Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

The Nasdaq Composite displayed resilience with its fifth successive day of gains, despite encountering its most substantial monthly decline in 2023. Closing at 14,034.97, the tech-centric index rose by 0.11% on Thursday. In contrast, the Dow Jones Industrial Average stumbled by 0.48%, finishing at 34,721.91, and the S&P 500 experienced a minor setback of 0.16%, concluding at 4,507.66.

Although a series of positive sessions managed to alleviate some of the monthly losses for the S&P 500 and the Dow, the broader market index reported a 1.77% decrease, while the Nasdaq endured a 2.17% loss during August. The Dow, composed of 30 stocks, encountered a significant drop of 2.36%. Traders also diligently examined fresh U.S. inflation data, particularly the core personal consumption expenditures index, which matched economists’ projections by increasing 0.2% month over month in July and 4.2% year over year. This index holds particular importance as a gauge of inflation for the Federal Reserve.

Some analysts highlighted the interplay between equities and bonds, noting that declining U.S. Treasury yields remain pivotal for potential near-term stock market growth. Looking ahead, investors are eyeing the upcoming non-farm payroll data release, hoping for signs of a meaningful economic slowdown that could influence the central bank’s stance on benchmark interest rate hikes.

Data by Bloomberg

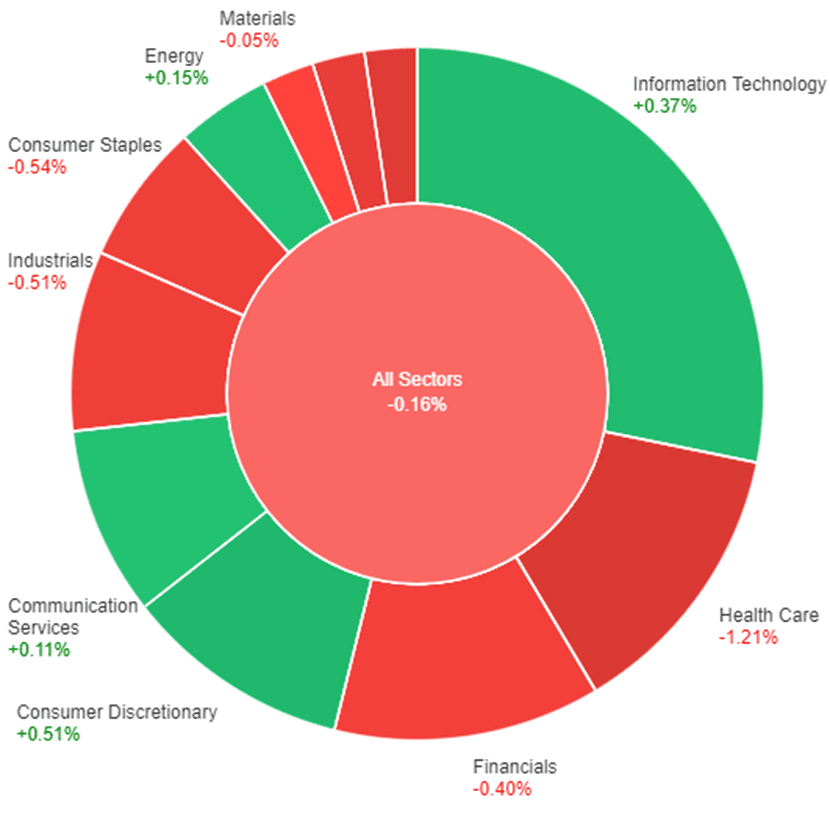

On Thursday, most sectors experienced a slight decline, with the overall market showing a decrease of 0.16%. However, there were a few areas of growth, notably Consumer Discretionary, which saw a rise of 0.51%, and Information Technology, which increased by 0.37%. Energy and Communication Services also recorded modest gains of 0.15% and 0.11% respectively. On the other hand, sectors like Health Care, Utilities, and Real Estate faced notable losses, with Health Care declining the most at 1.21%.

The dollar index rose 0.45% on Thursday, supported by better US data and one ECB hawk taking notice of the region’s economic headwinds. US consumer spending surged 8% in July, up from 6% in June, and June was revised higher. Jobless claims remained in their recent range, and the August Chicago PMI rebounded to 48.7.

The euro fell 0.7% against the dollar after Wednesday and Thursday’s recovery highs were rejected by the 30-day moving average (DMA) and other resistance levels. Sterling also fell 0.4% after it ran into sellers at its 30-DMA and cloud base. USD/JPY fell 0.57%, putting EUR/JPY down a whopping 1.26%, as relatively static Japanese government bond (JGB) yields contrasted with the 7.8 basis point (bp) drop in German bund yields.

The main event on Friday is the US employment report. Non-farm payrolls are forecast to be 170,000, down from 187,000 in July. Average hourly earnings are forecast to rise 0.3% from July, and the jobless rate is forecast to remain near 50-year lows at 3.5%. August ISM manufacturing is forecast at 47.0, down from July’s 46.4. More important will be ISM services due out on September 6.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| CHF | Consumer Price Index m/m | 14:30 | 0.2% |

| CAD | Gross Domestic Product m/m | 20:30 | -0.2% |

| USD | Average Hourly Earnings m/m | 20:30 | 0.3% |

| USD | Non-Farm Employment Change | 20:30 | 169K |

| USD | Unemployment Rate | 20:30 | 3.5% |

| USD | ISM Manufacturing PMI | 22:00 | 46.9 |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.