Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

On Wednesday, the stock market saw declines, driven by concerns about potential Federal Reserve interest rate hikes, leading to a 0.57% drop in the Dow Jones Industrial Average, a 0.7% dip in the S&P 500, and a 1.06% fall in the Nasdaq Composite. Rising Treasury yields played a role in these losses, particularly affecting technology stocks like Nvidia and Apple. Meanwhile, the US dollar strengthened due to positive ISM data, while the euro (EUR/USD) had a modest gain. GBP/USD declined below 1.25 as Bank of England officials questioned the need for further rate hikes. Precious metals like gold and silver slid due to rising US yields, while cryptocurrencies remained resilient amid discussions about a global cryptocurrency framework within the G20.

On Wednesday, the stock market experienced a notable decline, extending its lackluster performance into September. Investors grew increasingly apprehensive that the Federal Reserve might not have completed its interest rate hikes. The Dow Jones Industrial Average, for instance, dropped by 198.78 points, equivalent to 0.57%, settling at 34,443.19. Similarly, the S&P 500 saw a 0.7% dip, concluding the day at 4,465.48, while the Nasdaq Composite fared even worse, falling by 1.06% and closing at 13,872.47. These declines were largely attributed to rising Treasury yields, particularly the 2-year Treasury note, which surged by approximately 6 basis points and exceeded the 5% threshold.

The upward trajectory in Treasury yields was unsettling for risk assets, with technology stocks, in particular, underperforming. Notably, the Nasdaq experienced its third consecutive day of losses, with leading tech companies like Nvidia and Apple both witnessing declines of over 3%. This negative sentiment also weighed on the Dow, with stocks like Amgen and Boeing declining by around 2% each. The surge in Treasury yields coincided with stronger-than-expected economic data, causing concerns about the possibility of further interest rate hikes. Recent readings on the U.S. economy’s services and manufacturing sectors indicated that prices were moving unfavorably, triggering market uncertainty. Additionally, the probability of a rate hike in November rose, with traders assigning a greater than 40% chance, while a 93% likelihood of the central bank maintaining rates this month was noted, according to the CME Group. In light of this, Boston Fed President Susan Collins suggested cautious progress on rate hikes, although she acknowledged that further tightening might be warranted based on data trends.

Data by Bloomberg

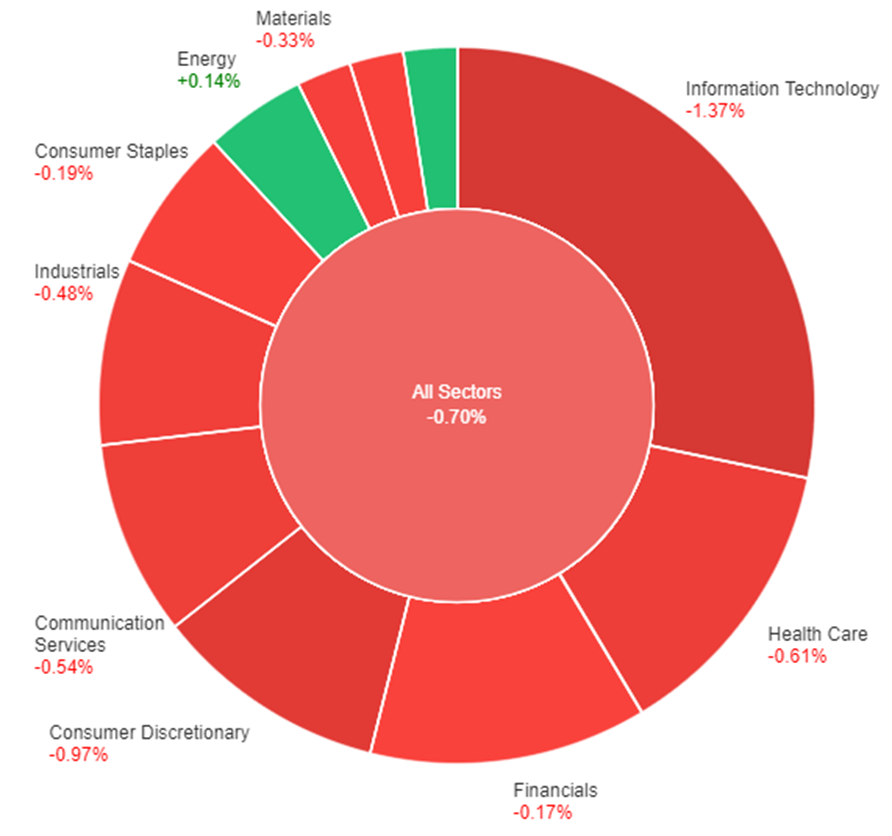

On Wednesday, the overall market saw a decline of 0.70%. Among the sectors, Utilities and Energy showed slight gains, with increases of 0.20% and 0.14%, respectively. On the other hand, several sectors experienced losses, with Information Technology being the hardest hit with a substantial drop of 1.37%. Consumer Discretionary also faced a significant decline of 0.97%. Other sectors like Health Care, Communication Services, Industrials, and Materials saw moderate declines ranging from 0.48% to 0.61%. Financials, Consumer Staples, Real Estate, and All Sectors recorded smaller losses, ranging from -0.17% to -0.70%.

On Wednesday, the dollar index strengthened as the ISM non-manufacturing PMI outperformed expectations, leading to a reversal in Treasury yields. Initially, these lower yields had put pressure on the U.S. currency, but the upbeat ISM data boosted expectations of a Federal Reserve interest rate hike in November, pushing the odds above 50%. Meanwhile, EUR/USD saw a modest increase of 0.12%. The European Central Bank (ECB) was mirroring the Fed’s rate hike expectations, with a potential hike in September and roughly a 50% chance of a rate increase on October 26. Traders were looking ahead to euro zone employment data and Q2 GDP figures for insights into the ECB’s near-term policy decisions.

USD/JPY managed to recover from earlier losses, thanks in part to rising Treasury yields and positive ISM data, bringing it closer to its early Asia 2023 high at 147.82. However, earlier remarks from Japan’s top currency diplomat, Masato Kanda, expressing concern about speculative yen selling, had initially weighed on the pair. On the other hand, GBP/USD dipped below 1.25, hitting lows not seen since early June 2023. The downward pressure was exacerbated by comments from BoE Governor Andrew Bailey, Deputy Governor Jon Cunliffe, and Swati Dhingra, who raised questions about the necessity for further rate hikes, adopting a less hawkish stance. Key support at the 200-DMA around 1.2425 was in focus, with a close below potentially signaling a move toward 1.1805, the March 8, 2023 low.

In the commodities market, rising U.S. yields had a negative impact on precious metals, with gold sliding by 0.4% to $1,917 and silver dipping 1.5% to $23.17. Meanwhile, cryptocurrencies defied the weight of high-interest rates, as Bitcoin rose by 0.5% to $25.8k, and Ether gained 0.55% to reach $1,641.30. This resilience was attributed to discussions within the G20 about establishing a global framework for cryptocurrencies.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| USD | Unemployment Claims | 20:30 | 232K |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.