Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

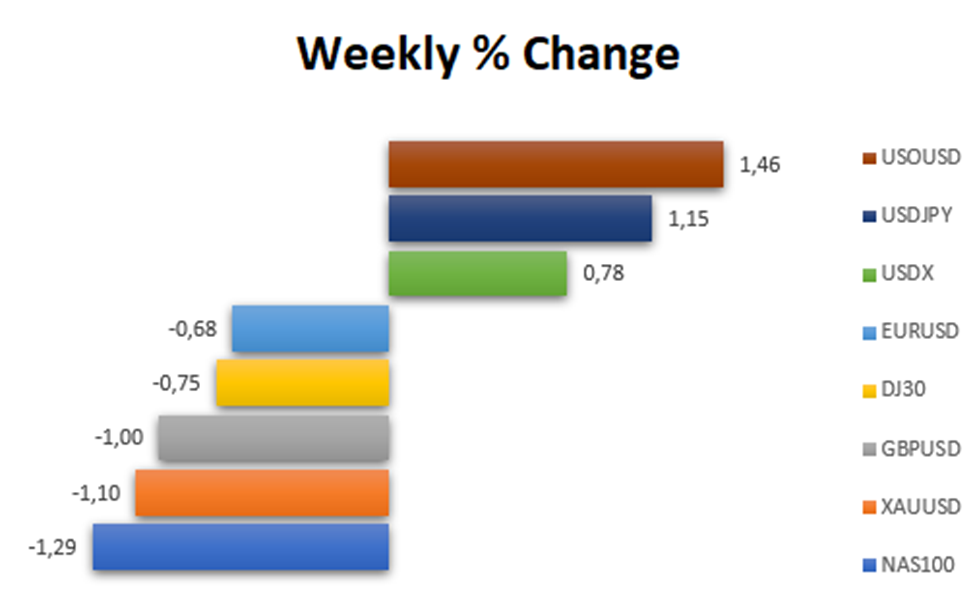

The US dollar embarked on an eight-week winning streak driven by surging oil prices, inflation worries, and assertive remarks from the Federal Reserve, resulting in a 0.78% increase in the USD Index.

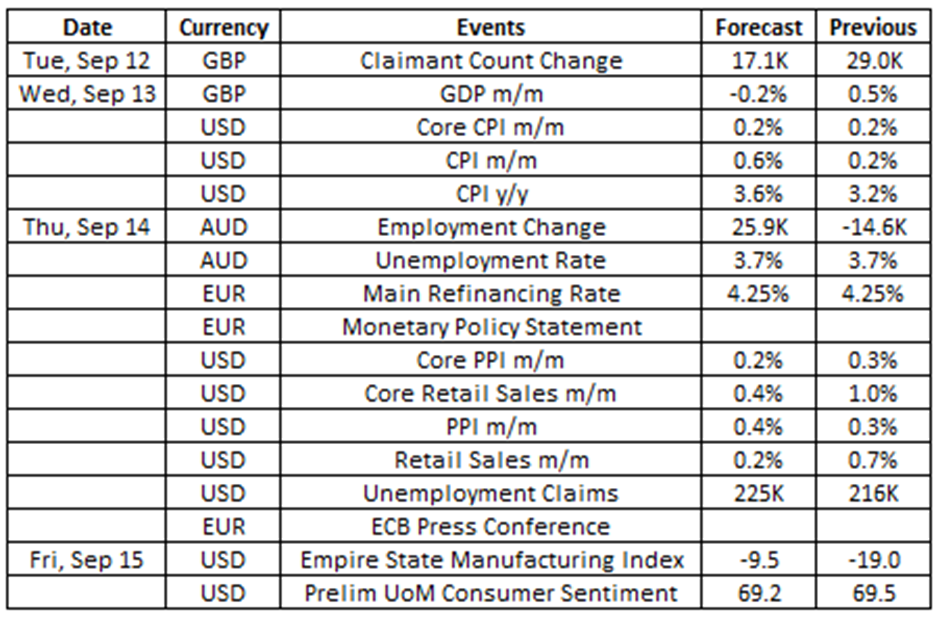

Source: VT Markets Economic Calendar

Of particular interest to traders this week will be the US Consumer Price Index (CPI), the US Producer Price Index (PPI), and the European Central Bank’s (ECB) Rate Decision. These items have the potential to significantly impact the markets. Exercise caution and stay up to date with the latest developments to ensure a successful week of trading.

Here are some notable market highlights for the upcoming week:

The number of people claiming unemployment benefits in the UK increased by 29,000 in July 2023.

The data for August 2023 will be released on 12 September, with analysts expecting a further increase of 17,000.

Takeaway: The rise in the number of people claiming unemployment benefits in the UK in July shows that there is a potential slowdown in the British economy. The expected increase in the Claimant Count Change for August suggests the possibility of another economic slowdown. This might have a negative effect on the British Pound.

The British economy expanded by 0.5% in June 2023, rebounding from a 0.1% decline in May.

Analysts anticipate a 0.3% decrease in the data for July 2023, scheduled for release on 13 September.

Takeaway: The rise in the British economy in June indicates that it is expanding. However, the expected decrease in GDP for July suggests a potential slowdown in the growth momentum. This might have a negative effect on the British Pound.

The monthly inflation rate in the US held steady at 0.2% in July 2023.

Analysts expect an increase of 0.5% in the upcoming CPI figures, set to be released on 13 September.

Takeaway: The slight rise indicates a deceleration in inflationary pressures. This slowdown could be attributed to various factors, such as stabilising commodity prices or reduced demand for certain goods and services. However, the projected increase for August suggests a potential rebound in inflationary trends. This might have a positive effect on the US Dollar.

Employment in Australia decreased by 14,600 in July 2023.

Figures for August 2023 will be released on 14 September, with analysts anticipating an increase of 40,000.

Takeaway: The upcoming Australia Employment Change report, which is a crucial factor affecting the performance of the Aussie Dollar, will offer valuable insights into the labour conditions in Australia. If the projected figures prove accurate, there is a possibility that we may witness a strengthening of the Aussie Dollar.

The ECB raised its key interest rates by 25 bps to 4.25% during its July meeting.

For the upcoming meeting on 14 September, analysts expect the central bank to keep the interest rates at 4.25%.

Takeaway: The upcoming ECB Rate statement is likely to result in increased volatility in the Euro. Based on the projected data, there is a possibility that the Euro might strengthen.

Producer prices in the US rose 0.3% in July 2023, the biggest increase since January 2023.

Analysts expect a 0.4% increase in the figures for August 2023, set to be released on 14 September.

Takeaway: The increase in producer prices for final demand in July suggests a potential slowdown in inflationary pressures. However, the expected increase in August indicates a possible rebound in producer prices, signalling a renewed upward trajectory. It is important to monitor these trends because changes in producer prices can have implications for consumer prices and overall inflation levels. This might have a slight positive effect on the US Dollar.

US retail sales were up 0.7% in July 2023. This follows a 0.3% increase in June 2023 and marks a fourth consecutive rise.

Analysts expect a further increase of 0.2% in the figures for August 2023, set to be released on 14 September.

Takeaway: The upcoming US retail sales report, which is a crucial factor affecting the performance of the US Dollar, will offer valuable insights into the state of consumer spending in the US. If the projected figures prove accurate, there is a possibility that we may witness a strengthening of the US Dollar.

The University of Michigan Consumer Sentiment Index for the US was revised from preliminary estimates of 71.2 to 69.5 in August 2023.

Analysts expect the index to remain at 69.5 in the upcoming figures, set to be released on 15 September.

Takeaway: The increase in consumer sentiment indicates a growing optimism among consumers about the economy. This positive outlook can impact consumer spending and overall economic growth. However, the anticipated lack of change in August suggests a halt to the current positive trend, which might have a negative effect on the US Dollar.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.