Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

The stock market witnessed a persistent upward trend with the S&P 500 maintaining a seven-week winning streak, inching closer to its previous all-time high. While the Dow Jones Industrial Average showed marginal movement, the S&P 500 surged by 0.45%, notably driven by gains in mega-cap tech companies like Meta Platforms and Alphabet. U.S. Steel shares soared by 26% following an acquisition announcement by Japan’s Nippon Steel. December marked robust performance across major indices, spurred by the Federal Reserve’s indication of potential short-term interest rate cuts in 2024 amidst cooling inflation. In the currency market, fluctuations in major pairs like EUR/USD, USD/JPY, Dollar Index, and British Pound were observed, influenced by speculation on rate cuts by central banks and economic indicators impacting their trajectories.

The stock market saw a continuation of its upward trend as the S&P 500 maintained its seven-week winning streak. The Dow Jones Industrial Average experienced marginal movement, edging up by only 0.86 points to 37,306.02, while the S&P 500 climbed by 0.45% to reach 4,740.56, inching closer to its all-time closing high from January 2022, now just 1.2% away. Communication services stood out with a 1.9% increase in the S&P 500, notably driven by gains in mega-cap tech companies like Meta Platforms and Alphabet, which surged nearly 3% and more than 2%, respectively. Additionally, U.S. Steel shares soared by 26% following the announcement of Japan’s Nippon Steel acquiring the company for $14.9 billion.

December showcased robust performance across major indices, with the S&P 500 up by 3.8% for the month, while the Dow and Nasdaq rose by 3.8% and 4.8%, respectively. The positive investor sentiment stemmed from the Federal Reserve’s indication of expecting three short-term interest rate cuts in 2024, given the backdrop of cooling inflation. This sentiment shift led to a drop in Treasury yields, with the 10-year Treasury yield dipping below the 4% mark, further contributing to the market’s positive trajectory.

Data by Bloomberg

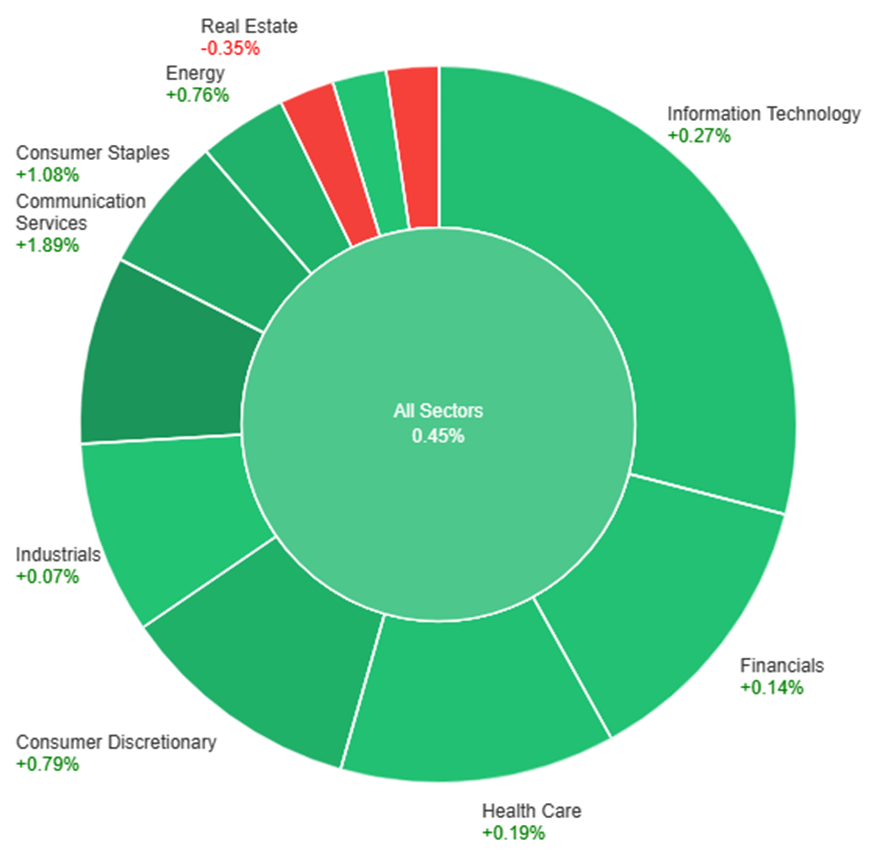

On Monday, the overall market saw a positive trend, with a collective rise of 0.45% across all sectors. Notably, Communication Services performed exceptionally well, soaring by 1.89%, followed by strong gains in Consumer Staples at 1.08% and Consumer Discretionary at 0.79%. Energy and Information Technology also contributed positively with increases of 0.76% and 0.27%, respectively. However, Utilities and Real Estate experienced declines, showing decreases of -0.30% and -0.35%, respectively, marking the only sectors that saw a downturn on that day.

In the recent currency market updates, the focus was primarily on the fluctuations of major currency pairs, notably the EUR/USD and USD/JPY, alongside observations regarding the Dollar Index and the British Pound. The Dollar Index experienced a 0.1% decline amid speculations regarding potential rate cuts by the Fed, ECB, and BoE in 2024. The EUR/USD pair saw a 0.3% rise, influenced by the rebound in Bunds-Treasury yield spreads due to resistance from some ECB policymakers against early 2024 rate cuts. However, the pair faced concerns over German Ifo business sentiment and the risk of a potential recession reading, impacting its trajectory within a specific trading range.

Conversely, USD/JPY observed a 0.5% increase as it continued its recovery from prior plunges, influenced by market uncertainties surrounding aggressive Fed rate cut expectations versus the possibility of a BoJ hike. The broader trend for USD/JPY seemed downward, particularly if the BoJ failed to indicate a move away from negative rates. Meanwhile, the British Pound declined by 0.3%, distancing itself from recent highs following a dovish Fed and hawkish BoE meeting. Focus shifted to the upcoming UK CPI report, while observations noted a bearish divergence from last week’s highs and a strong demand for Sterling at its 200-day moving average, hinting at potential consolidation in the near term.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| JPY | BOJ Policy Rate | Tentative | |

| JPY | BOJ Press Conference | Tentative | -0.10 (Actual) |

| CAD | Consumer Price Index m/m | 21:30 | -0.1% |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.