Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

The Dow Jones Industrial Average commenced the week with a robust surge of 1.16%, gaining 407.51 points to conclude at 35,473.13, marking its most substantial upswing since June 15. Buoyed by a nearly 4% rally from Amgen, the blue-chip index received a notable boost. In tandem, the S&P 500 climbed by 0.9% to settle at 4,518.44, while the Nasdaq Composite posted a more modest 0.61% increase, curtailed by a near 1% dip in Tesla shares following the departure of CFO Zach Kirkhorn. Both the Nasdaq and S&P 500 managed to break their four-day losing streaks.

Berkshire Hathaway exhibited a remarkable ascent of over 3%, reflecting investor contentment with the company’s financial results and robust cash reserves. Notably, shares of both A and B share classes reached unprecedented levels. Elanco, a player in the animal healthcare sector, surged by 4% after surpassing Wall Street expectations, whereas Tyson Foods faltered by 3.8% on the back of a less-than-anticipated report. In another significant development, Sovos Brands, recognized for Rao’s, witnessed a remarkable surge of more than 25% after Campbell Soup’s announcement of its acquisition of the pasta sauce manufacturer. While Campbell Soup’s shares slipped by approximately 1.8%, they settled at their lowest price in over a year. Following a challenging week on Wall Street, marked by a 2.9% slide in the Nasdaq Composite and a 2.3% dip in the S&P 500, the market rebounded with renewed vigor.

This resurgence was attributed to a stronger-than-expected corporate earnings season, with around 80% of S&P 500 companies surpassing Wall Street forecasts. According to Chris Zaccarelli, Chief Investment Officer of the Independent Advisor Alliance, the market has regained a “risk-on mode” due to the favorable earnings trend. Looking ahead, investors are poised to focus on the impending release of consumer and producer price index data for July, as these indicators hold crucial implications for inflation trends and economic well-being.

Data by Bloomberg

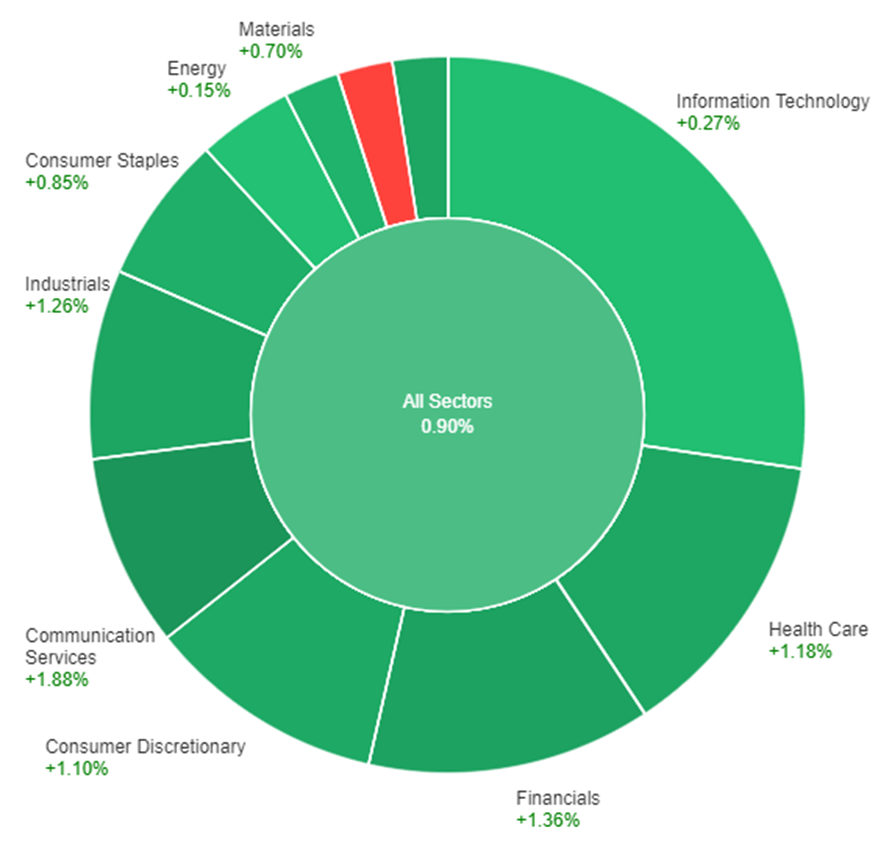

On Monday, across all sectors, the market showed a notable uptick of 0.90%. Particularly strong gains were observed in the Communication Services sector, which surged by 1.88%, followed closely by Financials with a rise of 1.36%, and Industrials, which advanced by 1.26%. Real Estate also exhibited a solid increase of 1.21%, while the Health Care sector saw a rise of 1.18%. Noteworthy gains were recorded in the Consumer Discretionary sector, which climbed by 1.10%, and the Consumer Staples sector, which experienced a respectable growth of 0.85%. Materials exhibited a modest uptrend of 0.70%. However, the Information Technology sector displayed a more subdued increase of 0.27%, and the Energy sector had a marginal rise of 0.15%. In contrast, the Utilities sector showed a slight decline of -0.02% during the same trading period.

Major Pair Movement

The dollar index initially rebounded on Monday from the previous slide triggered by Friday’s jobs report, yet it remained relatively unchanged as shorter-term Treasury yields decreased. The upcoming U.S. inflation report on Thursday could potentially affirm the belief that the Federal Reserve’s tightening cycle has concluded, increasing the likelihood of rate cuts in 2024. The recent jobs report offered conflicting signals regarding the labor market’s condition and the necessity for further Fed tightening, contributing to market uncertainty. While the labor market is gradually loosening, the exact timing of a significant shift and subsequent Fed rate cuts remains uncertain, especially considering the economy’s resilience despite substantial rate hikes by the Fed.

Market confusion persists over the necessity of tight policy, irrespective of the labor market’s status, particularly if inflation continues its trajectory towards the Fed’s target. Monday saw contrasting policy outlooks from Fed officials Bowman and Williams, hinting at a potential pause by the Fed until clearer indications emerge for a more or less restrictive approach. The impending Consumer Price Index (CPI) release on Thursday could play a pivotal role in resolving this policy divergence. In the currency markets, EUR/USD dipped slightly by 0.05%, unable to surpass Friday’s initial post-payrolls highs. The European Central Bank’s assessment of peaking underlying inflation and concerns over economic growth, amplified by Chinese economic uncertainties, could impact the probability of another ECB rate hike. USD/JPY, on the other hand, rose by 0.5% as buyers entered the market above 141.50 following post-payrolls lows. Despite the Bank of Japan’s hopeful stance on rising wages, low Japanese Government Bond yields continue to contrast with higher U.S. Treasury yields. Sterling managed to gain 0.3% after a hesitant start, supported by a rise in 2-year gilts-Treasury yields spreads and the maintenance of essential support levels following the Bank of England’s recent rate hike.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.