Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

On Monday, the S&P 500 index experienced minimal change as investors awaited a crucial debt ceiling meeting and officials worked to prevent a default. The index slightly increased by 0.02% to close at 4,192.63, while the Dow Jones Industrial Average fell by 0.42% to end at 33,286.58. In contrast, the Nasdaq Composite rose by 0.5% to settle at 12,720.78, reaching its highest closing and intraday levels since August. President Joe Biden and House Speaker Kevin McCarthy were scheduled to hold talks concerning the debt ceiling, with only 10 days remaining before a potential U.S. default. Negotiations faced hurdles due to disagreements over government spending cuts and tax increases.

Despite uncertainties in Washington and concerns about inflation, the stock market continued to rise, particularly driven by technology stocks, resulting in a winning week for major averages. The S&P 500 approached the 4,200 level, but market analysts emphasized the need for broader market participation to sustain the rally in the long term. Sylvia Jablonski, CEO at Defiance ETFs, suggested that stronger market breadth might come after the Federal Reserve’s June meeting. Economic data for the week included the second reading for first-quarter GDP on Thursday and the release of the Fed’s preferred inflation measure, the personal consumption expenditures gauge, on Friday. Additionally, investors awaited the Fed minutes from the May meeting, which could provide insights into the central bank’s stance on potential interest rate hikes. Notable upcoming reports included earnings announcements from Zoom Video, Lowe’s, and Dick’s Sporting Goods, signaling the winding down of the first-quarter earnings season.

Data by Bloomberg

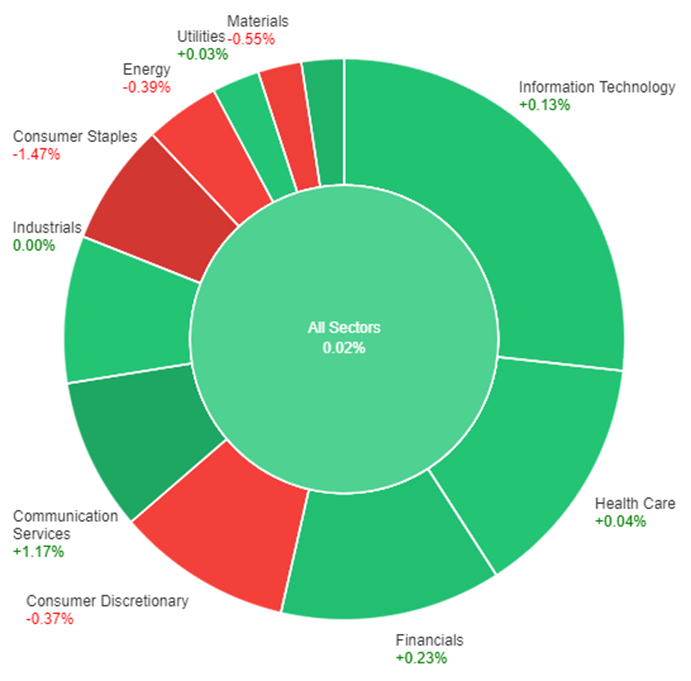

On Monday, the overall market showed a slight increase of 0.02%. Among the sectors, Communication Services performed the best, with a gain of 1.17%, followed by Real Estate, which rose by 0.67%. Financials experienced a modest increase of 0.23%, while Information Technology and Health Care sectors saw smaller gains of 0.13% and 0.04% respectively. Utilities and Industrials sectors remained relatively stable with minimal changes at 0.03% and 0.00% respectively. However, Consumer Discretionary, Energy, Materials, and Consumer Staples sectors all recorded declines, with Consumer Staples suffering the most significant loss at 1.47%.

Major Pair Movement

The US dollar index experienced a rise after comments from Minneapolis Fed President Neel Kashkari and St. Louis Fed President James Bullard suggested a hawkish stance. Kashkari indicated the possibility of interest rates exceeding 6%, while Bullard mentioned the potential for additional rate hikes in 2023. However, San Francisco Fed President Mary Daly took a more cautious approach, awaiting further data and suggesting that tighter credit conditions may be equivalent to one or two rate hikes. Atlanta Fed President Raphael Bostic expressed comfort in observing the economy’s performance given the significant tightening measures implemented thus far. Traders remained cautious due to ongoing debt ceiling negotiations aiming to prevent a US default before the June 1 deadline.

The EUR/USD pair experienced a slight dip, while front-end futures rates saw a modest increase in December 2023 rate cut expectations. USD/JPY rose as US-Japan yield expectations were influenced by the tighter Fed rate outlook. GBP/USD declined, influenced by the hawkish expectations of the Fed, as traders adjusted their positions ahead of important data releases. Bitcoin traded at $26.8k with minimal movement, while gold and silver prices experienced declines due to higher US yields impacting precious metals.

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| EUR | French Flash Manufacturing PMI | 15:15 | 46.1 |

| EUR | French Flash Services PMI | 15:15 | 54.0 |

| EUR | German Flash Manufacturing PMI | 15:30 | 44.9 |

| EUR | German Flash Services PMI | 15:30 | 55.0 |

| GBP | Flash Manufacturing PMI | 16:30 | 47.9 |

| GBP | Flash Services PMI | 16:30 | 55.5 |

| USD | Flash Manufacturing PMI | 21:45 | 50.0 |

| USD | Flash Services PMI | 21:45 | 52.6 |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com