Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

The stock market displayed a mixed session with varied movements across major indices: the Dow and S&P 500 edged slightly downward while the Nasdaq surged, propelled by tech stock performance. Factors including the U.S. 10-year Treasury yield dip below 4.2% and European market fluctuations played key roles. Amidst this, notable individual stock movements, like GitLab’s surge and the Russell 2000’s fall, highlighted nuanced market dynamics. Additionally, the currency market witnessed significant fluctuations, including the EUR/USD pair’s decline, highlighting the impact of central bank signals and global economic indicators on currency valuations.

The stock market experienced a mixed day on Tuesday as major indices saw varied movements. The Dow Jones Industrial Average and the S&P 500 slid slightly, with the Dow dropping by 0.22% to close at 36,124.56 and the S&P 500 inching down by 0.06% to 4,567.18. However, the Nasdaq Composite managed to gain 0.31%, reaching 14,229.91, propelled by the outperformance of technology shares. GitLab surged by 11.5% after surpassing quarterly financial expectations and issuing robust guidance for the current quarter. Conversely, the Russell 2000 fell by more than 1% after a recent upward trend, raising hopes for a broader market rally and potential interest rate cuts from the Federal Reserve.

The market’s movements were influenced by various factors, including fluctuations in the U.S. 10-year Treasury yield, which fell below the significant 4.2% level, indicating a cooling labor market. This prompted a boost in technology shares, driving the Nasdaq into positive territory for the session. Meanwhile, European markets displayed mixed performance, with the Stoxx 600 index closing 0.4% higher, fueled by gains in auto stocks but offset by drops in mining stocks. Telecom stocks also saw notable shifts, with Ericsson climbing by 4.4% following a deal with AT&T, while Nokia faced an 8.4% plunge due to anticipated losses. The overall market sentiment seemed to hinge on prospects of potential rate cuts from the Federal Reserve, despite attempts by Fed Chair Jerome Powell to temper expectations for such measures. Additionally, gold prices reached record highs, touching $2,100, propelled by geopolitical uncertainty, a weaker U.S. dollar, and expectations of future interest rate cuts.

The market’s trajectory appeared influenced by nuanced shifts in various sectors and global events, with investors closely monitoring economic data, Federal Reserve signals, and geopolitical factors that could impact future market movements.

Data by Bloomberg

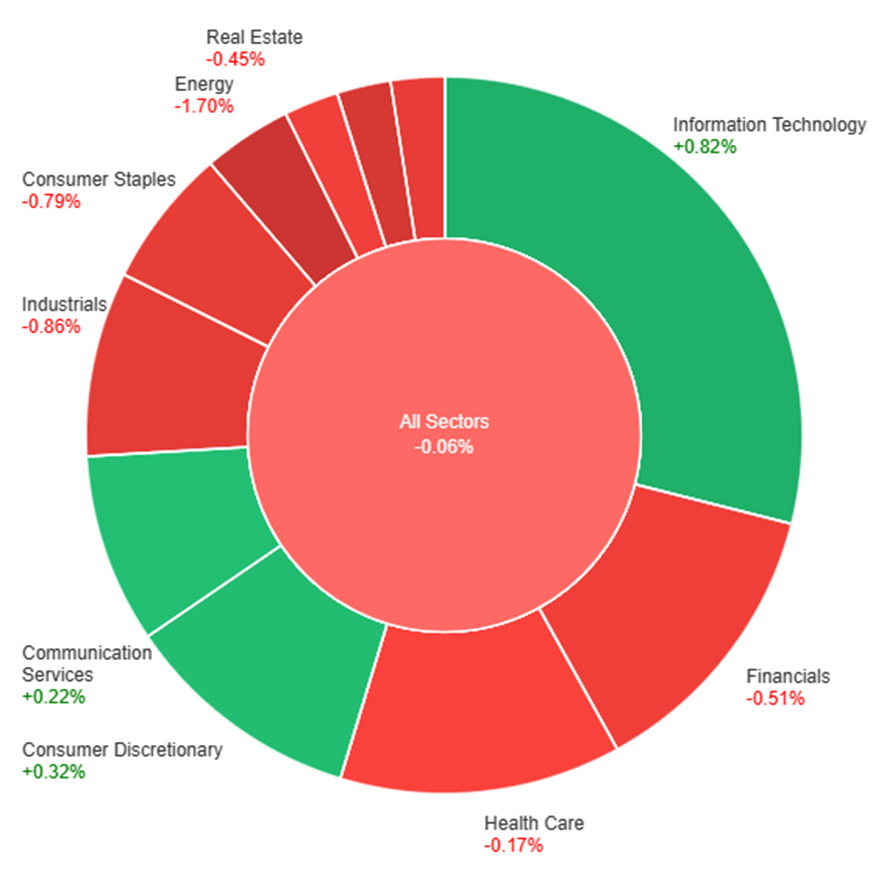

On Tuesday, the overall market saw a slight dip of 0.06%. However, specific sectors experienced varied movements. Information Technology surged by 0.82%, leading the gainers, followed by Consumer Discretionary (+0.32%) and Communication Services (+0.22%). Health Care (-0.17%), Real Estate (-0.45%), Financials (-0.51%), Consumer Staples (-0.79%), Utilities (-0.81%), Industrials (-0.86%), Materials (-1.37%), and Energy (-1.70%) all faced declines, with Energy and Materials showing the most significant drops among the sectors.

The currency market witnessed significant fluctuations, particularly in the EUR/USD pair, which plummeted by 0.5%. This decline came after ECB’s Isabel Schnabel hinted at holding off on further rate hikes, coupled with improved U.S. November ISM services. The breach of support at 1.0800 led to a 0.4% rise in the dollar index, heavily influenced by EUR/USD, surpassing its downtrend line and settling around the 200-day moving average at 103.56. The market anticipates potential dollar gains depending on forthcoming economic indicators like Thursday’s jobless claims, Friday’s employment report, and next Tuesday’s CPI. This could mitigate the slide in Treasury yields, which have been factoring in five Fed cuts in 2024, possibly commencing as early as March post the Fed’s Dec. 12-13 meeting. Simultaneously, the ECB appears poised for two rate cuts by April and a substantial 142 basis points cut by the year-end.

Meanwhile, the pound experienced a 0.4% decline amidst a drop in 10-year gilts yields. Sterling’s support from the Bank of England signals a longer maintenance of higher rates compared to the Fed in the upcoming year. However, this also highlights the greater challenge the UK faces in curbing disinflation compared to the U.S. and the eurozone. In another development, the USD/JPY pair rose by 0.1% after initial fluctuations following mixed U.S. data. Yet, a bearish outlook persists due to a double-top at 32-year highs, hinting at potential medium-term weakness as the Fed’s tightening cycle reverses. The pair has approached major support levels at 146.64, and further decline might target significant supports at 144.58.

Additionally, the Australian dollar fell by 1% post the RBA meeting, perceived as less hawkish than anticipated. Moody’s downward revision of China’s outlook and a subsequent drop in the CSI300 added to the pressure, leading to the Aussie’s decline to its lowest point since February 2019. These combined factors contributed to the noteworthy movements across the currency market, reflecting the influence of global economic indicators and central bank policies on currency pairs’ valuations.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| AUD | GDP q/q | 08:30 | 0.2% (Actual) |

| USD | ADP Non-Farm Employment Change | 21:15 | 131K |

| CAD | BOC Rate Statement | 23:00 | |

| CAD | Overnight Rate | 23:00 | 5.00% |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.