Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

In the final week of the first half of the year, the Nasdaq Composite experienced a significant decline as investors sold off shares of technology companies that had performed well so far in 2023. The Nasdaq dropped by 1.16%, while the S&P 500 also saw a loss of 0.45%, and the Dow Jones Industrial Average dipped slightly by 0.04%.

This pullback was primarily driven by a sharp decline in technology giants such as Nvidia, Alphabet, Meta Platforms, and Tesla. Despite the setback, the Nasdaq has still seen a substantial rebound this year, fueled by renewed investor optimism in artificial intelligence and expectations of a slowdown in the Federal Reserve’s interest rate hikes.

While the technology sector experienced a decline, other segments of the market performed well in the first half of the year. The S&P 500 has gained 12.7% and the Dow is up approximately 1.7%. Although the market rally stalled last week, overall, it has been a successful first half for investors.

Traders will keep an eye on the situation in Russia following a brief rebellion by a private military group, which could potentially introduce uncertainty into the markets. Additionally, economic reports for the week are relatively light, with the focus on the personal consumption expenditures index for May and corporate earnings reports from Walgreens Boots Alliance and Nike.

Data by Bloomberg

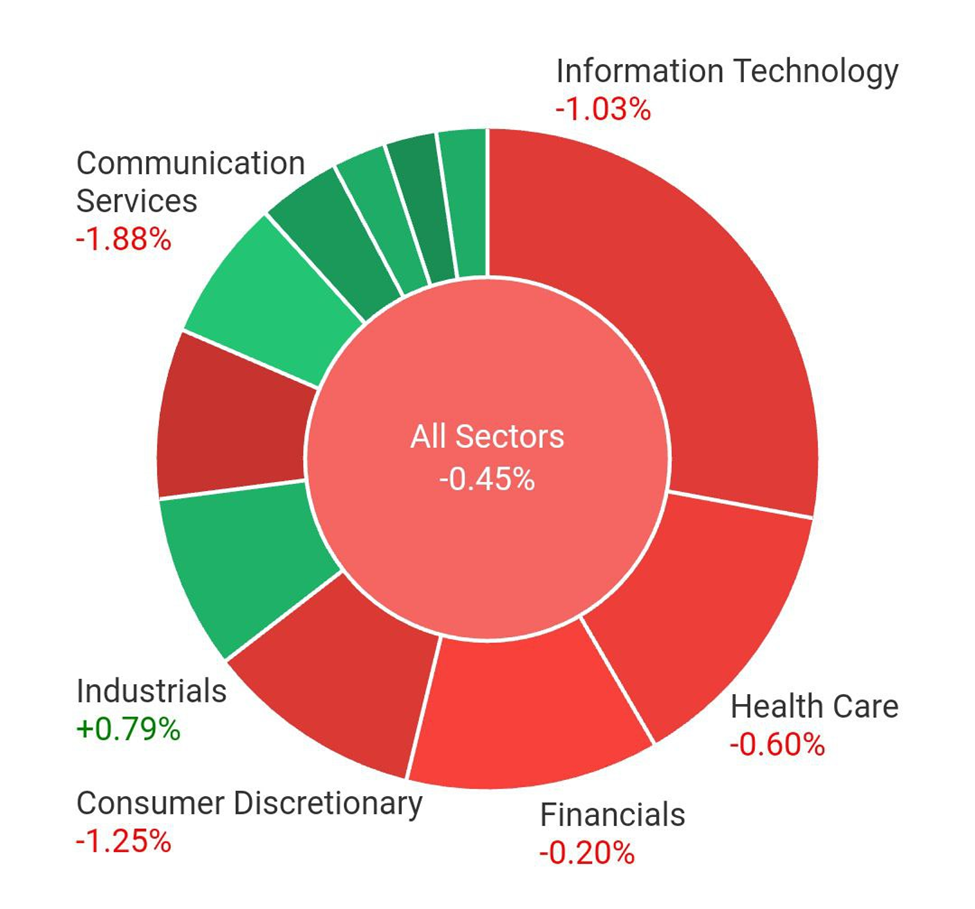

On Monday, the overall market experienced a slight decline of 0.45%. However, some sectors managed to perform well, with the Real Estate sector showing the highest gain at 2.21%, followed by Energy at 1.71% and Materials at 1.00%. Utilities and Industrials also saw positive growth with increases of 0.98% and 0.79% respectively.

On the other hand, several sectors faced declines, including Information Technology leading the losses with a decrease of 1.03%, followed by Consumer Discretionary and Communication Services both experiencing declines of 1.25% and 1.88% respectively. Financials, Health Care, and Consumer Staples also saw slight declines, with decreases of 0.20%, 0.60%, and 0.03% respectively.

GBP/USD remained steady after a day of little change, with the USD weakening slightly. The market anticipates that the Bank of England (BoE) will implement aggressive interest rate hikes, potentially raising rates by 50 basis points. However, relying solely on interest rates to control inflation may not be effective, raising concerns of a looming recession. In June, shop price inflation in the UK slowed down as retailers reduced prices.

The AUD/USD currency pair showed minimal reaction to the turmoil in Russia and remained on the sidelines. The AUD/USD rally was limited by the strengthening of USD/CNH (Chinese yuan) and supported by softer US yields.

EUR/USD initially declined near the 55-day moving average but later turned positive on Monday. The currency pair demonstrated resilience in the face of Russia-related geopolitical risks and disappointing Ifo data, which could strengthen positive technical indicators and contribute to further gains.

Despite potential instability in Europe’s eastern region due to a weekend mutiny, EUR/USD traded higher as investors focused more on a potential pause in the US Federal Reserve’s rate hikes and favourable positioning for long positions.

Market expectations indicate that the Federal Reserve may implement two more rate hikes, but current US rates are factoring in only one additional increase, potentially followed by cuts later in the year. Despite a decrease in euro positions and an increase in dollar positions,

EUR/USD managed to rally as investors reduced their overall exposure, suggesting a positive sign for the currency pair. In the US, the focus is on the forthcoming weekly claims data and May’s Personal Consumption Expenditures (PCE) figures, which will likely influence market dynamics.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| CAD | Consumer Price Index | 20:30 | 0.4% |

| CAD | Median Consumer Price Index | 20:30 | 4.0% |

| CAD | Trimmed Consumer Price Index | 20:30 | 3.9% |

| USD | CB Consumer Confidence | 22:00 | 103.9 |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.