Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

(All data taken from MT4)

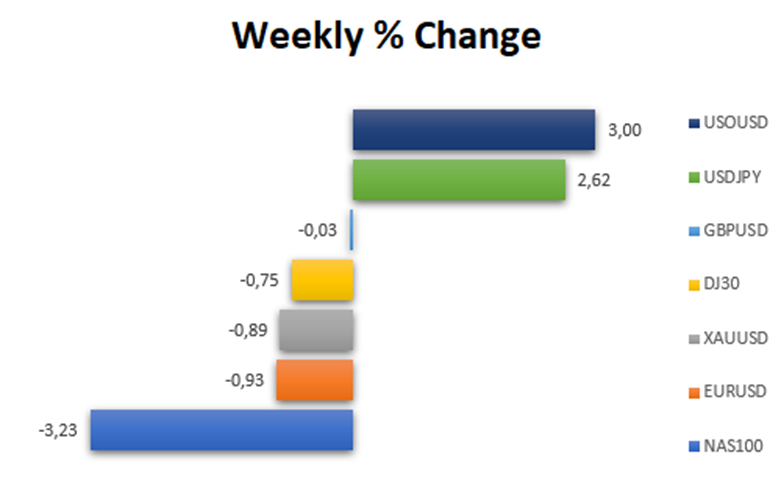

The Dollar Index is currently slightly above 102.00 but has seen slight losses recently due to dovish sentiments stemming from the release of December’s Nonfarm Payrolls (NFP) and the ISM PMIs. However, it closed the week with a 1.07% increase. In the 2023 Federal Reserve meeting, signs of a dovish approach emerged. The Fed seemed content with moderating inflation and signaled no rate hikes until 2024, implying a potential 75 bps of easing. Market forecasts currently lean towards a rate cut in March followed by another in May. This suggests a bearish trajectory for the US Dollar as lower interest rates might redirect available capital to markets offering higher yields.

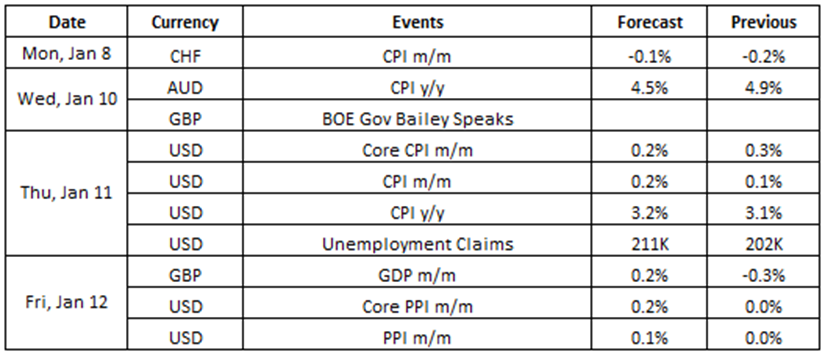

Source: VT Markets Economic Calendar

Following a turbulent start to 2024, the upcoming week is poised for potential high volatility. Key drivers include the release of inflation data, taking in CPI figures from Australia, the US, and alongside PPI data. The UK GDP release also holds considerable significance, contributing to potential market impacts. Traders are advised to focus on monitoring this week’s CPI data, acknowledging its role as a primary market influencer for a successful trading week.

registering a 4.9% increase in October 2023 (slightly down from September’s 5.6%), the Australian CPI is expected to further decrease to 4.4% in November 2023. Watch for the release on January 10, 2024.

Takeaway: Australia’s CPI reflects the current inflation condition in Australia. This slower forecast could potentially have a negative effect on the Australian Dollar.

In November 2023, US consumer prices edged up by 0.1% compared to the previous month, with an anticipated uptick of 0.2% expected in the December 2023 data. Keep an eye out for the release on January 11, 2024.

Takeaway: The US CPI reflects the current inflation condition in the US. This positive forecast could potentially have a positive effect on the US Dollar.

After contracting by 0.3% in October 2023, the UK GDP is anticipated to show growth of 0.2% in November 2023. Data is scheduled for release on January 12, 2024, following two months of consecutive growth.

Takeaway: The UK GDP reflects the current economic condition in the UK. This positive forecast could potentially have a positive effect on the British Pound.

US producer prices remained unchanged in November 2023 after a 0.4% decline in the prior period. Anticipations for the December 2023 data, set to be released on 12 January 2024, suggest a 0.1% increase.

Takeaway: The US PPI reflects the current inflation condition in the US. This positive forecast could potentially have a positive effect on the US Dollar.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.