Spreads

Spreads

Spreads

Spreads

Spreads

What happened in the market last week?

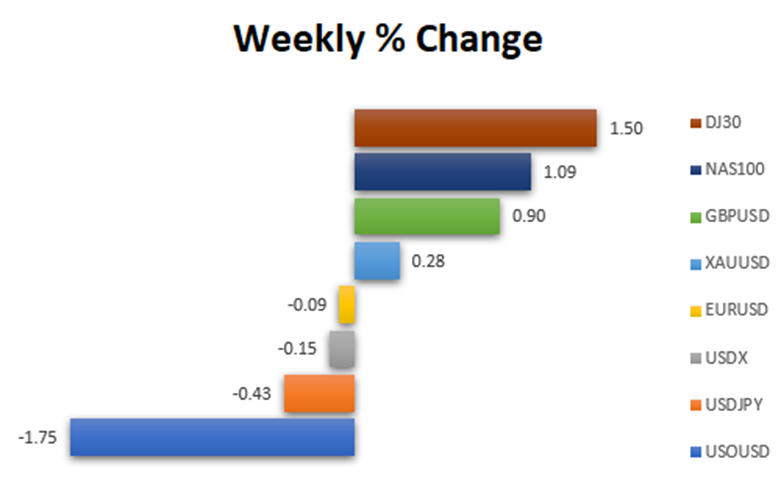

Last Week Market Pair Changes (All data is taken from the MT4 VT Markets)

The US Dollar (DXY) experienced a minor decline amid high market volatility, following mixed results from the US debt ceiling situation and jobs report.

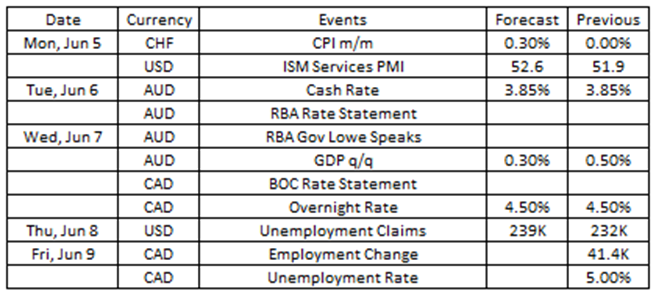

Source: VT Markets Economic Calendar

In the week ahead, market participants will turn their attention to key economic events including the US ISM Services PMI, as well as rate statements from the Reserve Bank of Australia (RBA) and the Bank of Canada (BOC). As analysts make their predictions, all eyes will be on these releases to understand their potential impact on financial markets.

Consumer prices in Switzerland stalled in April 2023, showing less growth than the 0.2% rise observed in March 2023.

For May 2023 data, which is set to be released on 5 June 2023, analysts expect a 0.1% increase.

Takeaway: Switzerland’s CPI data is a key focus for traders involved in CHF pairs, as it reveals the country’s inflation situation. A higher data release could lead to a stronger CHF currency.

The US ISM Services PMI increased to 51.9 in April 2023 from 51.2 in March 2023.

Data for May 2023 is scheduled for release on 5 June 2023, with analysts anticipating a higher figure of 52.1.

Takeaway: With limited US data releases this week, the US ISM Services PMI will be the market’s focus, alongside the US debt ceiling situation. Barring any surprises, the US Dollar may rise upon the data’s release.

In a surprising move, the Reserve Bank of Australia raised its cash rate by 25bps to 3.85% in May 2023, after keeping it at 3.6% in April 2023. This marks the 11th time the bank has increased rates in the past year.

The next cash rate will be released on 6 June 2023, with analysts expecting the RBA to hold its interest rate at 3.85%.

Takeaway: The Reserve Bank of Australia (RBA) will take centre stage for AUD pairs, with market expectations of the RBA maintaining a 3.85% interest rate after the previous 11 increases. If the rate remains as forecasted, the Australian Dollar could potentially rise.

In its April 2023 meeting, the Bank of Canada (BOC) kept the target for its overnight rate unchanged at 4.5% and stated that it would continue to monitor the latest economic data for future decisions on the policy rate.

The next rate statement will be released on 7 June 2023. Analysts anticipate that the BOC will keep its interest rate steady at 4.5%.

Takeaway: The Bank of Canada (BOC) will be the focus for CAD pairs, as the market anticipates the BOC maintaining a 4.5% interest rate in line with their previous decision. If the rate remains as forecasted, the Canadian Dollar may potentially weaken.

Canada’s economy added 41,400 jobs in April 2023 due to increased part-time work, the first growth since October 2022. The unemployment rate stayed at 5% for the fifth month, near the record-low of 4.9%.

For May 2023 data, set to be released on 9 June 2023, analysts predict that job creation will dip to 40,000 and the unemployment rate will rise to 5.1%.

Takeaway: This week, CAD pairs will also be influenced by the release of Canada Employment Change data, alongside the unemployment rate data. If the data is released in line with forecasts, we can expect the CAD pairs to weaken.