Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

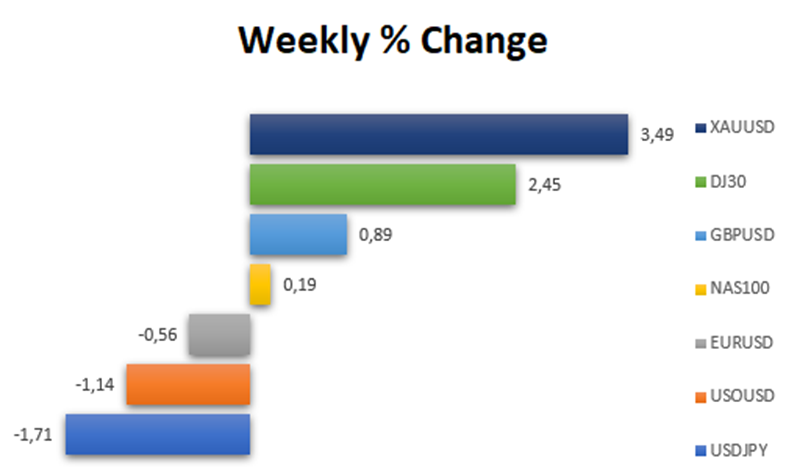

In the past week, the US dollar declined after Federal Reserve Chair Jerome Powell hinted at more balanced risks regarding interest rate changes. Powell’s cautious stance, interpreted as dovish, led investors to expect a pause in rate hikes. Consequently, the dollar index fell, marking a third consecutive week of losses. Powell’s remarks were informed by weak US manufacturing data, which confirmed the economic slowdown caused by rate increases. The softer inflation data in the US and the Eurozone reinforced expectations that central banks might refrain from raising rates, with some even predicting potential cuts. Following Powell’s comments, the euro and sterling appreciated against the dollar. The yen strengthened for the third week, buoyed by growing expectations of a shift in the Bank of Japan’s monetary policy. Amidst these market shifts, bitcoin soared to an 18-month high.

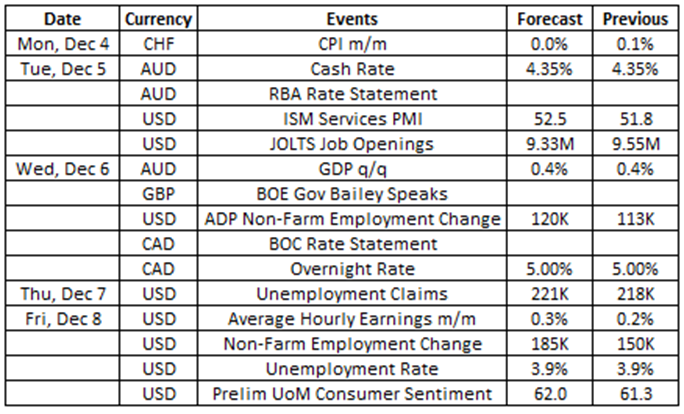

Source: VT Markets Economic Calendar

Various events are set to impact the markets this week, most notably the rate decisions of major central banks including the Reserve Bank of Australia and the Bank of Canada. Traders are advised to exercise caution and stay informed about the latest developments to ensure a successful week of trading.

Here are the upcoming market highlights for the week:

Reserve Bank of Australia Rate Statement (5 December 2023)

The Reserve Bank of Australia raised its cash rate by 25 bps to 4.35% in November after maintaining it at 4.1% following its previous four meetings.

Analysts predict that the central bank will keep its cash rate at 4.35% after its upcoming meeting on 5 December.

Takeaway: The interest rate statement decision from the RBA this week will create high volatility for the Australian Dollar. Market experts expect the central bank to maintain the interest rate, which could potentially weaken the Australian Dollar.

US ISM Services PMI (5 December 2023)

The Institute of Supply Management (ISM) Non-Manufacturing PMI—also known as the US ISM Services PMI—fell to 51.8 in October, the lowest in five months.

Updated figures will be released on 5 December, with analysts expecting an updated PMI of 52.

Takeaway: The US ISM Services PMI will provide information about the health of the US services sector. Based on the forecasted numbers, we can see that the services sector is still in expansion mode, which could potentially boost the US Dollar.

Australia Quarterly Gross Domestic Product (6 December 2023)

The Australian economy expanded by 0.4% in Q2 2023.

Analysts predict that the data for Q3, scheduled to be released on 6 December, will indicate slower expansion at 0.3%.

Takeaway: Australia’s Quarterly GDP will create high volatility for the Australian Dollar. Market experts expect the quarterly GDP to have another expansion which could potentially strengthen the Australian Dollar.

Bank of Canada Rate Statement (6 December 2023)

The Bank of Canada kept the target for its overnight rate at 5% following its October 2023 meeting.

Its next rate statement is scheduled to be released on 6 December, with analysts anticipating that the rate will remain at 5%.

Takeaway: The interest rate statement decision from the BOC this week will create high volatility for the Canadian Dollar. Market experts expect the central bank to maintain the interest rate, which could potentially weaken the Canadian Dollar.

US Jobs Report (8 December 2023)

The US economy added 150,000 jobs in October, a decrease from the 297,000 jobs added in September. Meanwhile, the unemployment rate increased to 3.9% in the same period, slightly exceeding the previous month’s figure of 3.8%.

Updated figures will be released on 8 December, with analysts forecasting the addition of 180,000 more jobs and an unemployment rate of 3.9%.

Takeaway: The US Jobs report is on the horizon, and it’s a big deal for the US Dollar. This report will tell us about jobs, unemployment, and wages in the US. Based on what experts are saying might happen, the US Dollar could get stronger.

University of Michigan Consumer Sentiment Index (8 December 2023)

The University of Michigan Consumer Sentiment Index for the US was revised to 61.3 in November from a preliminary figure of 60.4, but it remained at its lowest level since May.

Updated figures will be released on 8 December, with analysts expecting the index to hit 61.8.

Takeaway: The rise in consumer sentiment indicates a growing optimism among consumers about the economy. This positive outlook can influence consumer spending and contribute to overall economic growth. However, the higher reading for this data might have a positive effect on the US Dollar.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.