Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

On Monday, the stock market surged as traders eagerly awaited corporate earnings reports, pushing the Dow Jones Industrial Average to its best day since September. Despite concerns about rising Treasury yields, oil prices, inflation, and conflicts in the Middle East, investors were focusing on earnings reports, offering short-term optimism. The US dollar faced a decline due to geopolitical tensions, while the British pound rose, reflecting increased risk appetite. Meanwhile, the currency market monitored the USD/JPY pair and the movements in Treasury-JGB yield spreads, with expectations of higher interest rates driving the push towards a significant breakout at 150. Additionally, the Aussie, Kiwi, and Polish zloty all saw gains.

On Monday, the stock market saw a positive surge as traders eagerly anticipated a wave of corporate earnings reports, seemingly unfazed by an increase in Treasury yields. The Dow Jones Industrial Average experienced its best day since September, climbing 314.25 points, or 0.93%, to close at 33,984.54. Likewise, the S&P 500 recorded a 1.06% gain, ending the day at 4,373.63, and the Nasdaq Composite rose by 1.2% to reach 13,567.98. Leading the Dow’s ascent were Nike and Travelers Companies, both posting gains of approximately 2.1%, while all 11 S&P 500 sectors traded higher during the session. Earnings season was set to intensify, with 11% of the S&P 500 slated to report results, including notable names like Johnson & Johnson, Bank of America, Netflix, and Tesla. A focus on earnings reports was offering investors optimism in the short term, amid concerns about rising yields, oil prices, inflation, and conflicts in the Middle East.

Although the previous week had been marked by mixed performance in the stock market, with the S&P 500 experiencing a 0.5% gain for its second consecutive positive week and the Dow gaining 0.8%, it appeared that the market was beginning to normalize after reacting to geopolitical surprises. Despite potential volatility into the year’s end, investors were increasingly focusing on the fundamentals and corporate performance as the market appeared to adapt to recent uncertainties in the geopolitical landscape.

Data by Bloomberg

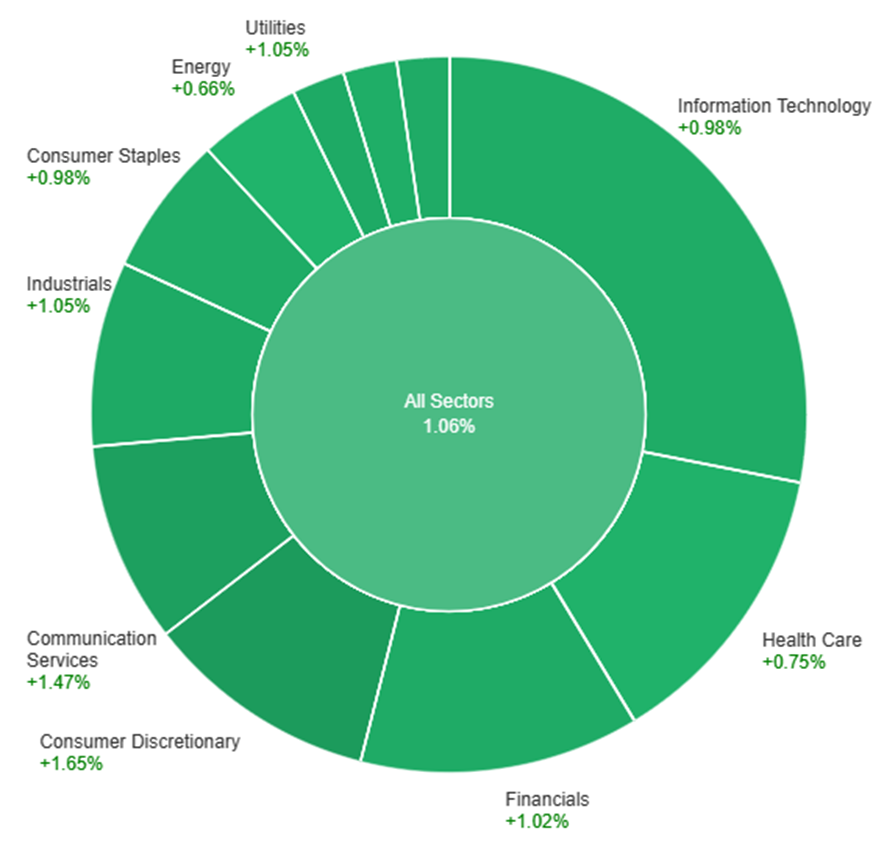

On Monday, across all sectors, the market experienced a positive trend with an overall increase of 1.06%. The highest gains were observed in the Consumer Discretionary sector, which saw a rise of 1.65%, followed by Communication Services at 1.47%, and Industrials at 1.05%. Other sectors also saw positive but relatively smaller gains, such as Utilities, Real Estate, Financials, Consumer Staples, Information Technology, Materials, Health Care, and Energy, with increases ranging from 0.66% to 0.98%.

In the currency market, the US dollar faced a decline of 0.37% as part of a broader retreat triggered by widespread derisking flows, largely connected to the Israel-Hamas conflict. This geopolitical tension had previously bolstered the US dollar late in the previous week. Despite a slight dip in bund-Treasury yield spreads, the EUR/USD pair managed to rise by 0.4% during this period, as demand for the safe-haven US dollar diminished. Notably, this surge came after eleven consecutive weeks of losses for the EUR/USD pair, a trend potentially signaling an oversold condition. It was also noted that the market sentiment had shifted, with expectations of the Federal Reserve halting its interest rate hikes.

On a similar note, the British pound (GBP) witnessed a 0.55% rise, benefiting from increased risk appetite and wider gilts-Treasury yield spreads. Huw Pill, the Chief Economist of the Bank of England (BoE), issued a warning against prematurely declaring victory over inflation. Sterling traders were anticipating the release of UK inflation data, with market expectations leaning towards the BoE being the sole major central bank likely to implement rate hikes. This expectation effectively ruled out the possibility of a UK rate cut until late 2024. Meanwhile, the USD/JPY pair remained relatively unchanged, lingering below the peak observed in October 2023 at 150.165 and the significant resistance point at 151.94, which had last been reached in 2022. The market was closely monitoring the movements in Treasury-JGB yield spreads, as they played a pivotal role in the carry trade dynamics of the currency pair. Strong US retail sales and other data that fueled expectations of higher interest rates from the Federal Reserve appeared to be the key factor driving the push towards a significant breakout at 150, with 151.94 serving as a major resistance level. Additionally, the absence of Japanese foreign exchange intervention was a critical piece of the puzzle in this scenario. Amid these developments, the Australian and New Zealand dollars, colloquially known as the Aussie and Kiwi, rose by approximately 0.7% as risk appetite rebounded in the market. Furthermore, the Polish zloty witnessed a remarkable increase of 2.2% following weekend election results that were perceived as likely to lead to improved relations within the European Union (EU).

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| GBP | Average Earnings Index 3m/y | 14:00 | 8.3% |

| CAD | CPI m/m | 20:30 | 0.1% |

| USD | Retail Sales m/m | 20:30 | 0.3% |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.