Spreads

Spreads

Spreads

Spreads

Spreads

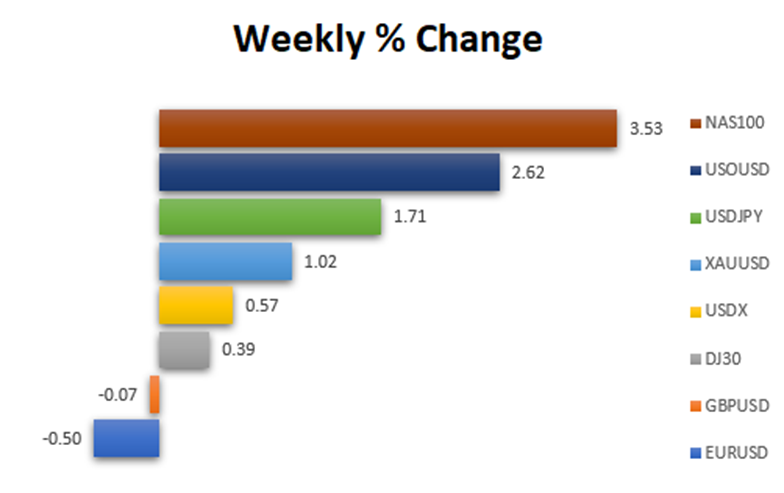

What happened in the market last week?

Last Week Market Pair Changes (All data is taken from the MT4 VT Markets)

The U.S. dollar experienced a modest increase due to the optimism of the USD debt ceiling discussion.

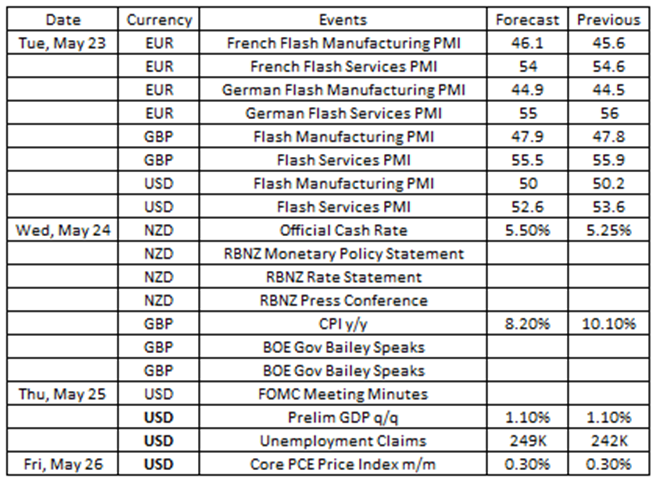

Source: VT Markets Economic Calendar

What to focus on this week?

This week, the focus is on RBNZ’s anticipated 12th consecutive interest rate hike, leading advanced nations. Investors expect more hikes despite RBNZ projections. The US Federal Reserve’s June decision is uncertain, with PCE inflation data and FOMC meeting minutes being key. The US dollar’s fate hinges on data supporting rate hikes or indicating slowing growth. Eurozone PMIs may affect the euro, while the UK pound faces potential challenges from inflation figures. Economic indicators and retail sales data will also influence the pound against the dollar.

In April 2023, Germany’s Manufacturing PMI experienced a slight upward revision to 44.5, marking the sector’s poorest performance since May 2020. Meanwhile, the UK Manufacturing PMI was adjusted higher to 47.8, and the US Flash Manufacturing PMI saw a downward revision to 50.2, compared to March’s reading of 49.2.

For May 2023 data, due on May 23, analysts predict German Manufacturing PMI at 43.6, UK’s at 48.8, and US’s at 50.3.

Takeaways: The market eagerly awaits Germany’s Manufacturing PMI data, which could impact the EUR/USD exchange rate. Meanwhile, the Bank of England and Federal Reserve will scrutinise UK and US manufacturing PMI, respectively, for insights into their countries’ economic conditions.

In April 2023, US Services PMI was revised to 53.6, the year’s largest expansion, while Germany’s reached 56, its fastest growth in a year. The UK Services PMI rose to 55.9, highlighting continuous sector expansion throughout the year.

For May 2023 data, set to be released on May 23, analysts forecast Germany’s Flash Services PMI at 56.6, UK’s at 54.3, and US’s at 53.

Takeaways: As the market eagerly awaits Germany’s Services PMI data, which has the potential to impact the EUR/USD exchange rate movement, the Bank of England and the Federal Reserve will also be closely examining Services PMI data from the UK and the US, respectively, to gain valuable insights into their respective countries’ economic conditions.

During its April meeting, the Reserve Bank of New Zealand increased its official cash rate by 50bps to 5.25%, reaching its highest level since December 2008.

For the upcoming meeting on 24 May, analysts predict that the RBNZ will implement an additional 25bps hike, raising the rate to 5.5%.

Takeaways: RBNZ is poised to increase interest rates for the 12th consecutive time, leading among advanced nations. Yet, this hike might be the final one, contrary to market expectations of surpassing RBNZ’s forecast with more raises. This may temporarily elevate the NZD/USD when the data is released.

The consumer price inflation rate in the UK eased to 10.1% year-on-year in March 2023 from 10.4% in February 2023.

As for the year-on-year CPI data set to be released on 24 May, analysts anticipate a further decline, projecting it to drop to 8.5%.

Takeaways: The pound has shown more resilience than other major currencies against the strengthening US dollar. However, the upcoming release of April’s CPI – expected to reveal a decrease compared to March – might challenge the prevailing consensus on sustained UK inflation. This could potentially result in a decline in GBP/USD value.

The Fed implemented a 25bps increase in its funds rate during its meeting on 3 May, adjusting it to a range of 5%-5.25%. This adjustment represents the 10th hike.

Analysts await the release of the next FOMC Meeting Minutes on May 24th, where they expect to find indications from the Fed about the ongoing tightening cycle. They anticipate the removal of a statement sentence that suggests the need for further policy firming.

Takeaways: This week, the market will be closely watching the FOMC Meeting Minutes release to assess the Fed’s recent position. If there are no substantial changes from the 3 May meeting, significant market fluctuations are not expected.

US Core PCE prices, excluding food and energy, experienced a 0.3% month-over-month increase in March 2023, maintaining the same growth rate as the previous month.

The data for April 2023 is set to be released on 26 May, with analysts expecting the same growth rate as March 2023 at 0.3%.

Takeaways: The Fed’s favoured price measure, the core PCE price index, is anticipated to have dropped by 0.3%. This might result in a temporary dip in the US Dollar Index. Nonetheless, it could positively affect US stocks, as the market may perceive this as an indication of easing inflation.