Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

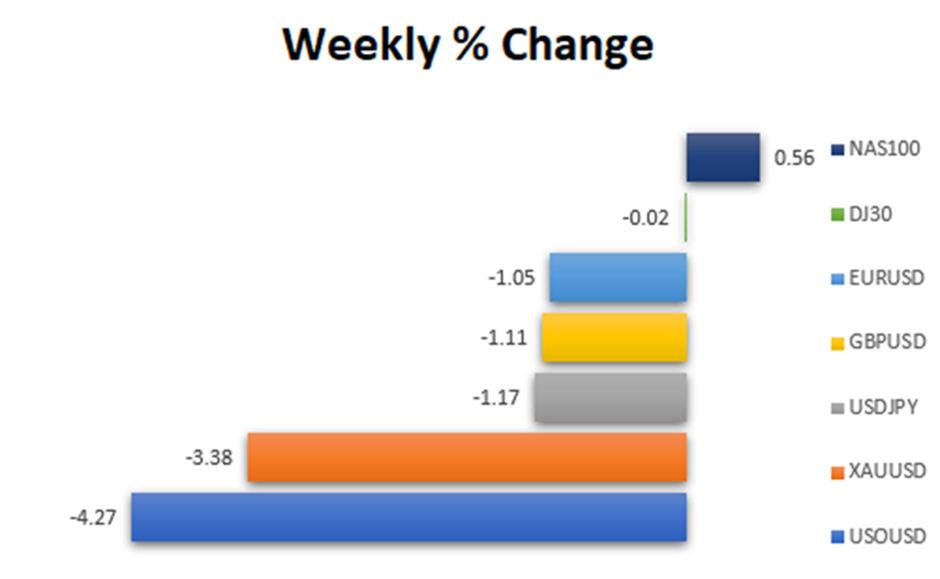

In the past week, the US dollar saw a slight uptick following positive job growth and a drop in the unemployment rate, hinting at a robust labor market. The US dollar index edged up by 0.3%, aiming for a modest weekly gain after a challenging November. However, the yen faced fluctuations, initially declining against the dollar after a substantial rally but maintaining its strength over the week. The employment report suggested the Federal Reserve might delay interest rate cuts until later in 2024, contrary to market expectations. Consequently, short-term US interest-rate futures traders adjusted their predictions, now leaning towards a potential rate cut in May instead of March. Despite the yen’s recent strength, doubts persist about its sustained momentum without further impetus from the Bank of Japan. Meanwhile, other currencies like the euro, pound, Australian dollar, and Chinese yuan experienced declines against the US dollar. Additionally, in the cryptocurrency realm, Bitcoin hovered near its highest point since April 2022.

Check more economic events in VT Markets Economic Calendar

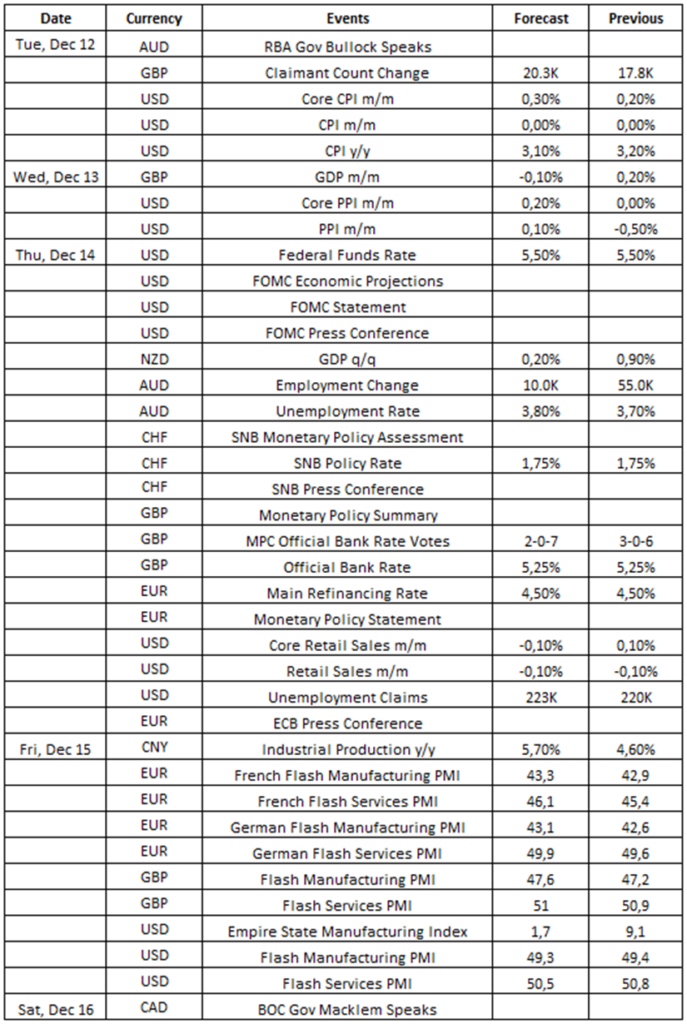

This week, the market’s primary focus revolves around the rate decisions of major central banks as they convene for their final meetings in 2023. Aside from these pivotal central bank decisions, the market is also keeping a close eye on the US consumer price index and producer price index, given that signs of inflation could influence the Fed’s policies during this period.

As always, traders are advised to exercise caution as we approach these upcoming market highlights for the week:

Consumer prices in the US remained unchanged in October after a 0.4% increase in September.

Analysts expect no changes in the updated consumer price index for November, set to be released on 12 December.

Takeaways:

The US Consumer Price Index (CPI) data, scheduled for release on December 12, 2023, is a crucial inflation indicator eagerly anticipated by traders. This data usually has a direct impact on USD currency pairs. According to the provided information, we expect this data release to potentially weaken the US Dollar.

The UK’s monthly gross domestic product (GDP) grew by 0.2% month-over-month in September 2023, following a 0.1% growth in August.

Updated figures are set to be released on 13 December, with analysts expecting the UK’s GDP to contract by 0.1%.

Takeaways:

The UK GDP data, set for release on December 13, 2023, reveals the UK’s economic condition, closely monitored by the market. This data typically directly affects GBP currency pairs. Based on the information provided, we anticipate that this data release might result in a weaker British Pound (GBP).

Producer prices in the US fell by 0.5% month-over-month in October 2023, marking the most significant decline since April 2020.

Analysts are forecasting an increase of 0.1% in the updated producer price index for the US, set to be released on 13 December.

Takeaways:

The US Producer Price Index (PPI) data, scheduled for release on December 13, 2023, is a crucial inflation indicator eagerly anticipated by traders. This data usually has a direct impact on USD currency pairs. According to the provided information, we expect this data release to potentially strengthen the US Dollar.

For the second consecutive time in November, the Federal Reserve maintained the federal funds rate at its 22-year high of 5.5%, a reflection of policymakers’ commitment to balancing the goal of reaching a 2% inflation target while avoiding excessive monetary tightening.

The next rate statement is slated for release on 14 December, with analysts expecting the rate to stay steady at 5.5%.

Takeaways:

This will be the last FOMC meeting in the year 2023 and will be closely watched by traders. After raising rates four times in 2023, the Fed held the interest rate unchanged in the last two meetings in September and November 2023. According to the provided information, we expect this data release to potentially weaken the US Dollar unless there are other impactful statements from the Fed.

The Swiss National Bank (SNB) unexpectedly opted to maintain its benchmark policy rate at 1.75% during its September 2023 meeting. This decision marks a temporary halt in the rate-hike campaign initiated in June of the previous year.

No change is expected in the SNB’s forthcoming rate statement, slated for release on 14 December.

Takeaways:

This will be the last Swiss National Bank (SNB) Interest Rate Decision in 2023 and will be closely watched by traders. According to the provided information, we anticipate that this data release could potentially weaken the Swiss Franc (CHF), unless there are other impactful statements from the SNB.

During its November meeting, the Bank of England held firm on its benchmark interest rate, keeping it steady at a 15-year high of 5.25% for the second consecutive time. This decision comes as a response to recent indications of a slowdown in the UK’s economy coupled with the persistent challenge posed by elevated inflation.

The next rate statement is expected to be released on 14 December, with analysts expecting the rate to be maintained at 5.25%

Takeaways:

This will be the last Bank of England (BoE) Interest Rate Decision in 2023 and will be closely watched by traders. According to the provided information, we expect this data release to potentially weaken the British Pound (GBP), unless there are other impactful statements from the BoE.

The European Central Bank (ECB) maintained its interest rates at 4.5% in October, signalling a notable departure from its 15-month trend of consecutive rate hikes. This decision underscores a shift towards a more cautious approach among policymakers, influenced by easing price pressures and apprehensions regarding an impending recession.

No change is expected in the ECB’s forthcoming rate statement, slated for release on 14 December.

Takeaways:

This will be the final European Central Bank (ECB) Interest Rate Decision in 2023 and will be closely watched by traders. According to the provided information, we anticipate that this data release could potentially weaken the Euro (EUR), unless there are other impactful statements from the ECB.

After a 6-month stretch of growth, retail sales in the US declined by 0.1% month-over-month in October 2023.

Analysts expect another 0.1% decrease in the forthcoming retail sales data for the US, scheduled to be released on 14 December.

Takeaways:

The US Retail Sales data, set for release on December 14, 2023, is eagerly anticipated by traders as a key economic indicator. This data typically directly influences USD currency pairs. Based on the provided information, we anticipate that this data release might lead to a potential weakening of the US Dollar.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.