Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

In a positive start to the week, stock markets experienced gains as Wall Street braced itself for the release of quarterly reports from major global companies. The Dow Jones Industrial Average reached its highest closing level in 2023, adding 76.32 points (0.22%) to close at 34,585.35. The S&P 500 climbed 0.39% to end the session at 4,522.79, and the Nasdaq Composite advanced 0.93% to 14,244.95. Notably, tech-giant Apple saw a 1.7% increase, Tesla climbed 3.2%, and JPMorgan Chase shares ticked up 2.4%.

The second-quarter earnings season gains momentum this week, with notable reports from major financial institutions like Bank of America, Morgan Stanley, and Goldman Sachs, along with companies such as United Airlines, Las Vegas Sands, Tesla, and Netflix. Analysts anticipate a challenging season, with a projected decline of over 7% in S&P 500 earnings compared to the previous year. Additionally, as the Federal Reserve enters its “blackout period” before its July policy meeting, traders are expecting a 97% likelihood of interest rate hikes later this month, after pausing them in June.

Despite concerns over profitability and economic performance, the stock market experienced a winning week, with the Dow Jones Industrial Average gaining 2.3%, its best weekly gain since March. The S&P 500 and Nasdaq Composite also saw gains of 2.4% and 3.3%, respectively. Market sentiment appears to be buoyed by the belief in a disinflationary, soft landing scenario. Ed Yardeni, president of Yardeni Research, expressed his perspective that although the economy may be experiencing a rolling recession, it is not a widespread economic downturn. Instead, he sees it as a rolling recovery.

These market movements were influenced by positive big bank earnings and softer inflation reports, which instilled hope that the central bank can effectively manage inflation without pushing the economy into a recession. As investors eagerly await earnings reports and monitor the Federal Reserve’s upcoming decisions, Wall Street faces a mixture of optimism and economic uncertainty.

Data by Bloomberg

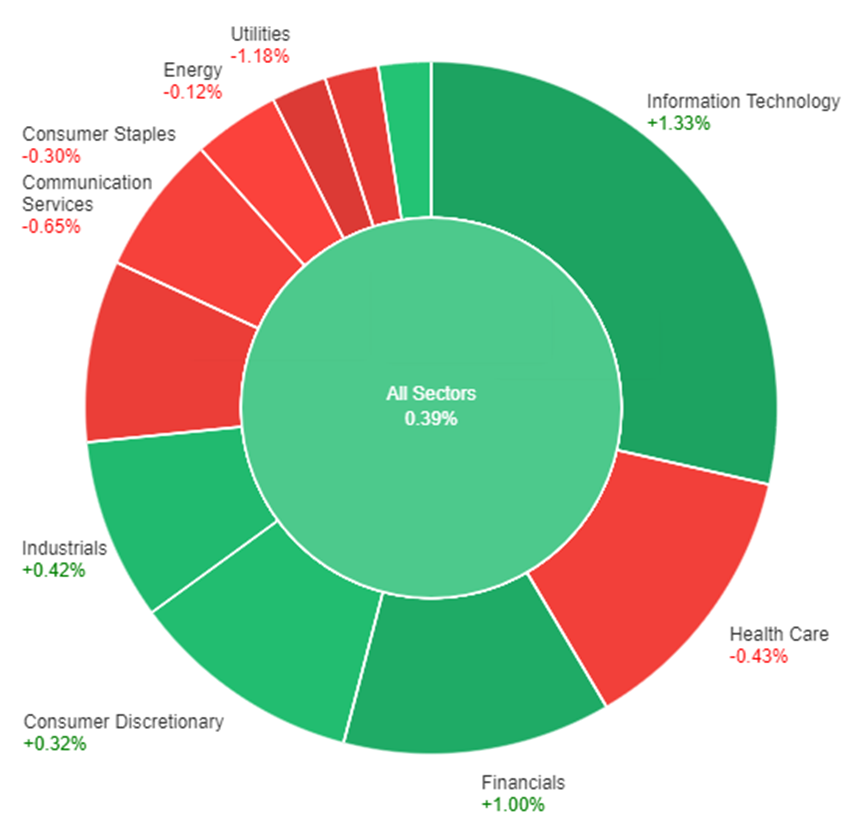

On Monday, the stock market showed a mixed performance. Information Technology had a strong day, gaining 1.33%, while sectors like Utilities and Communication Services experienced declines of 1.18% and 0.65% respectively. The overall market ended with a 0.39% increase.

Major Pair Movement

The US dollar index experienced a slight decline of 0.1% as its rebound from last week’s significant drop started to fade. Investors were eagerly awaiting the release of US retail sales data, which would determine whether the recent selloff driven by disinflation concerns would continue. Despite indications of disinflation and expectations of future rate hikes, the dollar had reached an oversold condition against major currencies such as the euro, yen, and pound. The currency was in need of consolidation or a correction, especially after the surprisingly positive July Michigan consumer sentiment, which suggested that the US economy was handling the Federal Reserve’s rate hikes better than anticipated.

The performance of the euro against the US dollar saw a slight increase of 0.1% after experiencing a decline from its recent high. Despite reports of falling German wholesale prices and unexpected drops in exports, the euro maintained its strong gains from July. Additionally, the yield spreads between 2-year bunds and US Treasury bonds remained significantly negative. The recovery of the US dollar against the Japanese yen faced resistance at a previously broken uptrend line, although Monday’s trading range exhibited higher lows and highs for the first time since the trend high in late June. The British pound declined by 0.1% ahead of the release of US retail sales and UK Consumer Price Index (CPI) data scheduled for Tuesday and Wednesday, respectively.

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| CAD | Consumer Price Index | 20:30 | 0.3% |

| USD | Retail Sales | 20:30 | 0.5% |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.