Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

The stock market opened the week on a positive note, with renewed investor interest in tech stocks following a recent slump. The Nasdaq Composite led the charge with a robust 1.14% gain, reaching 13,917.89, while the S&P 500 climbed by 0.67% to 4,487.46, and the Dow Jones Industrial Average closed at 34,663.72, up 0.25%, with Walt Disney contributing to its rise. Tesla surged by 10% due to an upgrade by Morgan Stanley, driven by optimism about its autonomous software. Qualcomm also saw a 4% increase after announcing a deal to supply Apple with 5G modems. The Technology Select Sector SPDR Fund rebounded by 0.5% after recent declines, and Disney shares rose by 1.2% following the resolution of a cable blackout dispute with Charter Communications. The market was buoyed by a report indicating that the Federal Reserve was unlikely to raise rates at its upcoming meeting, given improving inflation data. Investors are now eagerly awaiting key inflation figures in the coming week. In parallel, the US dollar declined broadly, while EUR/USD rose by 0.46%, despite the European Commission lowering its growth forecast, reflecting a weakening dollar amidst upcoming data releases and central bank meetings.

On Monday, the stock market saw a positive start to a significant week filled with inflation data releases. Investors displayed a renewed interest in tech stocks following a recent period of weakness. The Nasdaq Composite led the way with a robust 1.14% gain, reaching a value of 13,917.89. Similarly, the S&P 500 also climbed, rising by 0.67% to 4,487.46, while the Dow Jones Industrial Average advanced by 87.13 points, or 0.25%, closing at 34,663.72. Notably, Walt Disney shares contributed to the Dow’s increase. Tesla experienced a remarkable surge of 10% due to an upgrade by Morgan Stanley, which anticipated a significant rally owing to advancements in its autonomous software. In addition, Qualcomm shares rose by nearly 4% following their announcement that they would supply Apple with 5G modems for smartphones until 2026.

Meanwhile, the Technology Select Sector SPDR Fund (XLK), composed of tech shares within the S&P 500, had faced a 1.5% decline in August and more than a 1% decrease this month. However, on Monday, the ETF managed to rebound, recording a gain of approximately 0.5%. Remarkably, it had gained nearly 40% over the course of the year. Additionally, Disney shares increased by around 1.2% as the media conglomerate and Charter Communications resolved their cable blackout dispute. The positive sentiment in the market was further bolstered by a report from The Wall Street Journal on Sunday, which suggested that there was a consensus within the Federal Reserve not to raise rates at the upcoming meeting. The report also indicated a policy shift, with members perceiving less urgency for an additional rate hike later in the year, given the improving inflation data.

Investors eagerly await the release of key inflation data in the coming week, especially following a series of stronger-than-expected economic indicators from the previous week, which had raised concerns about the possibility of the Federal Reserve increasing rates more than previously anticipated.

Data by Bloomberg

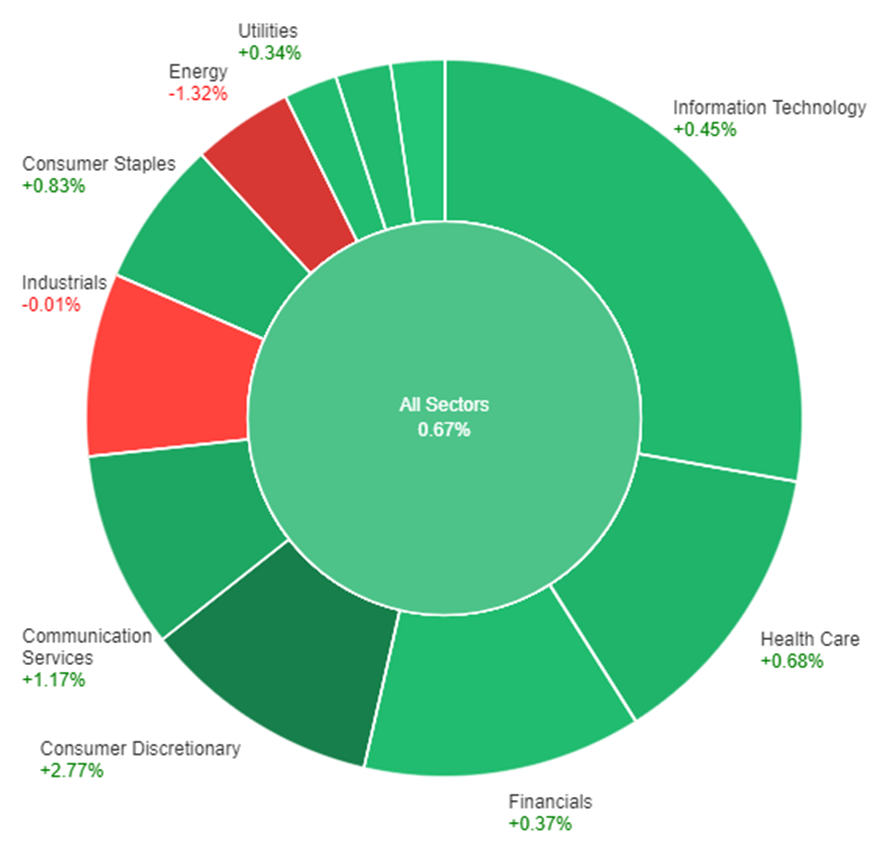

On Monday, the stock market displayed a generally positive trend, with all sectors collectively rising by 0.67%. Notably, Consumer Discretionary led the way with a significant gain of 2.77%, while Communication Services also performed well, posting a 1.17% increase. Consumer Staples, Health Care, and Information Technology sectors saw moderate gains, while Materials and Financials showed modest upticks. However, Real Estate and Industrials had marginal increases, and Energy experienced a notable decline of -1.32%, reflecting the varying performances of different sectors during the trading day.

On Monday, the US dollar experienced a broad decline, with USD/JPY dropping due to comments by BoJ Governor Kazuo suggesting the potential for a year-end rate hike. Concurrently, USD/CNH fell by 0.8% in response to stronger Chinese data and robust efforts to bolster the yuan. Despite Germany’s recession and a cut in forecasts by the EU Commission, EUR/USD rose by 0.46% amid the dollar’s overall retreat.

In the US, the New York Fed’s August Survey indicated little change in inflation expectations but heightened concerns about job prospects and financial conditions. After eight consecutive weeks of losses, consolidation was anticipated ahead of key data releases, including US CPI, PPI, and retail sales midweek, as well as the ECB meeting on Thursday. The drop in USD/JPY to its lowest level since September 1st contrasted with the rise in JGB yields but was influenced by more attractive 2- and 10-year Treasury yields at 4.99% and 4.29%.

GBP/USD, despite Bank of England policymaker Catherine Mann’s comments, gained 0.37% but remained above the 200-day moving average. The focus shifted to Tuesday’s UK employment report, which anticipated a significant drop in employment and an increased jobless rate. AUD/USD declined by 0.8%, reflecting strong gains in commodity prices and positive sentiment regarding China’s economy. The week ahead held key events, including German and euro zone updates, US CPI, and PPI releases, with inflation forecasts and retail sales data contributing to market dynamics.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| GBP | Claimant Count Change | 14:00 | 17.1K |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.