Spreads

Spreads

Spreads

Spreads

Spreads

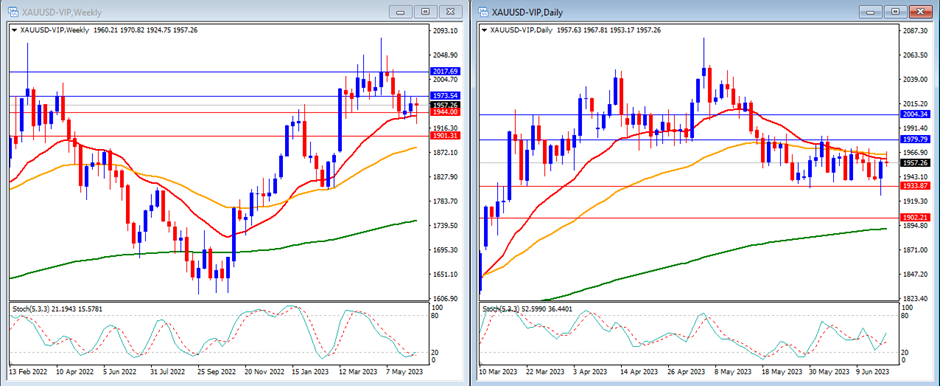

Gold (XAUUSD)

Last week, gold moved higher and was able to reach our weekly resistance level. Gold closed the week at $1,957.

On the weekly timeframe, we can observe that the Stochastic Indicator is moving inside the oversold area. This indicates that gold is in a bearish mode but starting to show signs of exhaustion. The gold price remains above the 20, 50, and 200-period moving averages.

Our weekly resistance levels are at $1,973 and $2,017, with support levels at $1,944 and $1,901.

On the daily timeframe, the Stochastic Indicator is moving in the middle. The price is currently below the 20 and 50-period moving averages, but still above the 200-period moving average.

Our daily resistance levels are at $1,979 and $2,004, with support levels at $1,933 and $1,902.

Conclusion: This week, gold may not experience as much volatility as it did last week, due to the lack of high-impact news from the US. We anticipate a slight downward movement for the precious metal, potentially reaching our support level at $1,944.

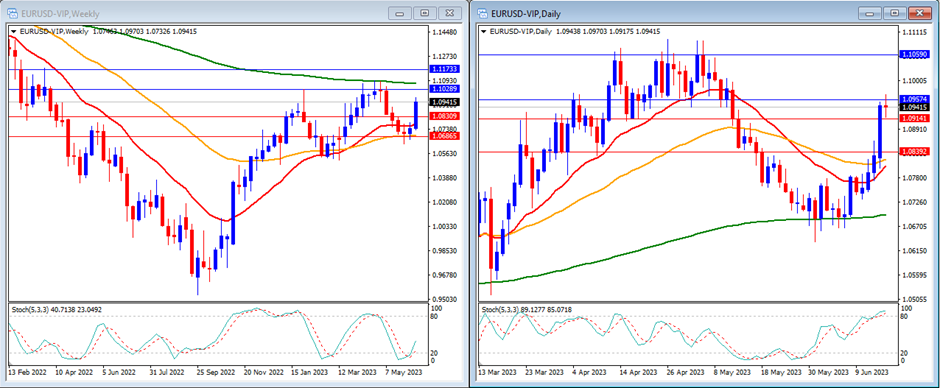

EURUSD

Last week, the EURUSD experienced an upward movement following the European Central Bank’s decision to raise its interest rates and release some positive statements. As a result, the EURUSD closed the week at 1.0941.

On the weekly timeframe, the Stochastic Indicator is crossing higher and exited the oversold area. The price is currently trading above the 20 and 50, but still below the 200-period moving averages.

Our weekly resistance levels are at 1.1028 and 1.1173, with support levels at 1.0830 and 1.0686.

On the daily timeframe, the Stochastic Indicator is moving higher entering the overbought level. The price is now moving above the 20, 50 and 200-period moving averages.

Our daily resistance levels are at 1.0957 and 1.1059, while the support levels are at 1.0914 and 1.0839.

Conclusion: This week, we will see Flash Services and Manufacturing PMI data releases from Germany and France, which will contribute to the overall EU data. We anticipate that the EURUSD may experience a stronger upward movement, potentially pushing it above the 1.1 level.

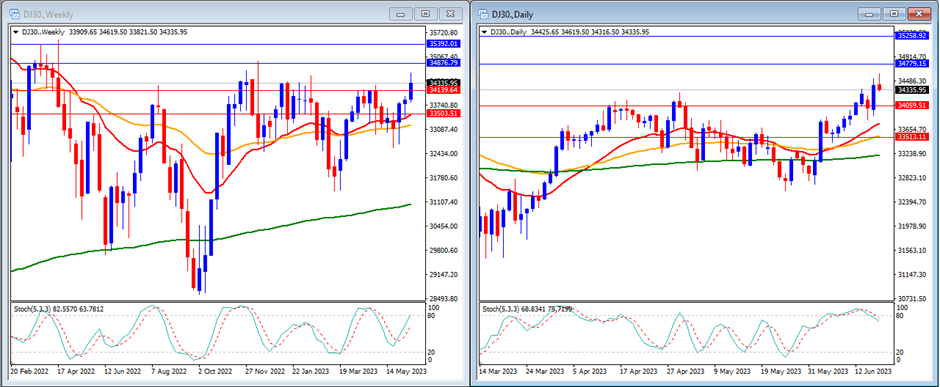

DJ30

Last week, the DJ30 (Dow Jones Industrial Average) saw an upward movement in response to the Fed’s decision and the inflation data in the US. The DJ30 closed the week slightly higher at 34,335.

On the weekly timeframe, we can observe that the Stochastic Indicator is moving higher in the middle. The price is currently moving higher than the 20, 50 and 200-period moving average.

Our weekly resistance levels are at 34,876 and 35,392, with support levels at 34,139 and 33,503.

On the daily timeframe, we can see that the stochastic indicator is moving lower trying to exit the overbought area. The price is moving above all the 20, 50 and 200-period moving averages.

Our daily resistance levels are at 34,779 and 35,258, with support levels at 34,059 and 33,513.

Conclusion: This week, the US stock market may experience slower movements due to the lack of high-impact news from the US. The positive sentiment caused by slower inflation could potentially affect the US indices, possibly leading the DJ30 to move higher and potentially surpass our resistance level at 34,876.

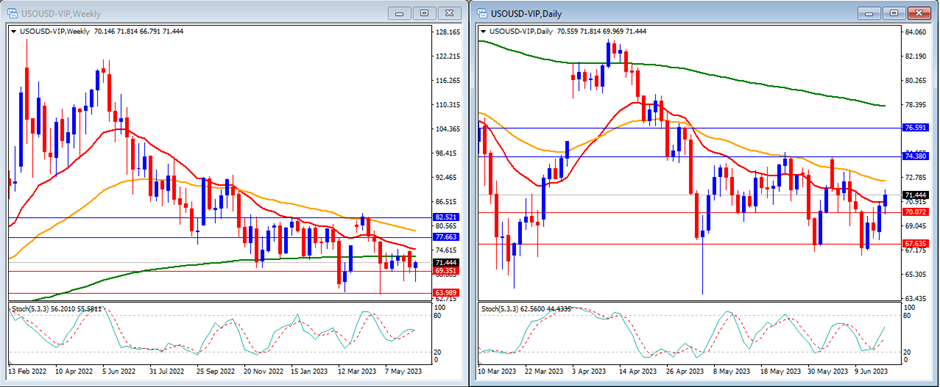

USOUSD

Last week, USOUSD (Oil) experienced a downward movement, reaching below our support level before rebounding higher. USOUSD closed the week at 71.44.

On the weekly timeframe, we can observe that the Stochastic Indicator is moving in the middle with no clear direction. The price is currently moving below the 20, 50, and 200-period moving averages.

Our weekly resistance levels are at 77.66 and 82.52, with support levels at 69.35 and 63.98.

On the daily timeframe, the Stochastic Indicator is moving slightly higher but still in the middle. The price is now moving above the 20, but still below the 50, and 200-period moving averages.

Our daily resistance levels are at 74.38 and 76.59, while support levels are at 70.07 and 67.63.

Conclusion: We can expect increased volatility in USOUSD (Oil) this week. We might see an upward movement with the potential to reach our resistance level at 74.38.

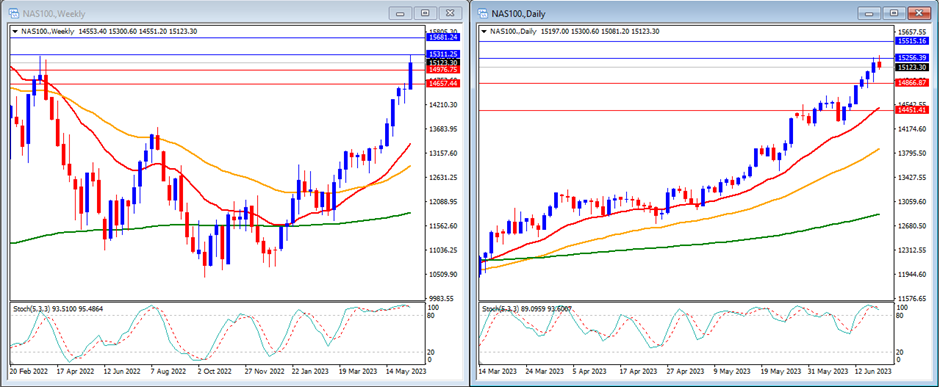

NAS100

Last week, the NAS100 continued its strong upward movement, influenced by the Fed rate decision and slower US inflation data. The NAS100 closed the week higher at 15,123.

On the weekly timeframe, we can observe that the Stochastic Indicator is still within the overbought range. The price is currently moving above the 20, 50, and 200-period moving averages.

Our weekly resistance levels are at 15,311 and 15,681, with support levels at 14,976 and 14,657.

On the daily timeframe, the stochastic indicator is moving inside the overbought area. The price is moving above the 20, 50, and 200-period moving averages.

Our daily resistance levels are currently at 15,256 and 15,515, while support levels are at 14,866 and 14,451.Conclusion: With no high-impact news coming from the US this week, the US stock market may move at a slower pace. The positive sentiment resulting from the slower inflation could potentially impact the US indices, which might cause the NAS100 to rise and possibly break through our resistance level at 15,311.

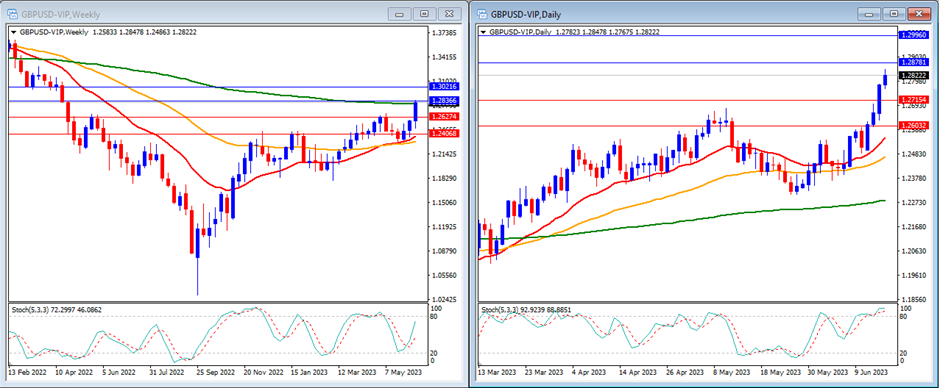

GBPUSD

Last week, GBPUSD experienced a strong higher movement and was able to break our resistance levels. GBPUSD closed the week at 1.2822.

On the weekly timeframe, the Stochastic Indicator is moving higher in the middle. The price is currently moving above the 20 and 50-period moving averages, and just at the 200-period moving average.

Our weekly resistance levels are at 1.2836 and 1.3021, while support levels are at 1.2627 and 1.2406.

On the daily timeframe, our stochastic indicator is moving strongly higher inside the overbought level. The price is currently moving above the 20, 50 and 200-period moving averages.

Our daily resistance levels are now at 1.2878 and 1.2996, while support levels are at 1.2715 and 1.2603.

Conclusion: This week, we can expect heightened volatility in GBPUSD, as the UK will release their CPI data and the BoE will issue its rate statement. We anticipate further upward movement in GBPUSD, with the potential to reach higher towards our resistance levels at 1.2878.

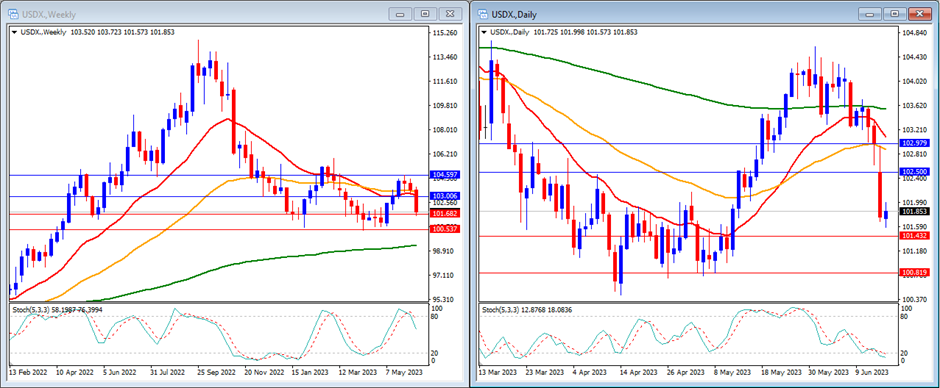

USD Index

Last week, the USD Index moved lower as the market reacted to the Fed’s decision to hold interest rates steady. The USD Index closed the week at 101.85.

On the weekly timeframe, we can observe that the Stochastic Indicator is moving lower after exited the overbought area. The price is currently below the 20 and 50, but still above the 200-period moving averages.

Our weekly resistance levels are at 103.00 and 104.59, with support levels at 101.68 and 100.53.

On the daily timeframe, the Stochastic Indicator is moving lower entering the oversold level. The price is now moving below the 20, 50 and 200-period moving averages.

Our daily resistance levels are at 102.50 and 102.97, with support levels at 101.43 and 100.81.

Conclusion: With no significant news from the US this week, the USD Index is likely to see slower movements. We can expect the possibility of the index moving higher, potentially reaching our resistance levels at 102.50.

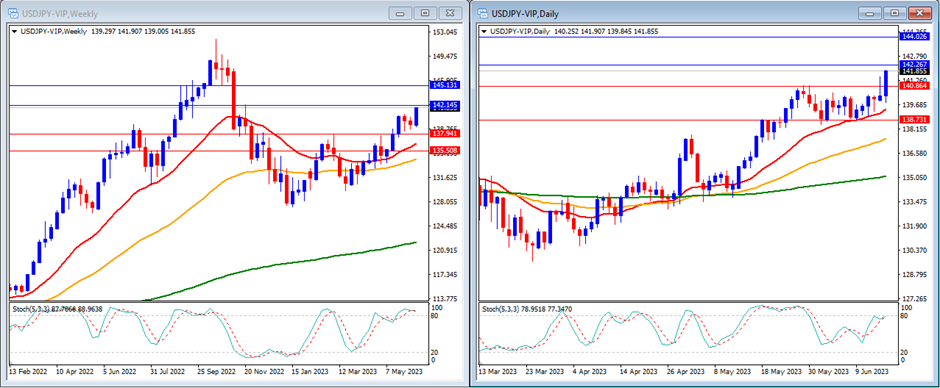

USDJPY

Last week, USDJPY experienced an upward movement following a dovish statement from the Bank of Japan towards the end of the week. The pair closed the week at 141.85.

On the weekly timeframe, we can observe that the Stochastic Indicator is moving inside the overbought zone. The price is above the 20, 50, and 200-period moving averages.

Our weekly resistance levels are at 142.14 and 145.13, with support levels at 137.94 and 135.50.

On the daily timeframe, the stochastic indicator is still moving higher targeting the overbought zone. The price is still above the 20, 50, and 200-period moving averages.

Our daily resistance levels are currently at 142.26 and 144.02, while the support levels are at 140.86 and 138.73.

Conclusion: This week, USDJPY is expected to experience low volatility due to the absence of high-impact news from both the US and Japan. However, market sentiment may still not favour the USD. We anticipate that USDJPY will move lower and attempt to reach our support level at 140.86.