Spreads

Spreads

Spreads

Spreads

Spreads

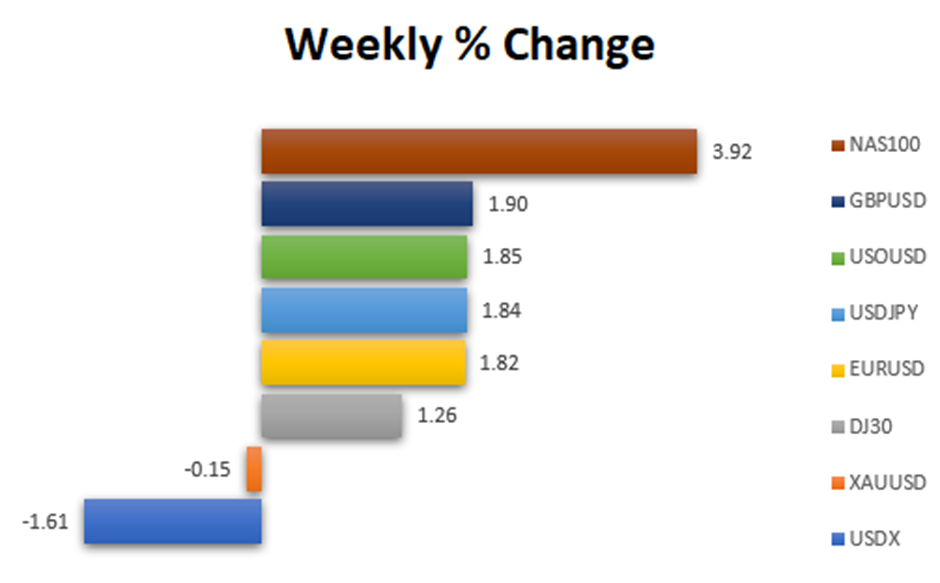

What happened in the market last week?

Source: VT Markets MT4

Last Week Market Pair Changes (All data is taken from the MT4 VT Markets)

The US Dollar (DXY) experienced a decline following economic data that revealed a gradual deceleration in inflation and output growth, coupled with the Federal Reserve’s decision to maintain interest rates for the first time in 11 meetings.

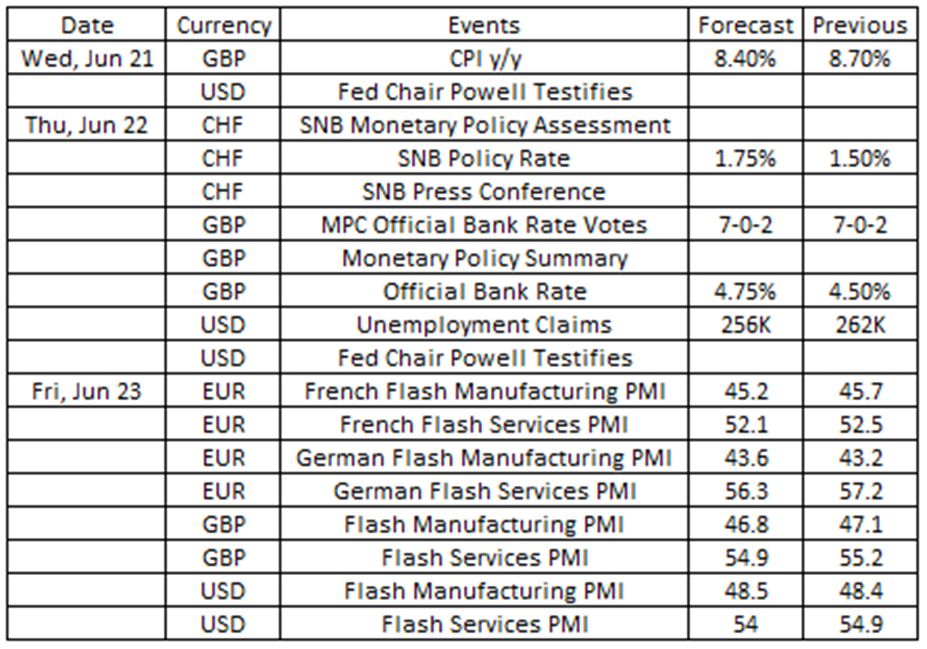

Source: VT Markets Economic Calendar

This week, Wall Street’s focus will be on speeches from the Federal Reserve, given their recent hawkish position. Meanwhile, in the UK, concerns about mortgaging are mounting as inflation persists at elevated levels, fuelling anticipation of additional rate increases. If Tuesday’s inflation data proves to be unfavourable, the Bank of England (BoE) may be pressured to raise rates. The Swiss National Bank (SNB) is projected to increase rates by 50 basis points, reaching the neutral rate.

UK’s CPI fell to 8.7% year-on-year in April 2023, the lowest since March 2022, due to a sharp slowdown in electricity and gas prices.

The next CPI data is set to be released on 21 June, with analysts expecting the index to drop further to 8.4%.

Takeaway: This week, the British Pound may be impacted by several economic data releases, with the CPI being a key inflation indicator that the market will closely observe. If the data is released in line with the forecast, it is anticipated that the British Pound may experience a slight decline.

The SNB raised its policy rate by 50 bps to 1.5% in its March meeting, following a similar move in December 2022.

Some analysts expect the next rate hike will be by another 50bps to 2.0%.

Takeaway: The Swiss Franc will be influenced by the SNB’s rate statement this week, as the market anticipates the decision that will also provide insights into Switzerland’s economic conditions. If the central bank raises its interest rates, we can expect high volatility movement for the Swiss Franc.

The BoE raised the bank rate by 25bps to 4.5% in May 2023, marking the twelfth consecutive rate increase.

Some analysts anticipate that the next rate hike will amount to an additional 25 bps, bringing the interest rate to 4.75%.

Takeaway: This week, the BoE’s rate statement will have a significant effect on the British Pound, as the market eagerly awaits the decision, which will also shed light on the UK’s economic conditions. Should the BoE decide to increase its interest rates, it is likely that the British Pound will experience a period of high volatility.

In May 2023, Germany’s Manufacturing PMI rose slightly to 43.2 but remained at a three-year low, while the UK’s and US’s PMIs dropped to 47.1 and 48.4, respectively.

Analysts predict Manufacturing PMIs for June 2023 as follows: Germany at 43, the UK at 46.5, and the US at 49.7.

Takeaway: Flash Manufacturing PMI data provides insights into the current state of the manufacturing industry. A reading above 50 indicates expansion within the sector. Based on the forecast numbers, it appears that the manufacturing industry is still in contraction and is working towards improvement.

In May 2023, US Services PMI dipped to 54.9 but remained robust since April 2022, while Germany’s hit a year-high of 57.2. The UK’s reached 55.2, marking four months of growth.

Analysts predict Services PMIs for June 2023 as follows: Germany at 57.5, the UK at 54.4, and the US at 53.

Takeaway: Flash Services PMI data provides insights into the current state of the service industry. A reading above 50 indicates expansion within the sector. Based on the forecast numbers, it appears that the service industry is in good condition and experiencing growth.