Spreads

Spreads

Spreads

Spreads

Spreads

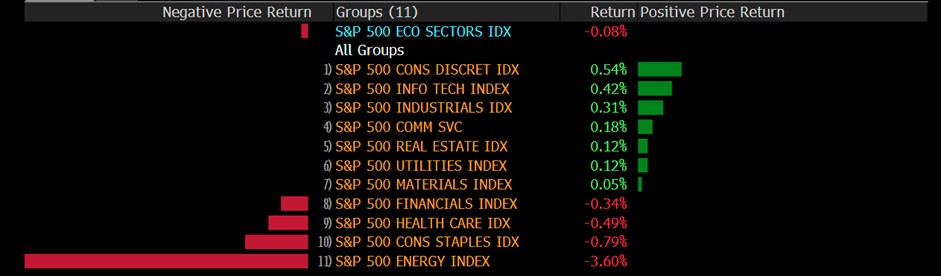

US stocks wavered on Thursday as traders parsed various corporate earnings against a backdrop of aggressive interest-rate hikes by global central banks. The US yield curve continued to be inverted as recession fears persisted.

The S&P 500 ended the session little changed after fluctuating throughout the day. The Nasdaq 100 closed up higher for the second straight day after swinging between modest gains and losses. The Nasdaq 100 closed up higher for the second straight day after swinging between modest gains and losses.

A flurry of economic data released this week assuaged fears of a downturn while hinting at stabilising growth. But the bond market, especially the persistently inverted Treasury yield curve, is flashing warnings on the economy amid a global wave of monetary tightening. All eyes will be on the US jobs report on Friday for further clues about the Federal Reserve’s path of rate hikes.

Elon Musk said he sees signs that the global economy has gone “past peak inflation.” Speaking at the electric-vehicle maker’s annual shareholder meeting, Musk said the company’s commodity and component costs are trending downward over the next six months. He also reiterated prior comments that he expects a mild recession to hit that could last 18 months.

“The trend is down, which suggests we are past peak inflation,” Musk said at Tesla’s Austin headquarters and factory. “I think inflation is going to drop rapidly” at some point in the future, he said.

Global central banks have embarked on a path of policy-tightening as inflation pressures consumers and corporate bottom lines. In the US, consumer prices increased by 9.1% in June from a year earlier, and Federal Reserve officials say the price gains have yet to slow. The next print on inflation comes on Aug 10.

Main Pairs Movement

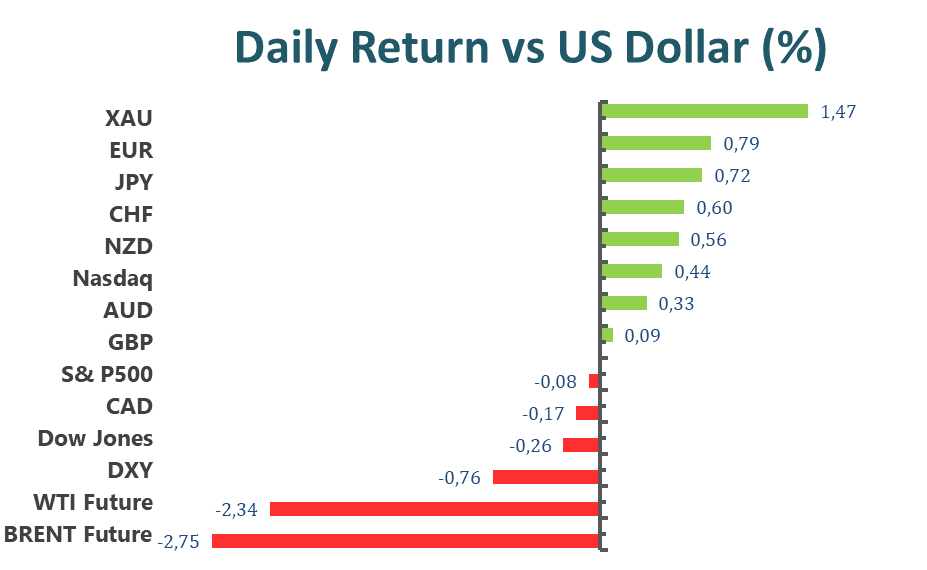

The dollar fell against most of its major rivals, ending the day near its recent lows, usually a sign of further declines ahead in the near term. The fear of a global recession returned after the Bank of England announced its latest decision on monetary policy. The central bank raised interest rates by 50bps to 1.75% as expected.

But politicians have revised their inflation forecast upwards, expecting a recession in the next five quarters. A Federal Reserve official said that recession risks have increased in the US and that interest rates should continue to rise at least through this year and the first half of 2023.

GBP/USD recovered some of its losses from the past two days and advanced towards 1.2170 in early European trading on Thursday. EUR/USD benefited from the broad dollar’s weakness and settled around 1.0250.

The AUD/USD advanced and hovered around 0.6970, bolstered by gold, as the bright metal reached fresh one-month highs in the US$1,790 price zone. The US dollar strengthened against the Canadian dollar, climbing to around 1.2860 before settling at that level. The barrel of WTI currently trades at US$88.40 a barrel.

XAU/USD has pushed down within its weekly bullish correction to mark a high of US$1,794.23. Gold price increased as US bond yields decreased and the Bank of England issued a warning that the UK’s economy might be headed for a recession later this year due to inflation could reach 13%.

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| USD | Nonfarm Payrolls (Jul) | 20:30 | 250K |

| USD | Unemployment Rate (Jul) | 20:30 | 3.6% |

| CAD | Employment Change (Jul) | 20:30 | 20.0K |

| CAD | Ivey PMI (Jul) | 22:00 | 60.3 |