Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

On Tuesday, the stock market faced a downturn, heavily influenced by a slump in technology stocks, especially with Nvidia’s earnings report on the horizon, causing its shares to fall by 4.4%. The Dow Jones Industrial Average slightly declined by 0.17%, while more significant drops were observed in the S&P 500 and Nasdaq Composite, decreasing by 0.60% and 0.92%, respectively. This trend reflected broader concerns over the tech sector’s high valuations, with companies like Amazon, Microsoft, and Meta also experiencing losses. Concurrently, major financial transactions grabbed headlines, including Capital One’s acquisition of Discover Financial Services for $35.3 billion and Walmart’s purchase of Vizio for $2.3 billion, both moves sparking notable stock surges. Additionally, currency markets saw fluctuations amid varied economic indicators and policy expectations, affecting the dollar index and EUR/USD pair. These market movements underscore the complexities of sector-specific trends and significant corporate deals, against a backdrop of evolving global economic conditions and monetary policies.

On Tuesday, the stock market experienced a downturn, influenced significantly by a decline in technology stocks, particularly ahead of Nvidia’s earnings report. The Dow Jones Industrial Average saw a slight decrease of 0.17%, closing at 38,563.80, while the S&P 500 and Nasdaq Composite fell by 0.60% and 0.92% respectively. Nvidia’s stock dropped by nearly 4.4% amid concerns over its high valuation despite anticipated strong earnings. This sentiment was echoed across other tech giants, with Amazon, Microsoft, and Meta also recording losses. The tech sector’s valuation, trading at around 30 times forward estimates, has raised doubts about further price-to-earnings (PE) multiple expansion, according to CFRA Research’s chief investment strategist, Sam Stovall.

In addition to the tech sector’s performance, significant financial transactions also captured market attention. Capital One Financial announced its plan to acquire Discover Financial Services in a deal valued at $35.3 billion, which is expected to close between late 2024 and early 2025, causing Discover’s stock to surge by 12.6%. Meanwhile, Walmart revealed its acquisition of TV manufacturer Vizio for $2.3 billion, a move that resulted in a 16% jump in Vizio’s shares and a more than 3% increase in Walmart’s stock following the retailer’s announcement of surpassing quarterly earnings and revenue expectations. These developments highlight the ongoing adjustments within the stock market, influenced by both sector-specific trends and significant corporate deals.

Data by Bloomberg

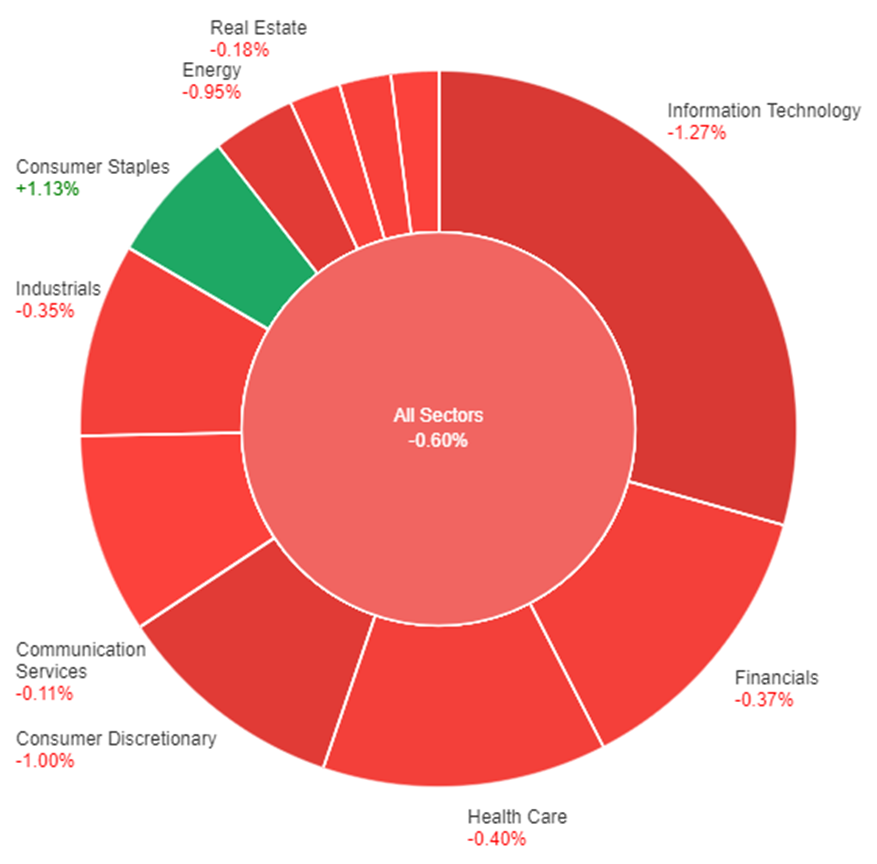

On Tuesday, the market saw a mixed performance across various sectors with an overall price decline of 0.60% across all sectors. Consumer Staples emerged as the top performer, recording a gain of 1.13%, while Information Technology faced the steepest decline, dropping by 1.27%. Sectors such as Consumer Discretionary and Energy also saw significant losses, decreasing by 1.00% and 0.95% respectively. Other sectors experienced more moderate changes, with Communication Services, Utilities, Real Estate, Materials, Industrials, Financials, and Health Care witnessing declines ranging from -0.11% to -0.40%.

The currency markets have recently experienced fluctuations, notably with the dollar index and the EUR/USD pair both witnessing a rise of 0.27%. This movement came amidst a complex backdrop of economic indicators and policy expectations. On one hand, the U.S. Treasury yields hit a resistance last week, influenced by a mix of conflicting domestic data, including softer Philly Fed and Leading Economic Index (LEI) figures, as well as external factors like China’s rate cut. These developments have somewhat dented the dollar’s strength. Furthermore, the anticipation around the Federal Reserve’s rate cuts for 2024 has seen a significant adjustment, with the market’s expectations dialing down from five to six rate cuts to less than four, aligning more closely with the Fed’s December projections of 75 basis points in cuts.

The detailed dynamics of these currency movements also reflect broader global economic sentiments and policy maneuvers. For instance, the EUR/USD rally on Tuesday was noteworthy, overcoming key resistance levels and indicating a potential shift in market sentiment. Meanwhile, the USD/JPY pair’s movements have been influenced by the Treasury-Japanese Government Bond (JGB) yield spreads, alongside speculations around the Bank of Japan’s policy directions and their implications for the currency pair. Additionally, the broader implications of these currency shifts, alongside upcoming economic data releases like global flash PMIs and U.S. jobless claims, are keenly awaited by the markets. They are expected to provide further clarity on the U.S. economic performance and its impact on currency valuations, especially as investors and analysts parse through the Fed’s upcoming meeting minutes for insights into future rate adjustments.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| AUD | Wage Price Index q/q | 09:30 | 0.9% |

| USD | FOMC Meeting Minutes | 03:00 (22nd) |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.