Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

The Nasdaq Composite extended its four-day decline on concerns of future Federal Reserve interest rate hikes, leading to a 0.89% drop, while the S&P 500 slipped 0.32%, and the Dow Jones Industrial Average added 0.17%. Apple’s shares fell 2.9% due to reports of potential iPhone bans in Chinese state-owned entities, contributing to the tech sector’s woes. Strong economic data, such as lower-than-expected jobless claims and rising labor costs, raised concerns of a sustained tight monetary policy by the Federal Reserve, potentially leading to further rate hikes despite expectations of a pause in September. In currency markets, the US dollar gained, driven partly by unexpected declines in jobless claims, while concerns about data distortions, global trade tensions, and potential interventions weighed on sentiment.

The Nasdaq Composite experienced its fourth consecutive decline due to concerns regarding the Federal Reserve’s potential interest rate hikes later this year. The tech-heavy Nasdaq fell by 0.89%, while the S&P 500 slipped 0.32%, and the Dow Jones Industrial Average added 0.17%. Investors were anticipating a pause in the Fed’s rate hikes for the rest of the year but are now worried about the possibility of one or two more increases. Additionally, Apple shares dropped by 2.9% amid reports that China might expand its ban on iPhones in state-owned entities. This decline in technology and semiconductor stocks contributed to the market’s negative sentiment.

Furthermore, strong economic data, including lower-than-expected jobless claims and higher labor costs, raised concerns that the Federal Reserve might maintain its tight monetary policy stance. The robust job market, combined with rising energy prices, could lead to further rate hikes by the Fed, despite expectations of a rate pause in September. Traders are closely monitoring corporate earnings reports, with C3.ai experiencing a 12.2% decline due to weak guidance. Overall, uncertainties about the Fed’s interest rate policy and global trade tensions have weighed on the market’s performance.

Data by Bloomberg

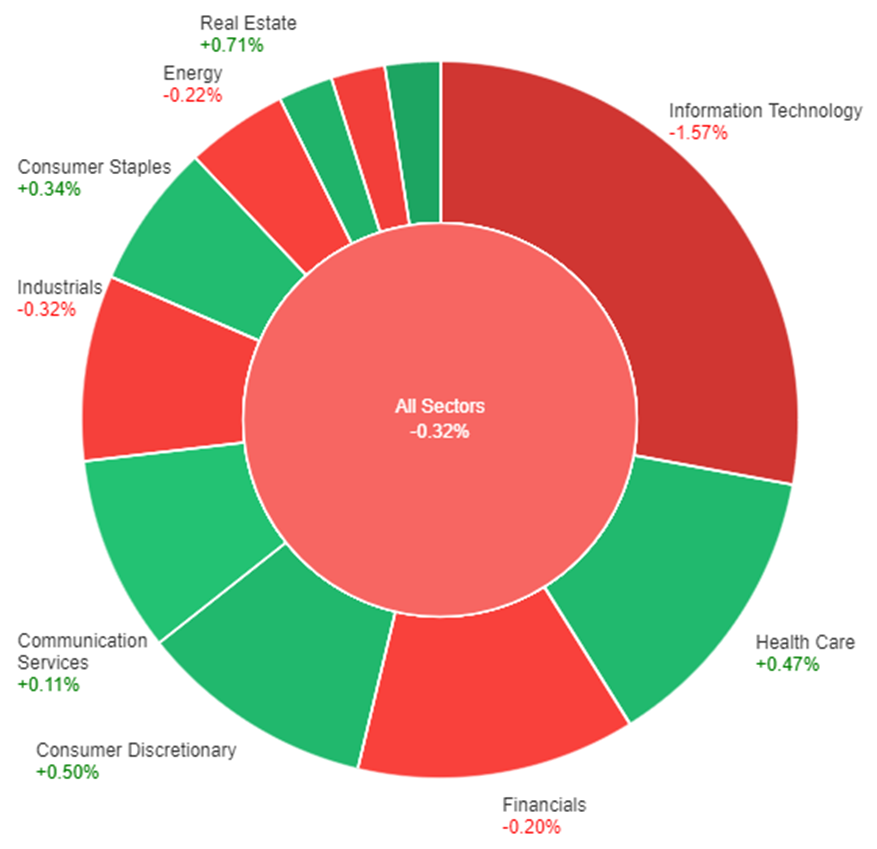

On Thursday, the overall market saw a slight decline of 0.32%. Among the sectors, Utilities and Real Estate experienced gains of 1.26% and 0.71%, respectively, indicating relative strength. Consumer Discretionary and Health Care also showed modest increases of 0.50% and 0.47%, while Consumer Staples and Communication Services posted smaller gains of 0.34% and 0.11%. On the other hand, Information Technology recorded a notable decline of 1.57%, leading the negative performance, followed by Materials (-0.44%), Energy (-0.22%), Financials (-0.20%), Industrials (-0.32%), and All Sectors (-0.32%). These sector-specific movements reflect the varied performance across different segments of the market on that particular day.

The US dollar saw some gains on Thursday, partly due to an unexpected drop in US jobless claims. However, these gains were tempered by concerns about data distortions resulting from the Labor Day holiday. Furthermore, the effects of a significant influx of corporate bond market supply this month seemed to have moderated. The EUR/USD pair fell by 0.29%, although it had recovered slightly from its low earlier in the week.

The Japanese yen weakened against the US dollar amid falling Treasury yields, while the threat of Japanese intervention to support the yen added to the pressure. Sterling also experienced a decline of 0.27% but managed to bounce back from its low. Concerns about China’s economy and trade tensions with Western nations were heightened, especially following reports of restrictions on iPhone use by government staff. Looking ahead, market participants are closely watching upcoming events such as Japanese economic data, Canada’s jobs report, US CPI data, and the ECB meeting, which are expected to be significant drivers of market sentiment in the near term.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| CAD | Employment Change | 20:30 | 18.9K |

| CAD | Unemployment Rate | 20:30 | 5.6% |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.