Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

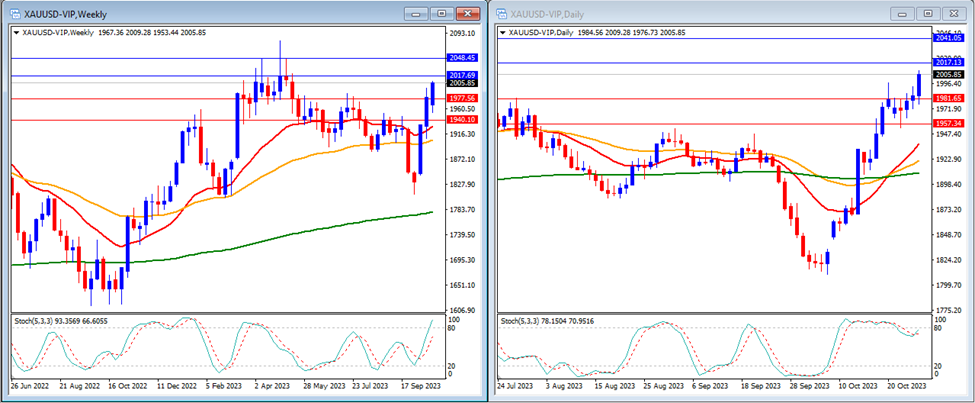

Last week, gold soared and broke above our resistance levels. Gold closed the week at $2,005.

On the weekly timeframe, we can observe that the Stochastic Indicator is moving higher, targeting the overbought area. The gold price is trading above the 20, 50, and 200-period moving averages.

Our weekly resistance levels are at $2,017 and $2,048, with support levels at $1,977 and $1,940.

On the daily timeframe, the Stochastic Indicator is moving just below the overbought area, while the price is currently trading above the 20, 50, and 200-period moving averages.

Our daily resistance levels are at $2,017 and $2,041, with support levels at $1,981 and $1,957.

Conclusion: This week, our focus will be on the tensions in the Middle East, which are expected to have a significant impact on the gold market due to its status as a safe haven. Additionally, the upcoming Fed rate decision will be a key market mover for the US Dollar, directly influencing the price of gold. We anticipate a slight correction in gold this week, expecting it to move lower to our support level at $1,977.

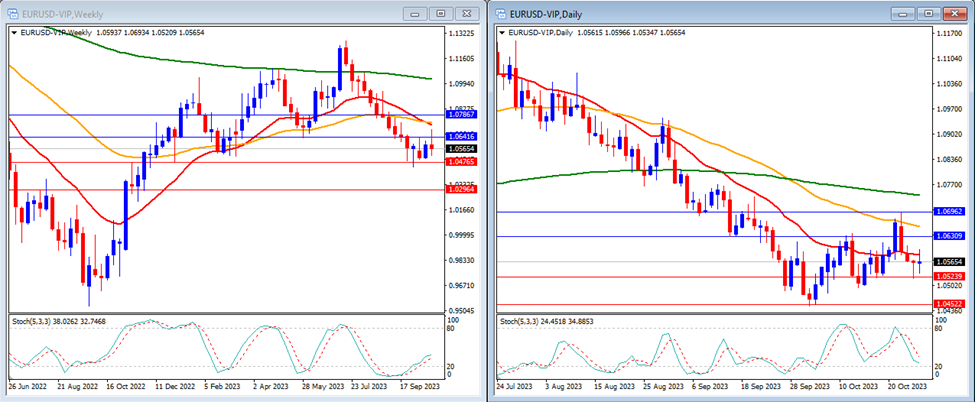

Last week, the EURUSD moved generally lower, but with a brief upward spike beyond our resistance levels. EURUSD closed the week at 1.0565.

On the weekly timeframe, the Stochastic Indicator is trending upward, exiting the oversold area. The price is trading below the 20-period, 50-period, and 200-period moving averages.

Our weekly resistance levels are at 1.0641 and 1.0786, with support levels at 1.0476 and 1.0296.

On the daily timeframe, the Stochastic Indicator is trending downward, aiming for the oversold area, while the price is trading below the 20, 50, and 200-period moving averages.

Our daily resistance levels are at 1.0630 and 1.0696, while the support levels are at 1.0523 and 1.0452.

Conclusion: We anticipate a highly volatile week for EURUSD as the market closely monitors updates regarding the war conditions in the Middle East. Additionally, the forthcoming Fed rate decision, which has the potential to influence the US Dollar, will directly impact EURUSD. Our expectation is for the EURUSD to trend slightly downward, potentially reaching our support level at 1.0523.

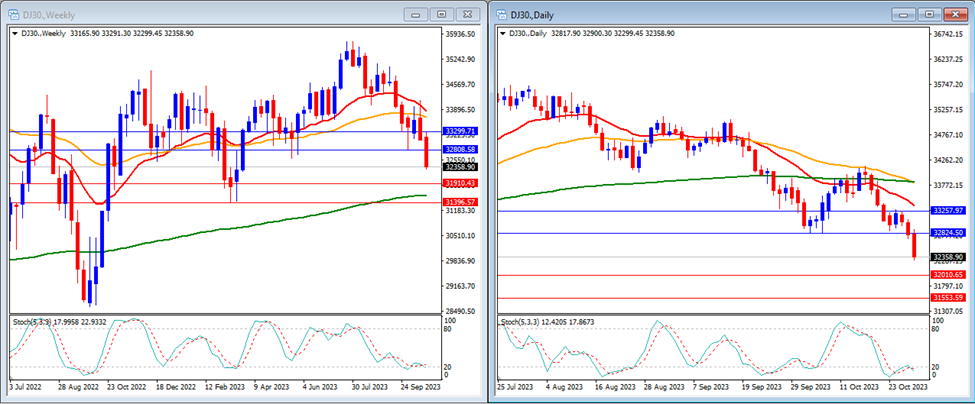

Last week, the DJ30 trended lower and successfully broke below our support level, closing the week at 32,358.

On the weekly timeframe, the Stochastic Indicator is trending lower, targeting the oversold area. The price is currently trading below the 20 and 50-period moving averages, yet remains above the 200-period moving average.

Our weekly resistance levels are at 32,808 and 33,299, with support levels at 31,910 and 31,396.

On the daily timeframe, the Stochastic Indicator is hovering around the oversold area. The price is currently trading below the 20, 50, and 200-period moving averages.

Our daily resistance levels are 32,824 and 33,257, with support levels at 32,010 and 31,553.

Conclusion: We anticipate a week of high volatility in the US stock market, driven by earnings reports from several companies and the upcoming Fed rate decision. As the market evaluates the US Dollar’s status as a safe haven, we expect the DJ30 might trend downward, possibly reaching our support level at 32,010.

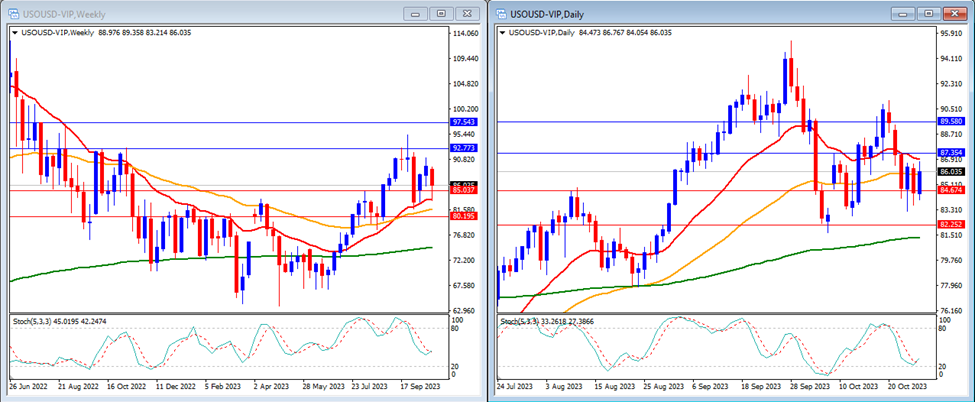

Last week, USOUSD (Oil) moved lower but managed to break above our daily support levels, closing the week at 86.03.

On the weekly timeframe, the Stochastic Indicator is trending lower, positioned midway. The price is trading above the 20-period, 50-period, and 200-period moving averages.

Our weekly resistance levels are 92.77 and 97.54, with support levels at 85.03 and 80.19.

On the daily timeframe, the Stochastic Indicator is hovering slightly above the oversold area. The price is currently trading below the 20-period moving average, yet remains above both the 50 and 200-period moving averages.

Our daily resistance levels are at 87.35 and 89.58, while support levels are at 84.67 and 82.25.

Conclusion: Based on the prevailing sentiment related to tensions in the Middle East, we anticipate further significant movement in USOUSD. There’s potential for an upward trend, with USOUSD possibly approaching our resistance level at 87.35.

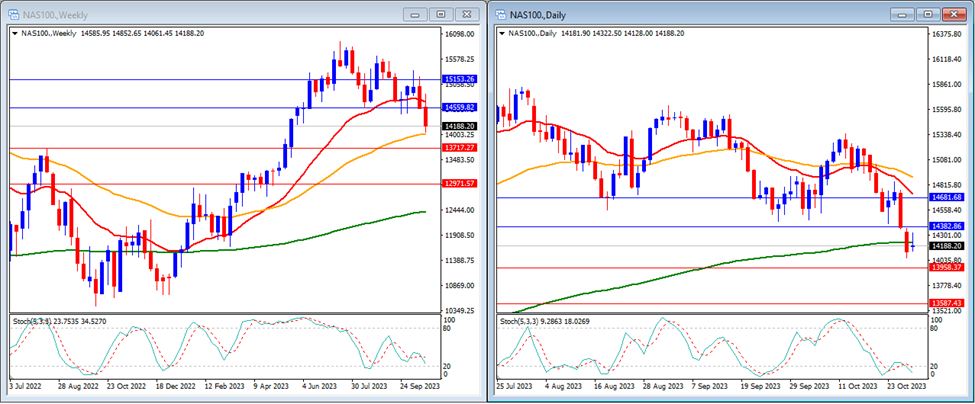

Last week, the NAS100 trended lower and successfully breached our support levels, closing the week at 14,188.

On the weekly timeframe, the Stochastic Indicator is trending downward, aiming for the oversold area. The price is currently trading below the 20-period moving average, yet remains above both the 50 and 200-period moving averages.

Our weekly resistance levels are 14,559 and 15,153, with support levels at 13,717 and 12,971.

On the daily timeframe, the Stochastic Indicator is trending lower and entering the oversold area. The price is currently trading below the 20, 50, and 200-period moving averages.

Our daily resistance levels are currently at 14,382 and 14,681, while support levels are at 13,958 and 13,587.

Conclusion: We anticipate a highly volatile week for the US stock market, influenced by earnings reports from several companies and the upcoming Fed rate decision. As the market assesses the US Dollar’s role as a safe haven, we expect the NAS100 might trend downward, potentially reaching our support level at 13,717.

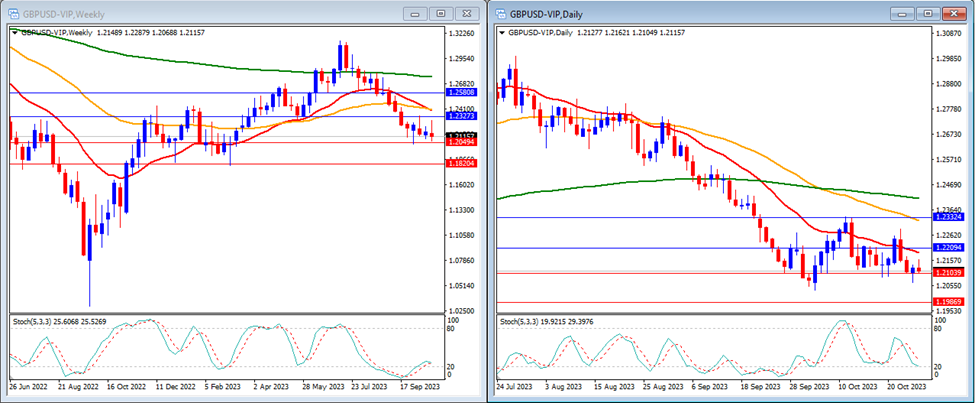

Last week, GBPUSD experienced a minor decline, consolidating within our designated support and resistance levels and closed the week at 1.2115.

On the weekly timeframe, the Stochastic Indicator is trending upward, positioned slightly above the oversold area. The price is currently trading below the 20-period, 50-period, and 200-period moving averages.

Our weekly resistance levels are at 1.2327 and 1.2580, while support levels are at 1.2049 and 1.1820.

On the daily timeframe, our Stochastic Indicator is moving lower, positioned slightly above the oversold area. Meanwhile, the price is trading below the 20-period, 50-period, and 200-period moving averages.

Our daily resistance levels are now at 1.2209 and 1.2332, while support levels are at 1.2103 and 1.1986.

Conclusion: This week, we expect heightened volatility in GBPUSD due to the forthcoming rate statements from both the Bank of England and the Fed. These announcements will likely be key market influencers for GBPUSD. Our projection is for GBPUSD to trend downward, potentially dropping below our support level at 1.2103.

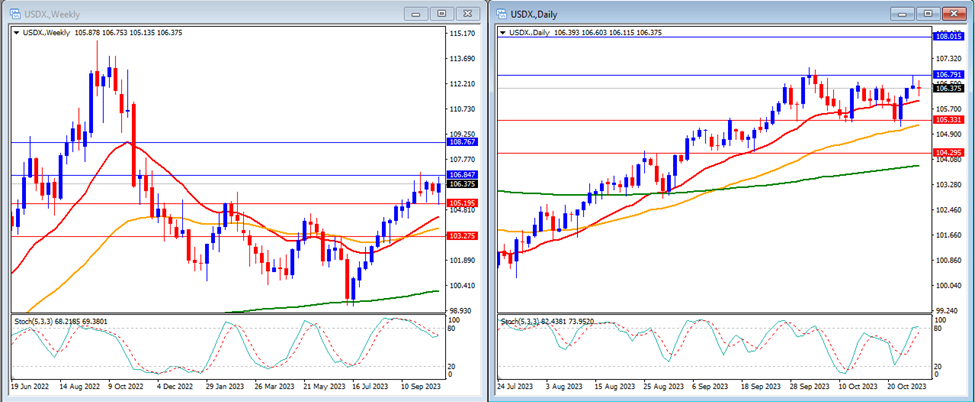

Last week, the USD Index experienced a modest rise, hovering between our established support and resistance levels, and concluded the week at 106.37.

On the weekly timeframe, the Stochastic Indicator is moving lower, positioned just beneath the overbought zone. Meanwhile, the price remains above the 20, 50, and 200-period moving averages.

Our weekly resistance levels are 106.84 and 107.98, with support levels at 105.19 and 103.27.

On the daily timeframe, the Stochastic Indicator is moving higher, approaching the overbought zone. Meanwhile, the price continues to trade above the 20, 50, and 200-period moving averages.

Our daily resistance levels are 106.79 and 108.01, with support levels at 105.33 and 104.29.

Conclusion: This week, we expect heightened volatility in the USD Index due to the upcoming Fed rate decision, which will have a direct impact on the index. Additionally, the market will be closely monitoring updates from the Middle East conflict. Our projection for the USD Index is a continued upward trend, potentially reaching our resistance level at 106.79.

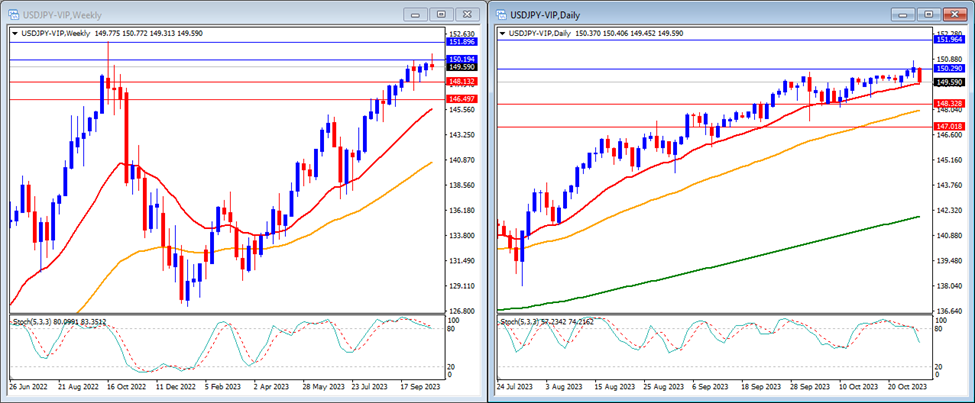

Last week, USDJPY trended modestly downward but is now approaching our resistance levels, ending the week at 149.59.

On the weekly timeframe, the Stochastic Indicator is positioned within the overbought zone. The price remains above the 20-period, 50-period, and 200-period moving averages.

Our weekly resistance levels are 150.19 and 151.89, with support levels at 148.13 and 146.49.

On the daily timeframe, the Stochastic Indicator is moving lower, positioned just beneath the overbought zone. Meanwhile, the price remains above the 20, 50, and 200-period moving averages.

Our daily resistance levels are currently at 150.29 and 151.96, while the support levels are at 148.32 and 147.01.

Conclusion: We anticipate a highly volatile week for USDJPY, with the market keenly observing updates on the Middle East conflict and potential interventions by the Bank of Japan in the currency market. The upcoming Fed rate decision, which will influence the US Dollar, adds to this anticipation. Given the ongoing market sentiment favoring the USD as a safe haven, we expect the pair to trend upward, potentially surpassing our resistance level at 150.29.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.