Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

With U.S. markets closed in observance of Presidents Day, global financial markets took center stage, showcasing mixed sentiments across different regions and sectors. Europe’s Stoxx 600 index saw a modest rebound, while Asian markets presented a mixed picture, influenced by the People’s Bank of China’s policy decisions and optimistic travel data from China. Meanwhile, the currency and commodity markets remained relatively stable, with minor movements in major currency pairs and commodities like gold seeing a slight rise. Key economic events, including policy decisions from the Reserve Bank of Australia and the People’s Bank of China, along with Canada’s CPI report, are highly anticipated by investors, potentially setting the tone for future market movements.

The U.S. markets were closed on Monday in observance of Presidents Day, leading to a day where international markets garnered more attention. In Europe, the Stoxx 600 index managed a modest recovery, ending the day by 0.17%, a slight rebound from its negative performance in the morning session. Sector-wise, there was a mixed picture; mining stocks experienced a downturn, dropping by 1%, whereas healthcare stocks moved in the opposite direction, recording a gain of 0.95%. This divergence highlights the varied investor sentiments across different sectors within the European stock market landscape.

In company-specific news, shares of the Swiss software firm Temenos saw an impressive jump of 8.8%, bouncing back from the significant losses it suffered following a negative report from Hindenburg Research. On the other side of the globe, in the Asia-Pacific region, the stock market outcomes were mixed. Chinese markets showed optimism as traders returned from the Lunar New Year holidays, encouraged by promising travel data, while the Hong Kong stock market faced a downturn. The monetary policy stance of the People’s Bank of China, which held a key policy rate steady, also played a crucial role in shaping market expectations, especially in a global context where the timing of the U.S. Federal Reserve’s policy easing remains a focal point of speculation.

Data by Bloomberg

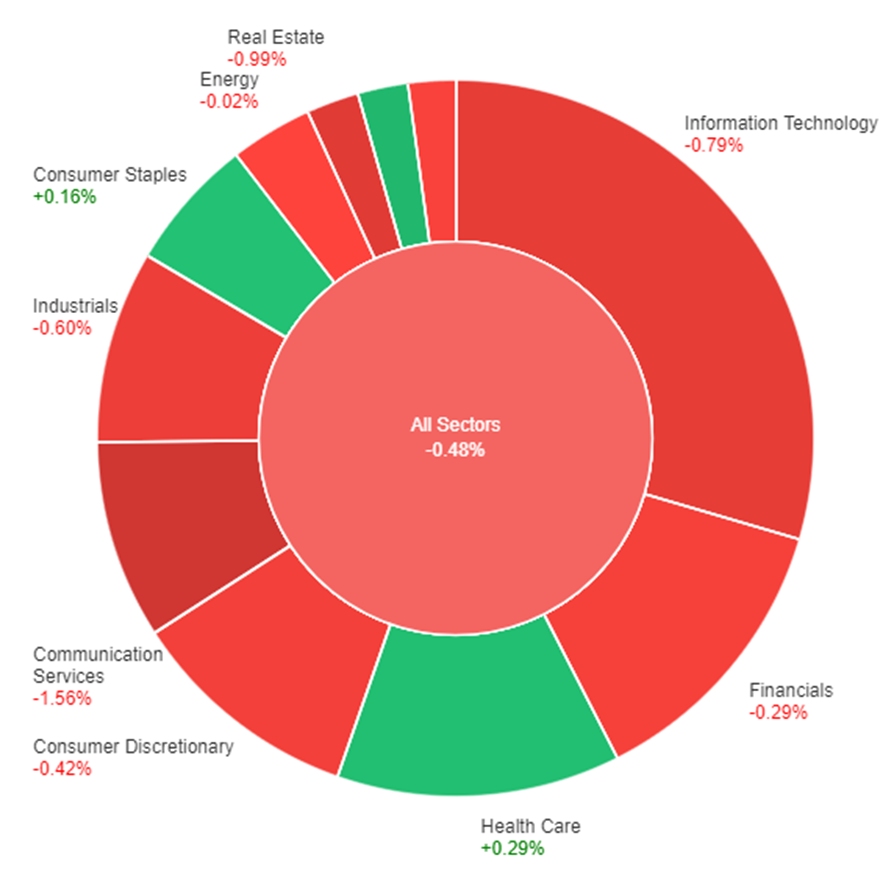

On Friday, the overall market saw a slight downturn, closing down by 0.48%. Despite the general negative sentiment, some sectors managed to post gains, with Materials leading the way with a 0.51% increase, followed by Health Care and Consumer Staples, which rose by 0.29% and 0.16%, respectively. On the flip side, the Communication Services sector faced the steepest decline at -1.56%, and Real Estate and Information Technology also experienced significant losses, dropping by -0.99% and -0.79% respectively. Other sectors such as Energy and Utilities saw marginal decreases, while Financials, Consumer Discretionary, and Industrials also ended the day in the red, highlighting a mixed but overall bearish performance across the market. Adding to the context, the US market was closed on Monday, suggesting that these movements were the last recorded before a day of inactivity in the trading sessions.

In the recent currency market updates, major currency pairs have shown minimal movement, adhering to their familiar trading ranges, influenced by the holiday closures in the United States and Canada. Despite this lull, a cautious optimism permeated the financial markets, reflected in the performance of some European and Japanese stock indexes as they neared record highs. The Euro to US Dollar (EUR/USD) exchange rate remained just below the 1.0800 mark, while the British Pound to US Dollar (GBP/USD) hovered around 1.2600. The GBP gained momentum during the European trading session, although it saw a slight retreat before the day’s end. Meanwhile, the US Dollar saw modest gains against traditionally safe-haven currencies such as the Swiss Franc (CHF) and the Japanese Yen (JPY), hinting at a buoyant mood within the financial markets.

On the commodity front, the Australian Dollar recorded a slight increase against the US Dollar, with the AUD/USD pair trading near 0.6540. In contrast, the Canadian Dollar depreciated against its US counterpart, approaching the 1.3500 level. These movements come ahead of significant macroeconomic events slated for early this week. The Reserve Bank of Australia (RBA) is expected to release its Meeting Minutes, which market participants will scrutinize for indications on future monetary policy, especially concerning inflation control and rate adjustments. Additionally, the People’s Bank of China (PBoC) is set to announce its decision on interest rates, specifically the Loan Prime Rate (LPR), which could influence global financial sentiments. Meanwhile, Canada’s upcoming Consumer Price Index (CPI) report for January is anticipated to show a 0.4% month-over-month increase, potentially impacting the CAD’s performance. Furthermore, spot Gold has seen a rise for three consecutive days, briefly surpassing the $2,020.00 mark, adding another layer of complexity to the market dynamics as investors await these critical economic updates.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| AUD | Monetary Policy Meeting Minutes | 08:30 | |

| CAD | Consumer Price Index m/m | 21:30 | 0.4% |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.