Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

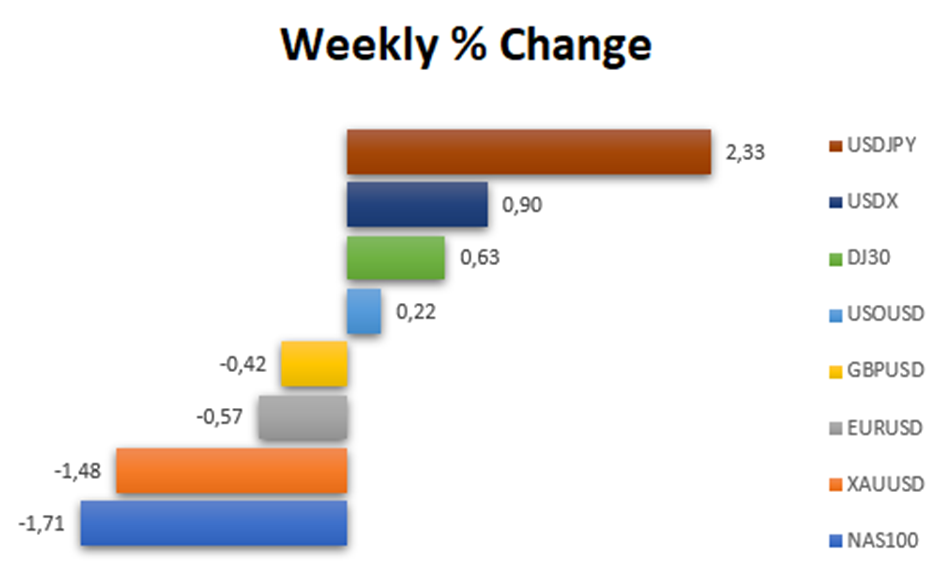

What happened in the market last week?

Last Week Market Pair Changes (All data is taken from the MT4 VT Markets)

Despite initial concerns regarding the July U.S. CPI release, the dollar started on a positive note driven by early-week risk aversion. China’s trade difficulties and uncertainty about additional economic support heightened global recession concerns. The dollar paused in the midweek as traders eased their long positions ahead of the inflation report, then weakened due to weaker-than-anticipated annual CPI figures. However, it rebounded as bond yields overlooked the data, focusing instead on the in-line monthly CPI numbers and hawkish comments from Fed Governor Daly. The dollar maintained its gains through Friday, bolstered by a better-than-expected PPI update that offset a surprising drop in consumer confidence reported by the University of Michigan.

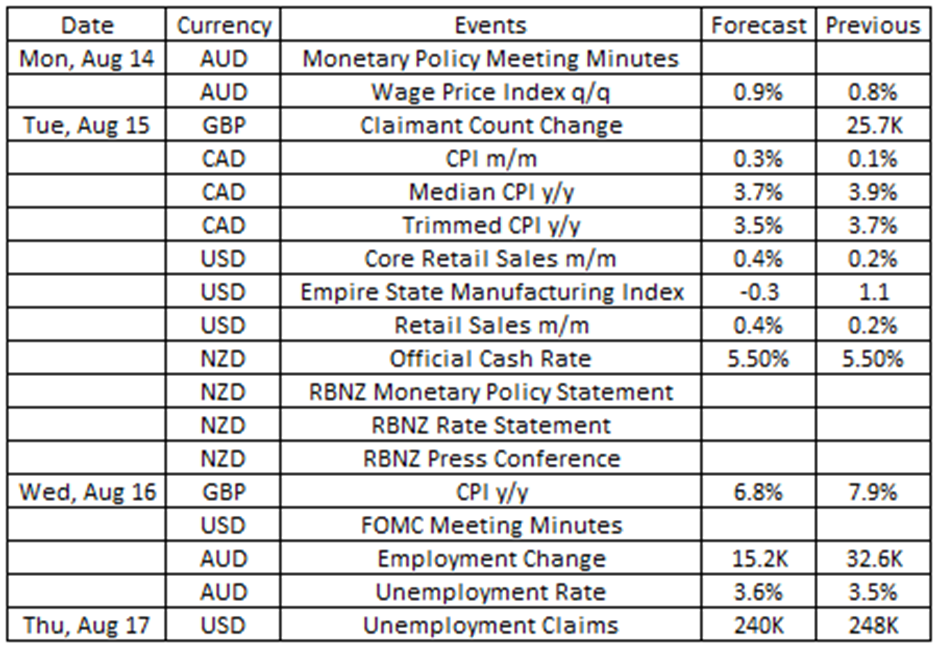

Source: VT Markets Economic Calendar

What to focus on this week?

Important economic events will have a significant impact on the forex market this week. Keep an eye out for the Reserve Bank of New Zealand’s (RBNZ) Rate Statement and the US data for retail sales. This information could greatly influence the markets, so it’s crucial for traders to be cautious and stay on top of the latest developments for a successful week of trading.

Here are some notable highlights for the week:

Australia Wage Price Index (15 August 2023)

The seasonally adjusted Wage Price Index in Australia showed that wages increased by 3.7% year-on-year in Q1 2023, following a year-on-year growth of 3.4% in Q4 2022.

Data for Q2 2023 is scheduled for release on 15 August, with analysts anticipating another increase of 3.8%.

Takeaway: The Australia Wage Price Index is expected to have a noteworthy impact on the Australian Dollar this week. If the data aligns with predictions, there’s a likelihood that the AUD will undergo a modest increase.

Canada Consumer Price Index (15 August 2023)

Canada’s Consumer Price Index (CPI) increased by 0.1% in June 2023 compared to the previous month.

Analysts anticipate a 0.2% increase in the figures for July, which are set to be released on 15 August.

Takeaway: The upcoming Canada CPI release will offer insights into the state of inflation in Canada and is poised to be a substantial factor in shaping the movement of the Canadian Dollar. Based on the anticipated figures, there’s a potential for a strengthening of the Canadian Dollar.

US Retail Sales (15 August 2023)

Retail sales in the US rose by 0.2% month-on-month in June 2023, following a 0.5% increase in May.

Analysts expect a 0.3% growth in the figures for July, scheduled for release on 15 August.

Takeaway: The forthcoming US retail sales report, a crucial factor affecting the performance of the US Dollar, will provide valuable insights into the status of consumer spending in the US. If the projected figures prove accurate, there is a possibility that we could witness a strengthening of the US Dollar.

UK Consumer Price Index (16 August 2023)

Consumer price inflation in the UK dropped to 7.9% in June 2023, marking the lowest level since March 2022.

The upcoming CPI figures are expected to show a further decline to 7.4%.

Takeaway: The UK CPI data will be the market mover for the Pound sterling this week. Based on the forecasted numbers, there is a possibility that the Pound sterling might weaken.

Reserve Bank of New Zealand Rate Statement (16 August 2023)

During its July meeting, the Reserve Bank of New Zealand maintained the official cash rate (OCR) at 5.5%.

Analysts predict that the RBNZ will keep the OCR unchanged at 5.5% following its upcoming meeting on 16 August.

Takeaway: The RBNZ maintained its official cash rate at 5.5% in July, after raising it by 525bps since October 2021. The decision aims to balance spending and inflation pressures and target 1-3% inflation by H2 2024. If the data is released according to the forecast, there’s a possibility that we could observe a slight weakening of the New Zealand Dollar.

Federal Funds Rate (17 August 2023)

The Federal Reserve raised the target range for the federal funds rate by 25 bps to 5.25–5.5%, in line with market expectations.

Additionally, the central bank also resumed its tightening campaign after a pause in June.

Takeaway: The upcoming release of the FOMC Meeting Minutes will reveal whether there have been any changes in the Fed’s stance since the previous meeting.

Employment in Australia (17 August 2023)

Employment in Australia surged by 32,600 in June 2023. Meanwhile, the unemployment rate stood at 3.5%, remaining unchanged from May. It continues to hover close to the 50-year lows reached in October 2022.

Analysts anticipate that employment figures for July 2023 will show an increase of 25,100, with the data scheduled for release on 17 August.

Takeaway: Based on the forecasted numbers, the Australian Dollar might weaken.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.