Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

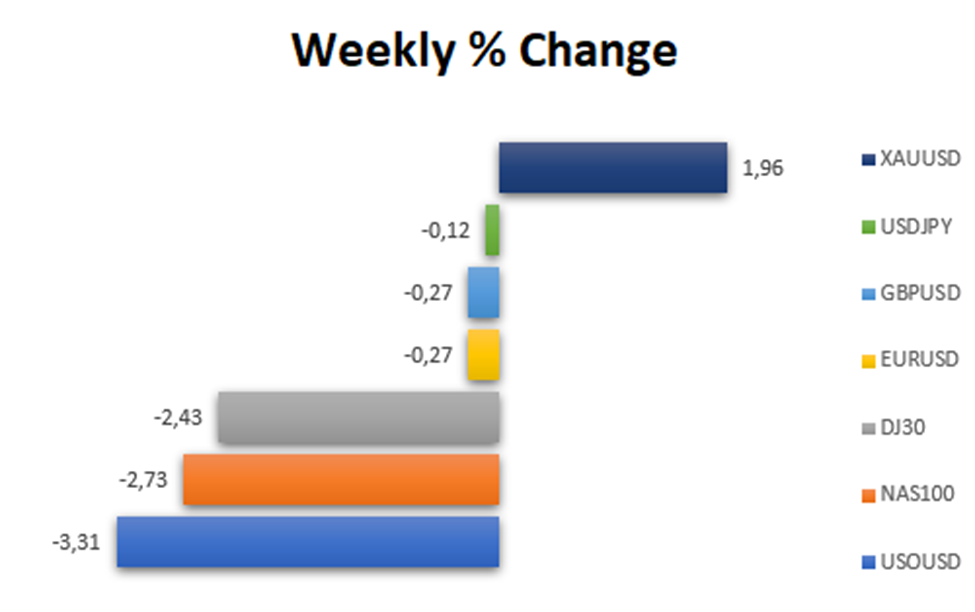

The US dollar saw a marginal decline against a basket of currencies due to portfolio rebalancing. However, bolstered by positive economic data, it was on track to conclude the week on a stronger note. US consumer spending in September surpassed expectations, pointing to a robust fourth quarter, even as inflation pressures persisted. The dollar index settled at 106.5, marking a 0.07% decrease, but was up by 0.4% over the week. Analysts link this temporary weakness to portfolio rebalancing. Despite the encouraging economic indicators, the dollar faced challenges in securing significant gains, potentially because it was overbought.

The forex market trod carefully in anticipation of forthcoming policy meetings by the Federal Reserve and the Bank of Japan. The expected easing of inflation might prompt the Fed to maintain its stance, while the Bank of Japan could explore adjustments to its bond-yield control policy.

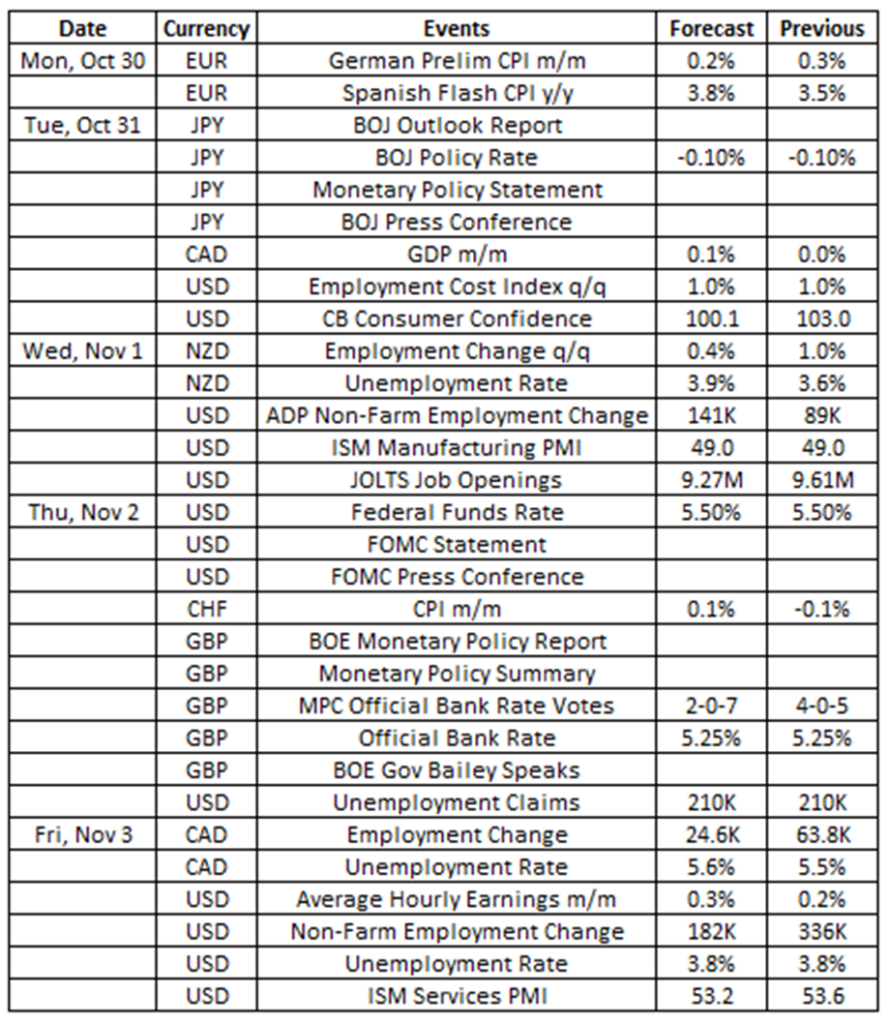

Source: VT Markets Economic Calendar

This week, traders are primarily focused on the rate decisions of major central banks, such as the Federal Reserve and Bank of England. Alongside these, the US Jobs Report is slated for release, serving as a critical indicator of the US’ economic health. Traders and investors are advised to be cautious, as these events could drive market fluctuations.

Here are some key economic highlights to keep an eye on during the week:

BOJ Rate Statement (31 October 2023)

In its September meeting, the Bank of Japan (BoJ) unanimously voted to keep its key short-term interest rate at -0.1% and the 10-year bond yields at 0%.

Analysts predict that the central bank will keep these interest rate levels in its upcoming meeting on 31 October.

Takeaway: We will have the BOJ Rate statement in which the BOJ will determine their interest rates. This is expected to cause high volatility in the Japanese Yen. Based on forecasted numbers, the JPY might weaken.

Canada Gross Domestic Product (31 October 2023)

Canada’s economy showed stagnation in July, following a 0.2% decline in June.

Analysts expect a 0.1% growth for Canada’s GDP in August, with the figures set to be released on 31 October.

Takeaway: The release of Canada’s GDP data will inform traders about the current economic condition in the country. Based on the forecast numbers, it appears that the Canadian economy is growing, which could potentially lead to an upward movement for the Canadian Dollar.

US FOMC Rate Statement (2 November 2023)

During its meeting in September, the Federal Reserve (Fed) maintained the target range for its funds rate at a 22-year high of 5.5%.

Analysts predict that the Fed will keep interest rates steady at 5.5% in the upcoming meeting on 2 November.

Takeaway: We have the FOMC meeting this week where the Fed will determine its interest rates. This is likely to cause significant volatility in the US Dollar. Based on the forecasted numbers, there’s a possibility that the US Dollar may weaken.

Bank of England Rate Statement (2 November 2023)

In its September meeting, the Bank of England held its policy interest rate at 5.25%, the highest level since 2008. This was influenced by the latest inflation and labour data.

As the next meeting approaches on 2 November, analysts predict that the central bank will maintain the rate at 5.25%.

Takeaway: We await the interest rate decision from the Bank of England (BOE) this week, expected to induce significant volatility in the Great Britain Pound (GBP). This decision will shed light on the UK’s economic conditions. Based on forecasted numbers, the market anticipates the BOE to keep the interest rate unchanged, which could potentially lead to a weakening of the GBP.

Canada Employment Change (3 November 2023)

The Canadian economy added 63,800 jobs in September 2023, the highest in eight months. However, the unemployment rate held steady at 5.5% for the third consecutive month.

Looking ahead, analysts forecast an addition of 24,600 jobs for October. These figures, due for release on 3 November, are also expected to show a slight rise in the unemployment rate to 5.6%.

Takeaway: According to the projected figures, there is a possibility that Canada’s employment data will potentially weaken the Canadian Dollar due to slower job additions and a higher unemployment rate.

US Jobs Report (3 November 2023)

The US nonfarm payrolls saw an increase of 336,000 in September, while the unemployment rate stayed steady at 3.8%.

For October 2023, the data set to be released on 3 November is anticipated to report an addition of 172,000 jobs, with the unemployment rate projected to remain at 3.8%.

Takeaway: The US Jobs Report will be released this week, and it holds significant implications for the US Dollar. This report will provide insights into jobs, unemployment, and wages in the US. According to expert predictions, the US Dollar could potentially strengthen.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.