Spreads

Spreads

Spreads

Spreads

Spreads

Last Week Market Pair Changes (All data is taken from the MT4 VT Markets)

The US dollar remained stable, with a slight decrease of 0.03% in the USDX. The stability came after the release of data showing inflation growth in March, although at a slower rate, which further solidified the Fed’s plan to raise interest rates at the upcoming monetary policy meeting.

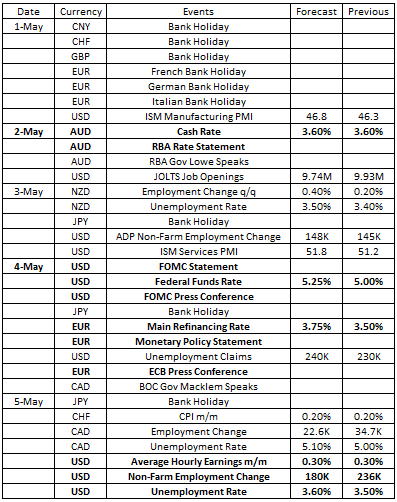

This week, market participants await the release of highly awaited economic reports, which will highlight key indicators such as Rate Statements in the US and Australia, as well as Employment Change in the US and Canada. These reports have immense significance as they enable traders and investors to make informed decisions and stay ahead of the market.

1 May 2023 | US ISM Manufacturing PMI

The US ISM Manufacturing PMI fell to 46.3 in March 2023, the lowest since May 2020.

Analysts expect a reading of 46.6 for April 2023.

2 May 2023 | Reserve Bank of Australia Rate Statement

During its April meeting, the RBA held its cash rate steady at 3.6%, in line with market expectations. This marks the first pause in the current hiking cycle, which began in May 2022.

For April, analysts expect the central bank to keep the rate unchanged at 3.6%.

3 May 2023 | US ISM Services PMI

The US ISM Services PMI dropped to 51.2 in March 2023 from 55.1 in February 2023, the slowest growth in three months.

For April, analysts expect a reading of 50.6.

3 May 2023 | FOMC Meeting and Funds Rate

The Fed raised its funds rate by 25bps to 5% in March 2023.

Despite a slower inflation rate, analysts anticipate that the central bank will continue to raise interest rates, with another 25bps hike to 5.25% in April 2023.

4 May 2023 | European Central Bank Main Refinancing Rate

Most ECB policymakers agreed to raise key interest rates by 50bps to 3.5% last month, though some members would have preferred not to increase them until the financial market tensions had subsided.

The ECB is set to deliver a 25bps rate hike in its May meeting, with further increases expected to be implemented in subsequent meetings.

5 May 2023 | Canada Employment Change

The Canadian economy added 35,000 jobs in March 2023, while the unemployment rate remained unchanged at 5% for the fourth consecutive month. This is near the record low of 4.9% seen in June and July 2022.

For April 2023, it is anticipated that job creation numbers will drop slightly to 25,000. The unemployment rate is expected to be at 5.1%.

5 May 2023 | US Employment Change

The US economy created 236,000 jobs in March, the least since December 2020. Meanwhile, the unemployment rate edged down to 3.5% in March 2023.

Analysts expect the US to create 190,000 jobs in April 2023, while the unemployment rate will be at 3.5%.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.