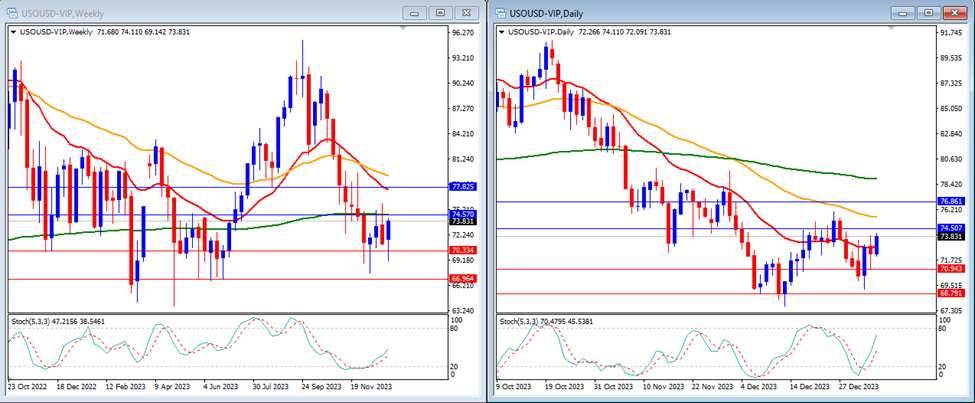

Last week, USO/USD prices rose and closed the week at 73.83.

On the weekly timeframe, the Stochastic Indicator indicates a slight upward movement just above the oversold area. The price remains below the 20, 50, and 200-week moving averages.

Weekly resistance levels: 74.57 and 77.82.

Weekly support Levels: 70.33 and 66.96.

On the daily timeframe, the Stochastic Indicator is moving higher targeting the overbought area, and the price currently moving below the 20-day moving average, but still below the 50 and 200-day moving averages.

Daily resistance levels: 74.50 and 76.86.

Daily support levels: 70.94 and 68.79.

Conclusion: This week, we anticipate high volatility due to some high-impact data releases from the US such as CPI and PPI data. However, we must also remain vigilant for any updates regarding tensions in the Middle East. Our analysts foresee potential upward momentum for USO/USD this week, possibly driving it toward our next resistance level at 74.57.

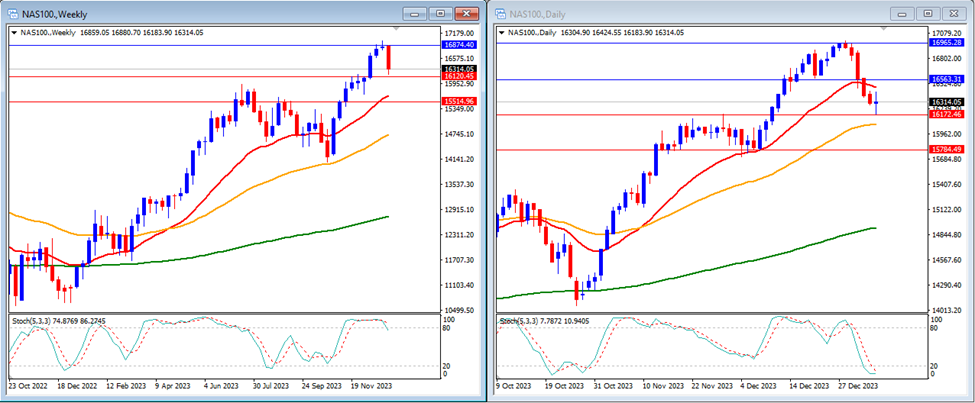

Last week, NAS100 prices fell and closed the week at 16,314.

On the weekly timeframe, the Stochastic Indicator is currently situated within the overbought area, while the price continues to trade above the 20, 50, and 200-week moving averages.

Weekly resistance levels: 16,874.

Weekly support Levels: 16,120 and 15,514.

On the daily timeframe, the Stochastic Indicator is moving lower, entering the oversold area. Currently, the price moves below the 20-day moving average, but remains above the 50, and 200-day moving averages.

Daily resistance levels: 16,563 and 16,965.

Daily support levels: 16,172 and 15,784.

Conclusion: This week, we anticipate high volatility due to some high-impact data releases from the US such as CPI and PPI data. Our analysts predict a potential upward trend for the NAS100, possibly reaching our resistance level at 16,563.

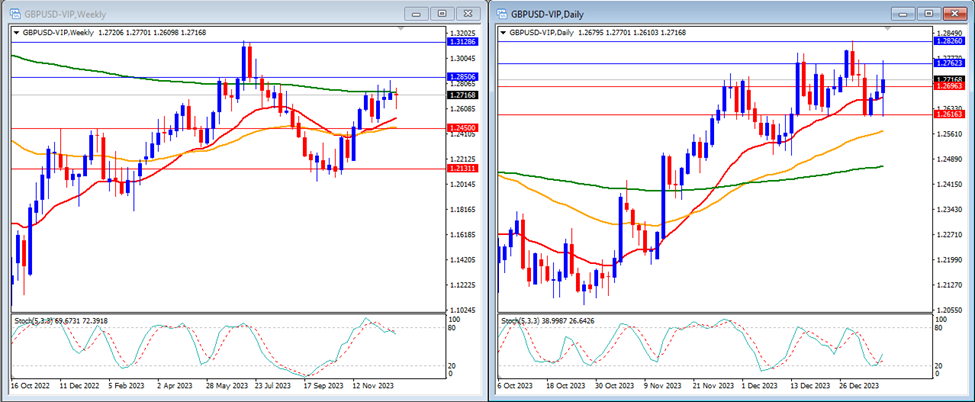

Last week, GBP/USD prices slightly fell and closed the week at 1.2716.

On the weekly timeframe, the Stochastic Indicator is moving lower, exiting the overbought area. The price is trading above the 20 and 50-week moving averages but remains below the 200-week moving average.

Weekly resistance levels: 1.2850 and 1.3128.

Weekly support Levels: 1.2450 and 1.2131.

On the daily timeframe, our Stochastic Indicator crosses back higher just above the oversold area. Currently, the price is trading above the 20, 50, and 200-day moving averages.

Daily resistance levels: 1.2762 and 1.2826.

Daily support levels: 1.2696 and 1.2616.

Conclusion: This week, we anticipate high volatility due to some high-impact data releases from the US such as CPI and PPI data. We will also have UK GDP as the market mover for GBP. Our analysts foresee a potential upward trend for the GBP/USD, potentially reaching our resistance level at 1.2850.

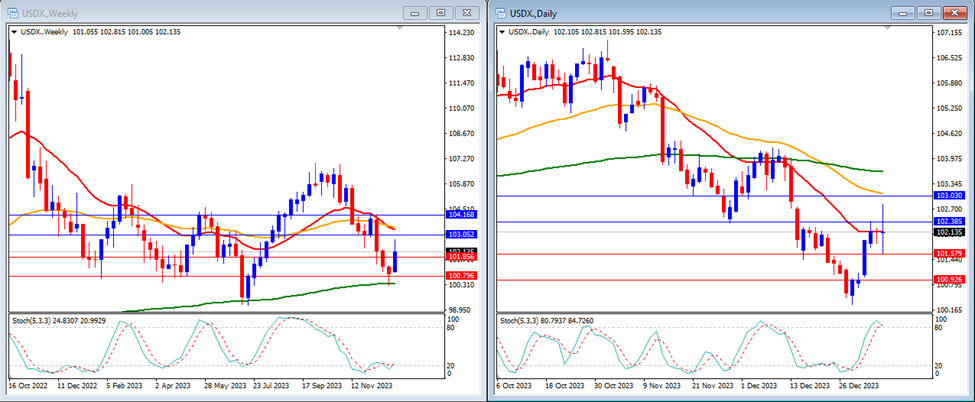

Last week, USDX prices rose and closed the week at 102.13.

On the weekly timeframe, the Stochastic Indicator is moving just slightly above the oversold area. Currently, the price is trading below the 20 and 50-week moving averages but remains above the 200-week moving average.

Weekly resistance levels: 103.05 and 104.16.

Weekly support Levels: 101.85 and 100.79.

On the daily timeframe, the Stochastic Indicator moving higher around the overbought area. The price is currently trading around the 20-day moving average but remains below the 50 and 200-day moving averages.

Daily resistance levels: 102.38 and 103.03.

Daily support levels: 101.57 and 100.92.

Conclusion: This week, we anticipate high volatility due to some high-impact data releases from the US such as CPI and PPI data. Our analysts foresee a potential downward trend for the USD Index, potentially reaching our support level at 101.85.

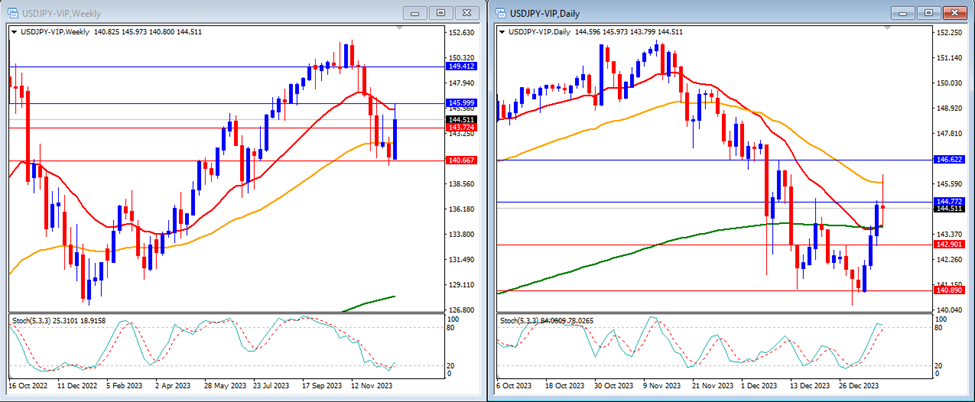

Last week, USD/JPY prices rose and closed the week at 144.51.

On the weekly timeframe, the Stochastic Indicator moves around the oversold area. The price is currently trading below the 20-week moving average but above the 50 and 200-week moving average.

Weekly resistance levels: 145.99 and 149.41.

Weekly support Levels: 143.72 and 140.66.

On the daily timeframe, the Stochastic Indicator moves higher near the overbought area. Currently, the price is moving below the 50-day moving average, but above the 20 and 200-day moving averages.

Daily resistance levels: 144.77 and 146.62.

Daily support levels: 142.90 and 140.89.

Conclusion: This week, we anticipate high volatility due to some high-impact data releases from the US such as CPI and PPI data. Our analysts foresee a potential upward trend for the USD/JPY, potentially reaching our resistance level at 145.99.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.