Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

Stocks experienced a decline on Tuesday, influenced by Home Depot’s underwhelming forecast. The financial market also focused on a crucial meeting between President Joe Biden and congressional leaders regarding the U.S. debt ceiling. The Dow Jones Industrial Average closed below its 50-day average for the first time since March 30, with a drop of 336.46 points or 1.01% to 33,012.14. Similarly, the S&P 500 decreased by 0.64% to 4,109.90, while the Nasdaq Composite fell 0.18% to 12,343.05.

The disappointing performance of Home Depot, a Dow member, contributed to the overall decline. The company reported lower-than-expected quarterly revenue and revised its full-year guidance due to consumers postponing major home improvement projects. Furthermore, April’s retail sales figures were weaker than economists predicted, with a 0.4% increase instead of the anticipated 0.8%.

The financial market has remained stuck within a range of 3800 to 4200 on the S&P 500 since November, indicating the uncertainty felt by investors regarding policy outcomes. Questions surrounding the economy’s response, consumer spending sustainability, and the duration of these conditions have contributed to this stagnant state, according to U.S. Bank Wealth Management’s Bill Merz.

Investors are anxiously awaiting progress on debt ceiling negotiations, with Treasury Secretary Janet Yellen warning of a potential default as early as June 1 if no agreement is reached. Yellen emphasized the severe consequences of a default, including a potential breakdown of financial markets and worldwide panic. President Biden maintains optimism about the ongoing negotiations, while House Speaker Kevin McCarthy highlights significant obstacles that still need to be overcome. Biden has stood firm on his position that raising the debt ceiling is non-negotiable, while McCarthy has advocated for a deal linking the increase to spending cuts. In response to the pressing matters, Biden will curtail his upcoming international trip and prioritize the debt ceiling negotiations.

Data by Bloomberg

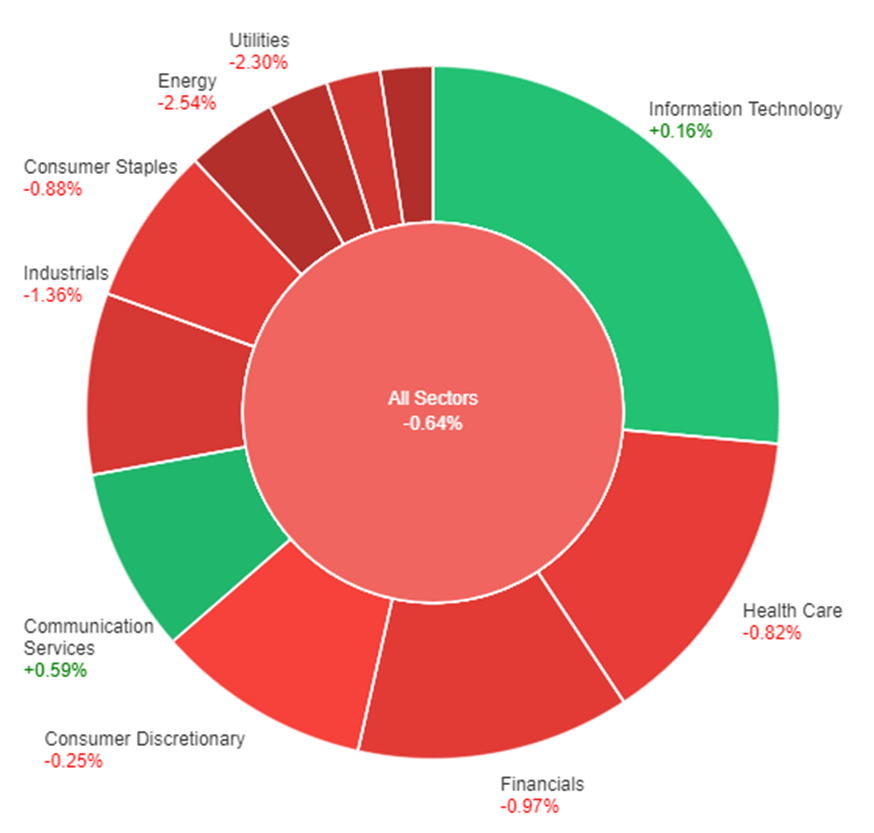

On Tuesday, the overall market experienced a decline of 0.64% in price change across all sectors. However, some sectors managed to show positive gains, with Communication Services leading the way with a 0.59% increase, followed by Information Technology with a modest gain of 0.16%. On the other hand, several sectors faced notable losses, with Real Estate taking the biggest hit, declining by 2.61%. Energy and Utilities also struggled significantly, with both sectors experiencing declines of 2.54% and 2.30%, respectively. Industrials and Materials also faced notable losses, dropping by 1.36% and 1.64%, respectively. Other sectors that experienced negative price changes include Consumer Staples (-0.88%), Financials (-0.97%), Health Care (-0.82%), and Consumer Discretionary (-0.25%).

Major Pair Movement

The dollar index rebounded on Tuesday, recovering from initial losses as strong U.S. data and opposition to rate cuts by Federal Reserve speakers lifted Treasury yields. However, the dollar’s gains were limited as 2- and 10-year rates faced resistance from their 200-day moving averages, resulting in modest pullbacks.

While U.S. data showed solid performance, it was marred by downward revisions to previous months and April’s retail sales rise of 0.4% fell short of the forecasted 0.8%. However, the control group’s 0.7% increase, surpassing the 0.3% forecast, provided some offsetting positive news. Industrial production was revised down, almost offsetting the beat in April.

As a result, EUR/USD remained largely unchanged, while sterling experienced a 0.36% loss. USD/JPY surged after the U.S. data release, reaching a high of 136.69 on EBS. Despite this, the pullback in Treasury yields limited USD/JPY’s gain to only 0.15%.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| AUD | Wage Price Index q/q | 09:30 | 0.9% |

| GBP | BOE Gov Bailey Speaks | 17:50 |