Spreads

Spreads

Spreads

Spreads

Spreads

US stocks declined higher on Thursday, struggling for direction and saw a lot of instability near a key technical level as traders awaited the all-important jobs report for clues on the Federal Reserve’s next policy steps. The persistent optimism and tepid US data continued to support the Federal Reserve’s monetary policy pivot and dragged the US Dollar to multi-month lows.

The dovish bias of the Federal Reserve (Fed) Chairman Jerome Powell, as well as downbeat comments from US Treasury Secretary Janet Yellen, initially raised hopes of easy rate hikes. Additionally, some Chinese cities announced they are easing their testing and control coronavirus-related policies, which acted as a tailwind for the equity markets.

On Friday, the US will publish the Nonfarm Payrolls report, which might provide fresh impetus. On the Eurozone front, investors are waiting for the speech from European Central Bank (ECB) President Christine Lagarde.

The benchmarks, S&P 500 and Dow Jones Industrial Average both little changed on Thursday as the S&P 500 closed mixed but the US 10-year Treasury bond yields plummeted to a four-month low. The S&P 500 was down 0.09% on a daily basis and the Dow Jones Industrial Average dropped lower with a 0.6% gain for the day. Eight out of eleven sectors in the S&P 500 stayed in negative territory as the Financials sector and the Consumer Staples sector is the worst performing among all groups, losing 0.71% and 0.47%, respectively. The Nasdaq 100 meanwhile was little changed with a 0.1% gain on Thursday and the MSCI World index was up 0.8% for the day.

Main Pairs Movement

The US dollar slumped sharply on Wednesday, suffering from daily losses and dropped towards the 104.70 level amid expectations for the Federal Reserve’s monetary policy pivot. The dovish comments from Fed policymakers favouring a 50 bps Fed rate hike in December allowed the US Treasury bond yields to refresh a four-month low amid receding market pessimism and a rush toward the riskier assets. The focus will then shift to the release of the closely-watched US monthly jobs report – popularly known as NFP.

GBP/USD surged higher on Thursday with a 1.57% gain after jumping above the 1.2030s area as the US Dollar struggles to gain any meaningful traction. On the UK front, the overnight dovish remarks by Bank of England (BoE) Chief Economist Huw Pill failed to drag the cable lower. Meanwhile, EUR/USD regained upside traction and grinds near a five-month high past 1.0500 amid a weaker US dollar across the board. The pair was up almost 1.10% for the day.

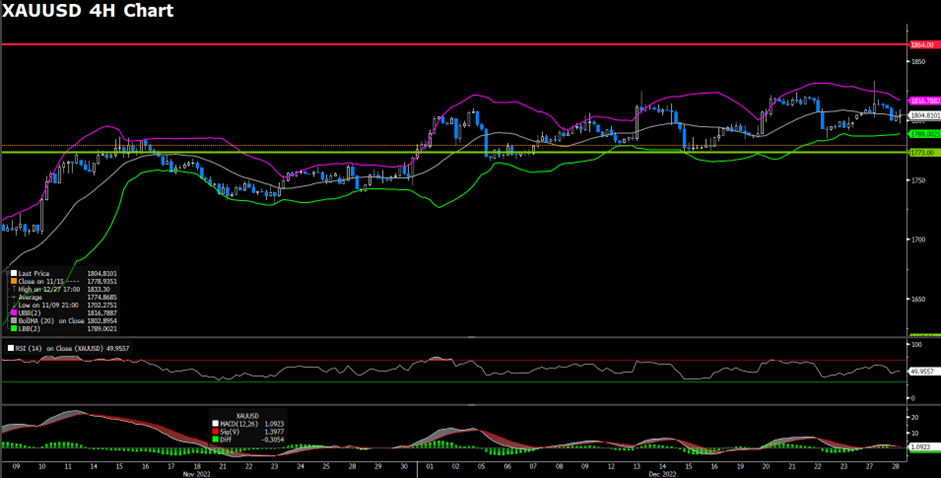

Gold rallied sharply with a 1.96% gain for the day after refreshing a four-month high above the $1,800 mark during the US trading session, as the hopes of slower Federal Reserve rate hikes provided strong support to the precious metal. Meanwhile, WTI Oil advanced sharply with a 0.83% gain for the day.

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| AUD | Retail Sales (MoM) | 08:30 | -0.2% |

| EUR | ECB President Lagarde Speaks | 10:40 | |

| NZD | RBNZ Gov Orr Speaks | 12:30 | |

| USD | Nonfarm Payrolls (Nov) | 21:30 | 200K |

| CAD | Employment Change (Nov) | 21:30 | 5.0K |

| USD | Unemployment Rate (Nov) | 21:30 | 3.7% |