Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

Stock futures showed minimal movement as Wall Street tracked the market’s resilience against impending inflation data. Modest increases in Dow Jones futures contrasted slight declines in S&P 500 and Nasdaq 100 futures, indicating a sustained end-of-year rally with indices securing multi-week gains. Investor sentiment faces a test with the upcoming release of the consumer price index (CPI) and the Federal Reserve’s final meeting, compounded by Oracle’s post-trading decrease. Additionally, recent dollar index growth, speculation on central bank actions, and stable currency pair movements contribute to the market’s delicate balance, with inflation and corporate earnings poised to challenge bullish sentiment.

Stock futures exhibited minimal movement on Monday evening as Wall Street monitored the potential for the ongoing market surge to withstand upcoming inflation data. Futures linked to the Dow Jones Industrial Average marginally increased by 2 points, while S&P 500 and Nasdaq 100 futures experienced slight declines, each less than 0.1%. Despite these fractional changes, Monday’s modest stock market rise suggested that the end-of-year rally persisted, marking the S&P 500’s highest closure since March 2022 and the Dow’s strongest settlement since January 2022. Notably, all three major indices—the Dow, S&P 500, and Nasdaq Composite—maintained three-day winning streaks and had secured six consecutive weeks of gains.

However, investor sentiment faces a pivotal test on Tuesday as the release of November’s consumer price index (CPI) before the market opens and the commencement of the Federal Reserve’s final meeting of the year could sway market direction. Additionally, the market might react to tech giant Oracle’s after-hours trading decline of 7%, prompted by its fiscal second-quarter revenue missing Wall Street’s expectations. These developments indicate a delicate balance for the market, with inflation data and corporate earnings posing potential challenges to the prevailing bullish sentiment.

Data by Bloomberg

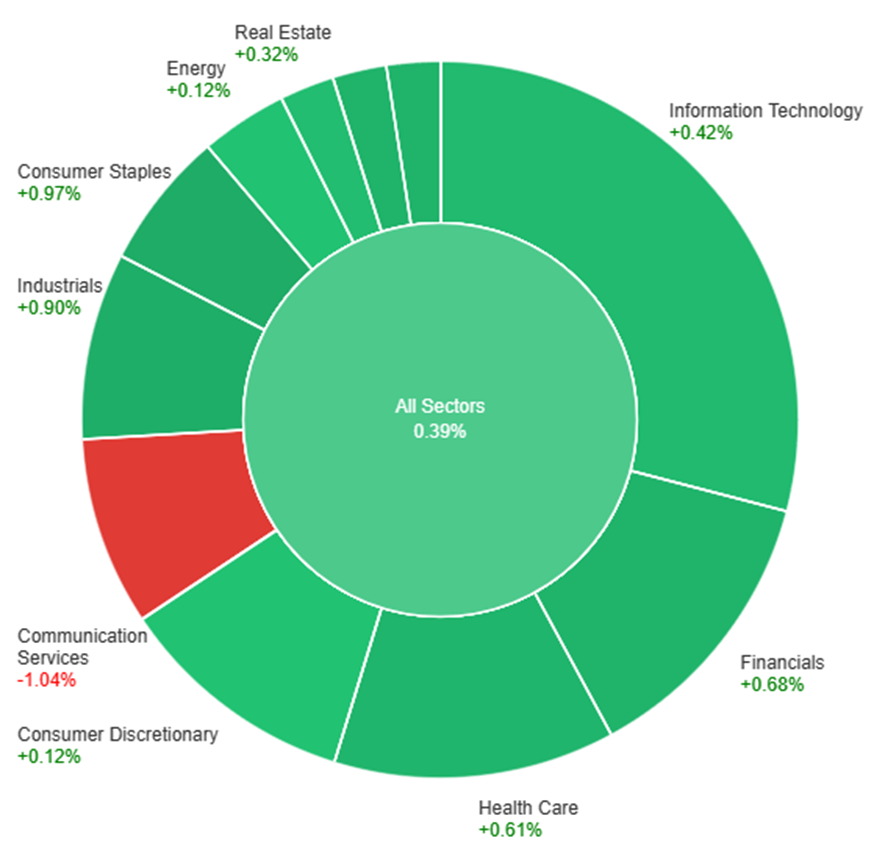

On Monday, the market saw an overall positive trend with all sectors showing gains except for Communication Services, which experienced a decline of 1.04%. Consumer Staples led the gains with a notable increase of 0.97%, followed closely by Industrials at 0.90%, Materials at 0.71%, and Financials at 0.68%. Sectors like Utilities, Health Care, and Information Technology also contributed to the uptrend, albeit to a slightly lesser extent, with gains ranging from 0.42% to 0.66%. However, the Real Estate and Consumer Discretionary sectors showed more modest increases at 0.32% and 0.12%, respectively. Energy mirrored Consumer Discretionary with a similar 0.12% gain.

In recent market movements, the dollar index experienced a 0.13% surge post an encouraging payrolls report, prompting a sharp reversal in USD/JPY’s decline driven by exaggerated speculation on BoJ rate hikes and aggressive Fed rate cut predictions. Attention now pivots towards the upcoming U.S. CPI release and the Fed’s meeting conclusion later in the week. Treasury yields and the dollar, after robust Treasury auctions, have been on a decline.

The USD/JPY pair showcased a notable 0.9% ascent, nearly recovering from its substantial plunge in November, which saw a drastic 3.8% decline in a single day. Misinterpretation of BoJ Governor Kazuo Ueda’s remarks on potential rate hikes led to misconceived expectations, dispelled by reports suggesting the BoJ sees no rush in eliminating negative interest rates owing to insufficient evidence of sustained inflation stemming from wage growth. Market futures currently indicate a probability of a 10bp hike not until April, post-spring wage negotiations, and the disclosure of FY 2024-5 plans. The primary determinant for USD/JPY and other dollar pairings continues to be the trajectory of Fed policies. Anticipations have shifted post the jobs data, now leaning towards a first Fed hike in May rather than March, with four hikes projected by year-end, as opposed to the previously expected five.

Meanwhile, other currency pairs experienced relatively stable movements. EUR/USD remained stagnant, potentially influenced by concerns regarding China’s contracting economy, expectations of 130bp ECB cuts by 2024, and apprehensions about Ukraine’s financial capability in countering Russia’s invasion. Sterling demonstrated minimal change, relinquishing earlier gains, preceding notable U.S. event risks, including UK jobs data and the BoE and ECB meetings later in the week. The market favors the BoE’s initial cut in June, projecting a total of 75bp reductions next year. The Australian dollar declined by 0.15%, affected by surging Treasury yields, Chinese deflation trends, and plummeting energy prices, with USD/CNH reaching its highest level since November 20th.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| GBP | Claimant Count Change | 15:00 | 20.3K |

| USD | Core CPI m/m | 21:30 | 184K |

| USD | CPI m/m | 21:30 | 3.9% |

| USD | CPI y/y | 21:30 | 62.0 |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.