Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

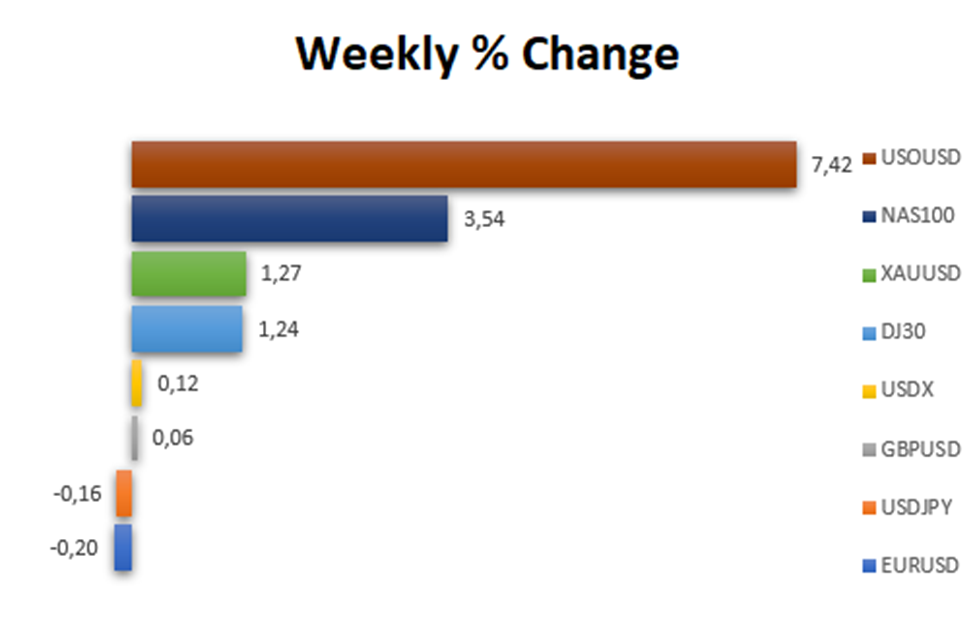

The US Dollar saw slight gains of 0.12% during the week, continuing its upward trajectory. This gain occurred despite signs that the Federal Reserve may halt its interest rate hikes. Notably, Thursday and Friday witnessed a recovery in the dollar’s value, driven partly by labour market data released on Friday. This data revealed a cooling labour market with a three-tenths of a percent increase in unemployment and a slight drop in average earnings.

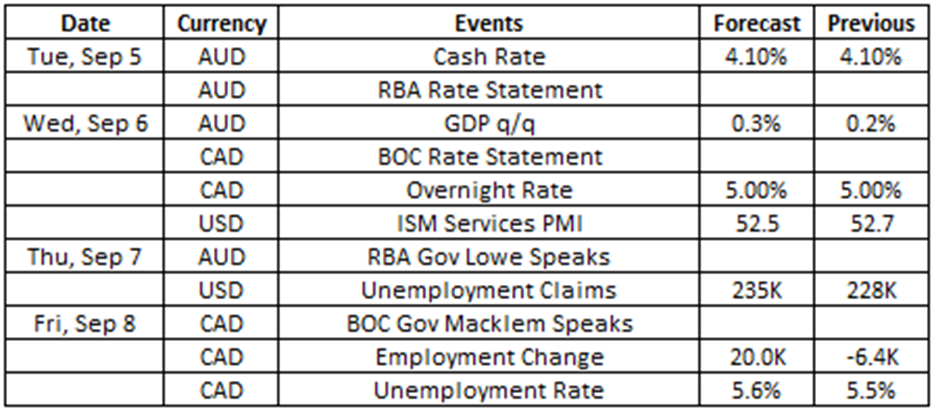

Source: VT Markets Economic Calendar

The financial world is keeping a close watch on some important economic news this week. Two major central banks, the Reserve Bank of Australia (RBA) and the Bank of Canada (BOC), will be releasing their rate statements. Given the potential for increased market volatility, we advise traders to exercise caution and stay mindful of their trading strategies.

Here are some notable highlights for the upcoming week:

The Reserve Bank of Australia held its cash rate steady at 4.1% during its August meeting, continuing the rate pause for the second consecutive month.

The central bank is set to announce the next interest rate adjustment on 5 September, and analysts anticipate that the RBA will maintain its rate at 4.1%.

Takeaway: The interest rate decision from the RBA this week will likely create high volatility for the Australian Dollar. Market experts expect the central bank to maintain the interest rate, which could potentially weaken the Australian Dollar.

The Australian economy saw a 0.2% quarter-on-quarter expansion in Q1 2023, following a 0.6% increase in Q4 2022.

The figures for Q2 2023 are scheduled for release on 6 September, with analysts predicting another 0.2% increase in the GDP.

Takeaway: Australia’s quarterly GDP release will likely create high volatility for the Australian Dollar. Market experts expect the quarterly GDP to show another expansion, which could potentially strengthen the Australian Dollar.

The Bank of Canada (BOC) increased the target for its overnight rate by 25 bps to 5% in July 2023. This move followed a surprising 25 bps rate hike in the previous meeting and extended the bank’s tightening cycle, which had briefly paused in March and April.

The next rate statement is scheduled for release on 6 September, and analysts expect the BOC to maintain its interest rates at 5%.

Takeaway: The interest rate decision from the Bank of Canada (BOC) this week is expected to create high volatility for the Canadian Dollar. Market experts anticipate that the central bank will maintain the interest rate, a move that could potentially weaken the Canadian Dollar.

The US Institute of Supply Management (ISM) Non-Manufacturing Purchasing Managers’ Index, also known as the US ISM Services PMI, fell to 52.7 in July 2023. This follows a four-month high of 53.9 in June.

The ISM’s data for August 2023 is scheduled for release on 6 September, with analysts anticipating a slight decrease to 52.6.

Takeaway: The US ISM Services PMI will be the key market mover for the US Dollar this week. This PMI data will offer insights into the health of the US services sector. Based on the forecasted numbers, it appears that the services sector is still in expansion mode, which could potentially bolster the US Dollar.

The Canadian unemployment rate edged higher to 5.5% in July 2023 from 5.4% in the previous month, marking the third consecutive increase to levels last seen in January 2022. This reflects some softening in the Canadian labour market.

The figures for August are set to be released on 8 September, with analysts anticipating that the unemployment rate will remain at 5.5%.

Takeaway: According to the projected figures, there is a possibility that Canada’s unemployment rate will remain the same as in the previous period, potentially strengthening the Canadian Dollar.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.