Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

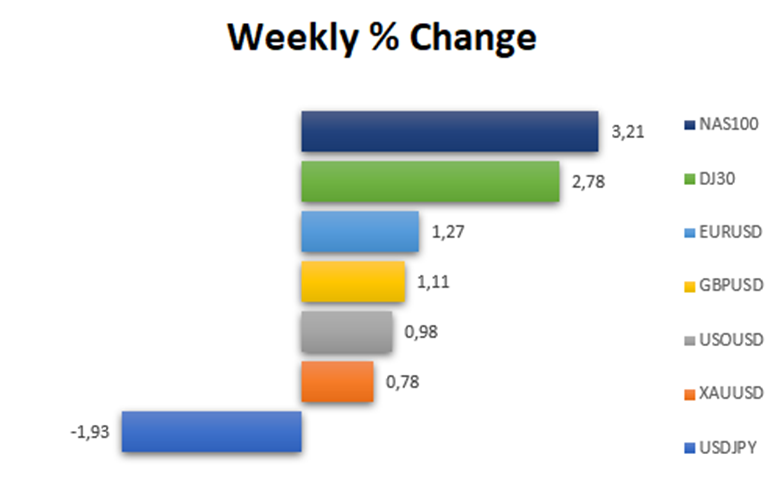

In the past week, the US dollar experienced a slight increase during early European trade on Friday. However, it’s set for its most significant weekly decline since July. This drop is attributed to the Federal Reserve indicating potential rate cuts in the upcoming year. Meanwhile, European central banks are maintaining their more aggressive stances, contributing to the dollar’s downward trajectory.

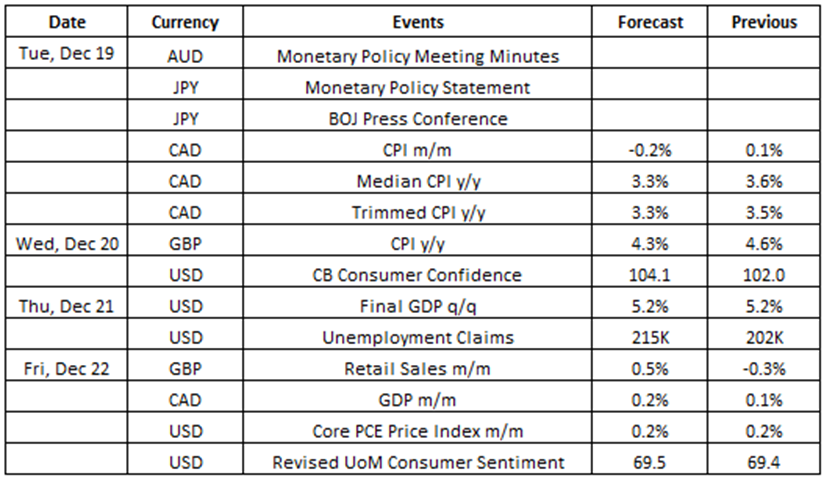

Check more economic events in the VT Markets Economic Calendar

This week, the market’s focus will primarily revolve around the Bank of Japan’s rate decision. Investors are eagerly anticipating any statements from the bank’s governor Kazuo Ueda, especially after observing the impact of the strong Japanese Yen arising from a weakening US Dollar. In addition to this, consumer price index (CPI) and gross domestic product (GDP) data for various regions will also be released, possibly further affecting the market.

As always, traders are advised to exercise caution as we approach these significant market highlights for the week:

Following its October meeting, the Bank of Japan (BOJ) maintained its key short-term interest rate at -0.1% and held 10-year bond yields steady at approximately 0%.

No changes are expected in the BOJ’s upcoming rate statement, scheduled for release on 19 December.

Takeaways:

This will be the last Bank of Japan’s (BOJ) Interest Rate Decision in 2023 and will be closely watched by traders. According to the provided information, we anticipate that this data release could potentially weaken the Japanese Yen (JPY) unless there are other impactful statements from the BOJ.

Canada’s CPI rose by 0.1% month-over-month in October 2023, rebounding from a 0.1% decline in September.

Analysts expect a decrease of 0.2% in the CPI figures for November, scheduled for release on 19 December.

Takeaways:

Canada Consumer Price Index (CPI) data is a crucial inflation indicator eagerly anticipated by traders. This data usually has a direct impact on CAD currency pairs. According to the provided information, we expect this data release to potentially weaken the Canadian Dollar.

The UK’s annual CPI data reflected a decline in the UK’s inflation rate, from 6.7% in August and September 2023 to 4.6% in October 2023.

Analysts expect the UK’s annual CPI to drop further to 4.3% in the next set of updated figures, scheduled for release on 20 December.

Takeaways:

The UK annual Consumer Price Index (CPI) data, 2023, is a crucial inflation indicator eagerly anticipated by traders. This data usually has a direct impact on GBP currency pairs. According to the provided information, we expect this data release to potentially weaken the British Pound.

The US economy saw an annualized expansion of 5.2% in Q3 2023, surpassing a preliminary estimate of 4.9% and marking the strongest growth since Q4 2021.

Analysts expect a 5.2% expansion in the US economy to be confirmed following the release of updated GDP data on 21 December.

Takeaways:

The US final GDP is a crucial indicator eagerly anticipated by traders which shows the latest update regarding the US economy. This data usually has a direct impact on USD currency pairs. According to the provided information, we expect this data release to potentially strengthen the US Dollar.

Retail sales in the UK declined by 0.3% month-over-month in October 2023 following a revised 1.1% decrease in September.

Analysts expect a 0.5% increase in the next set of UK retail sales figures, scheduled for release on 22 December.

Takeaways:

The UK retail sales data is a crucial economic indicator eagerly anticipated by traders. This data usually has a direct impact on GBP currency pairs. According to the provided information, we expect this data release to potentially strengthen the British Pound.

The Canadian economy grew by 0.1% in September 2023, primarily propelled by a 0.3% increase in goods-producing industries. This also marked its first upturn in six months.

Analysts expect a 0.2% increase in the next set of GDP data for Canada, slated for release on 22 December.

Takeaways:

Canada’s GDP is a crucial indicator eagerly anticipated by traders which shows the latest update regarding Canada’s economy. This data usually has a direct impact on CAD currency pairs. According to the provided information, we expect this data release to potentially strengthen the Canadian Dollar.

Core personal consumption expenditure (PCE) prices for the US increased by 0.2% in October 2023, marking a slight easing from the 0.3% rise observed in September.

Analysts expect a 0.2% increase in the core PCE price index for the US following the release of updated data on 22 December.

Takeaways:

The US core PCE price index data is a crucial economic indicator eagerly anticipated by traders. This data usually has a direct impact on USD currency pairs. According to the provided information, we expect this data release to potentially strengthen the US Dollar.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.