Spreads

Spreads

Spreads

Spreads

Spreads

(All data is taken from the MT4 VT Markets)

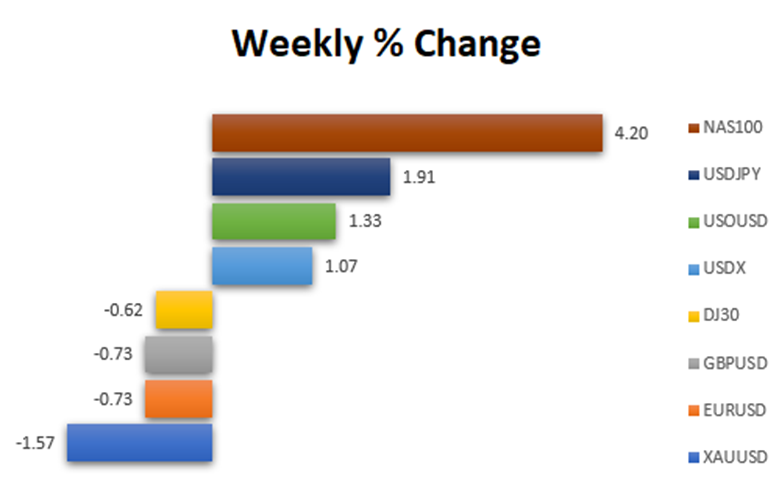

The US Dollar (DXY) strengthened on higher interest rate expectations, but debt ceiling concerns weighed on market sentiment, boosting demand for safe-haven assets.

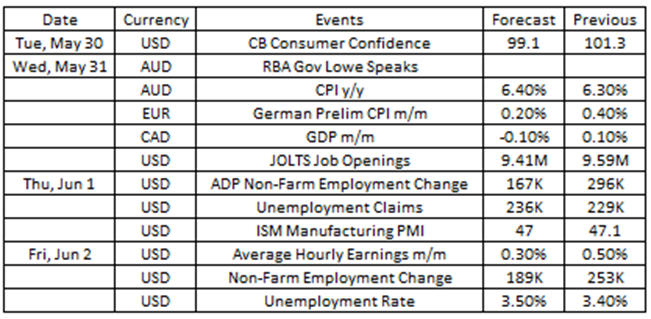

Source: VT Markets Economic Calendar

This week’s key economic indicators, including the US Jobs Report and Canada’s Gross Domestic Product, are in the spotlight for the financial sector. These fundamental reports are crucial for traders to navigate the markets and make informed decisions. Stay tuned for the latest updates.

The monthly CPI in Australia increased 6.3% in the year to March 2023, slowing from a 6.8% rise in the year to February 2023.

The data for April 2023 will be released on 31 May, with analysts expecting a further slowdown, dropping to 6%.

Takeaway: Markets will closely monitor inflation data like CPI to gauge future market trends and central bank decisions. Australia’s CPI is expected to slow, potentially causing a temporary dip in AUD/USD upon release.

The Canadian economic activity in February edged up by 0.1%, following a 0.6% expansion in January.

For March 2023 data, set to be released on 31 May, analysts expect a 0.1% decline.

Takeaway: A projected 0.1% drop in Canada’s GDP hints at a slight rise in USD/CAD, particularly with the US Dollar’s potential strength this week.

The number of job openings in the US dropped by 384,000 to 9.6 million in March 2023, the lowest level since April 2021.

Data for April 2023 will be released on 31 May, with analysts expecting another drop to 9.2 million.

Takeaways: With the Federal Reserve’s rate decision looming after recent hawkish data, the focus shifts to this week’s US Jobs report. Markets may scrutinise JOLTS Job Openings as an indicator for Friday’s US Non-Farm Employment Change release.

Private businesses in the US created 296,000 jobs in April 2023, a significant increase compared to the downwardly revised figure of 142,000 in March 2023.

May 2023 data will be released on 1 June, with analysts anticipating a job creation figure of around 200,000.

Takeaway: Awaiting the Federal Reserve’s rate decision after recent hawkish data, attention shifts to this week’s US Jobs report. Markets may closely observe ADP Non-Farm Employment Change as an indicator for Friday’s US Non-Farm Employment Change release.

The ISM Manufacturing PMI in the US rose to 47.1 in April 2023, up from a three-year low of 46.3 in the previous month.

Analysts predict that the index for May 2023, scheduled for release on 1 June, will be at 48.

Takeaway: After the lower US Flash Manufacturing PMI release, attention could shift to the ISM Manufacturing PMI. Should the data fall short of expectations, a weaker US Dollar may be expected. Conversely, with higher anticipated numbers, a stronger US Dollar is probable.

The US Non-Farm Employment Change unexpectedly increased by 253,000 jobs in April 2023, outperforming the expected 180,000 and coming after a downwardly revised 165,000 in March. Concurrently, the unemployment rate in April 2023 dropped to 3.4%, matching a 50-year low previously seen in January.

For May 2023 data, scheduled for release on 2 June, analysts anticipate that Non-Farm Employment will see an addition of 180,000 jobs, with the unemployment rate projected at 3.5%.

Takeaway: Markets will closely watch May’s US Jobs report, focusing on Non-Farm Employment Change and Unemployment rate, as the Fed may keep interest rates steady. Recent strong economic data could spark further Fed discussions.