Spreads

Spreads

Spreads

Spreads

Spreads

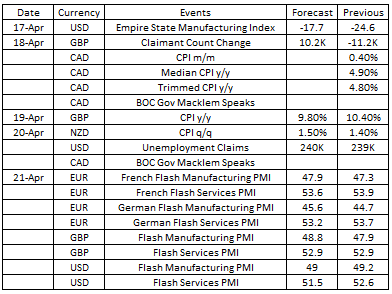

This week, market participants are eagerly awaiting some highly anticipated economic reports. The focus will be on key indicators such as CPI in Canada, the UK, and New Zealand, as well as Flash Manufacturing and Services PMI in the UK and the US. These much-awaited reports are crucial in helping traders and investors stay ahead of the curve and make informed decisions.

Here are the key events to watch out for:

The NY Empire State Manufacturing Index sank to -24.6 in March 2023 from February’s -5.8.

Analysts anticipate a reading of -15 in April.

The number of people claiming for unemployment benefits in the UK fell by 11,200 in February 2023.

For March, analysts expect this trend to persist, with a projected decrease of 9,500.

CPI in Canada rose 0.4% in February 2023, easing from 0.5% in January.

For March, analysts expect the index to increase by 0.3%.

UK inflation rose unexpectedly in February, with CPI up 10.4% annually from 10.1% in January. This was the first increase in four months.

For March, analysts expect a lower reading of 10.2%.

New Zealand’s CPI jumped 1.4% in the fourth quarter of 2022 from the previous quarter.

For the first quarter of 2023, analysts forecast the index to increase by 1.6%.

In March 2023, the German Flash Manufacturing PMI was revised slightly higher to 44.7, while the Flash Services PMI was revised slightly lower to 53.7.

For April, analysts expect the Flash Manufacturing PMI to be released at 45.5, while Flash Services PMI at 53.5.

UK Flash Manufacturing PMI came in at 47.9 in March 2023, down from February’s seven-month high of 49.3.

Analysts expect a reading of 48.5. in April.

The US Flash Manufacturing PMI came in at 49.2 in March 2023, up from 47.3 in February. Meanwhile, Services PMI was revised lower to 52.6.

For April 2023, analysts expect the US Flash Manufacturing PMI to be released at 48, while Flash Services PMI at 51.8.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.