Spreads

Spreads

Spreads

Spreads

Spreads

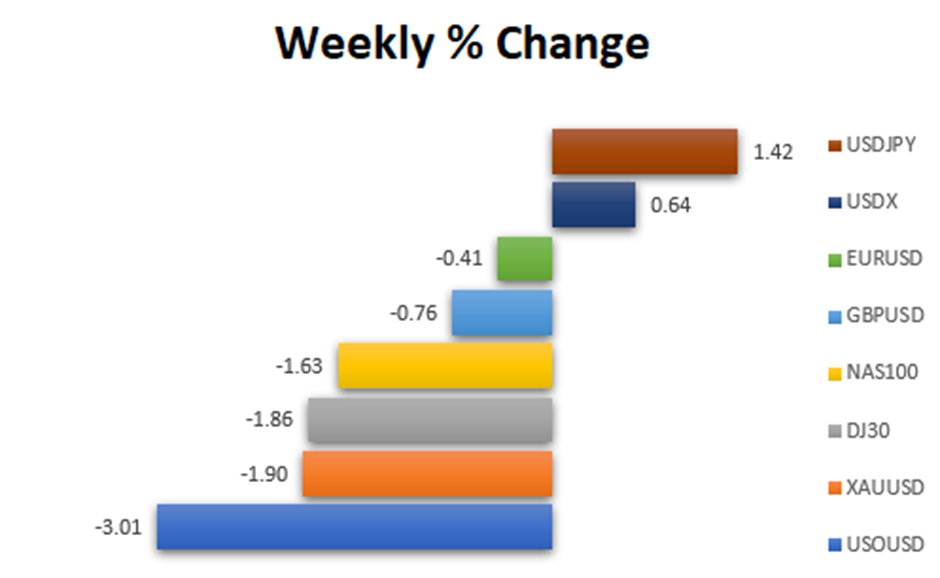

What happened in the market last week?

Last Week Market Pair Changes (All data is taken from the MT4 VT Markets)

The US Dollar (DXY) increased by 0.64% as the market responded positively to Powell’s statement that the economy remains strong and resilient.

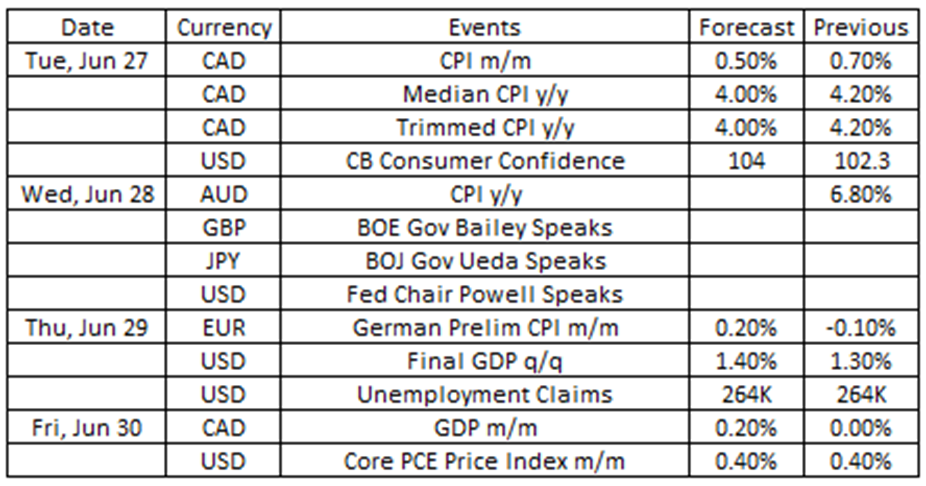

Source: VT Markets Economic Calendar

This week, market participants prepare for important economic events such as the release of Canada’s Gross Domestic Product (GDP) and Consumer Price Index (CPI), in addition to Australia’s CPI.

Traders are anticipated to keep a close watch on these critical updates to tailor their strategies and acquire valuable knowledge about the financial markets.

Remember to stay updated with a summary of noteworthy developments.

Canada’s CPI rose 0.7% in April 2023 compared to March 2023 figures.

Analysts anticipate a 0.5% increase for May data, set to be released on 27 June.

Takeaway: The upcoming release of Canada’s CPI data will be a significant market mover for the Canadian Dollar, as it provides insight into the current inflation situation in the country.

Based on the forecast numbers, it appears that inflation will be slower, which could potentially weaken the Canadian Dollar.

Australia’s CPI saw a 6.8% increase in the year leading up to April 2023, a rise from the 6.3% gain observed in the year ending in March 2023 – the lowest in 10 months.

Analysts predict a slower growth of 6.4% for the data covering the year to May 2023, set for release on 28 June.

Takeaway: The forthcoming release of Australia’s CPI data is poised to considerably influence the Aussie Dollar, shedding light on the nation’s prevailing inflation scenario.

The forecast figures suggest a slowdown in inflation, which may result in a potential weakening of the Australian Dollar.

CPI in Germany experienced a 0.10% decrease in May 2023 compared to the previous month, marking the first decline in five months.

CPI data for June will be published on 29 June, with analysts predicting a 0.3% increase.

Takeaway: The forthcoming German Prelim CPI data release is expected to notably impact the Euro, considering Germany’s position as one of the biggest countries in the Eurozone.

This CPI data will offer insights into the present inflation conditions in Germany. The forecast numbers indicate a slowdown in inflation, which could potentially result in heightened fluctuations for the Euro.

Canadian economy displayed no growth in March 2023, as service-producing industries stagnated, and goods-producing industries saw a minor 0.1% decline.

Analysts anticipate a 0.2% growth for April 2023 data, scheduled for release on June 30.

Takeaway: The release of Canada’s GDP data will inform traders about the current economic condition in the country.

Based on the forecast numbers, it appears that the Canadian economy is experiencing growth, which could potentially lead to an upward movement for the Canadian Dollar.

US Core PCE prices, excluding food and energy, experienced a 0.4% month-over-month increase in April 2023.

The data for May 2023 is set to be released on 30 June, with analysts expecting a 0.3% growth.

Takeaway: The upcoming release of the US PCE Price Index is expected to significantly impact the US Dollar, as it provides insights into personal consumption expenditure prices in the country.

Based on the forecast numbers, it appears that the rate of personal consumption expenditure will slow down, which could potentially lead to a weakening of the US Dollar.