Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

On Wednesday, the stock market experienced notable gains, propelling the S&P 500 tantalizingly close to the 5,000 mark, thanks to strong quarterly results underscoring a robust economy. The index rose by 0.82%, setting a new closing high of 4,995.06, while the Nasdaq Composite and Dow Jones also posted gains, driven by upbeat corporate earnings and the growth of tech giants like Nvidia and Microsoft. Despite the Federal Reserve’s cautious stance on interest rate cuts, investor optimism remained buoyed by signs of resilient consumer spending and positive corporate guidance. Additionally, the currency market saw adjustments ahead of key U.S. economic data, with the dollar index slightly retreating as markets await the upcoming CPI report, potentially influencing future Fed policy decisions.

On Wednesday, the stock market witnessed significant gains, with the S&P 500 inching closer to the coveted 5,000 mark, achieving a new closing high as a result of strong quarterly results that suggest a thriving economy. The index saw a 0.82% rise, closing at 4,995.06, and even touched 4,999.89 at its peak during the session. Similarly, the Nasdaq Composite and the Dow Jones Industrial Average experienced increases, with the Nasdaq up by 0.95% to 15,756.64 and the Dow Jones rallying 156 points or 0.4%, to close at an all-time high of 38,677.36. These gains were propelled by optimistic corporate earnings and significant growth in major technology companies like Nvidia, Microsoft, Meta Platforms, Alphabet, and Amazon.

The market’s robust performance is attributed to a better-than-expected earnings season, strong corporate guidance, and signs of resilient consumer spending despite high-interest rates. This optimism persisted even as the Federal Reserve and its officials, including Chair Jerome Powell and Minneapolis Fed President Neel Kashkari, suggested a more cautious approach towards rate cuts, potentially delaying them longer than investors had anticipated. In addition, the stock market’s advance reflects a growing comfort among investors with the prospect of delayed rate cuts. Meanwhile, other notable movements included a significant rise in Enphase Energy’s stock following positive comments on its inventory situation, Ford’s surge after surpassing fourth-quarter expectations, and New York Community Bancorp’s volatile performance after Moody’s downgrade. The market is also anticipating earnings reports from major companies like Walt Disney, PayPal, and Arm Holdings.

Data by Bloomberg

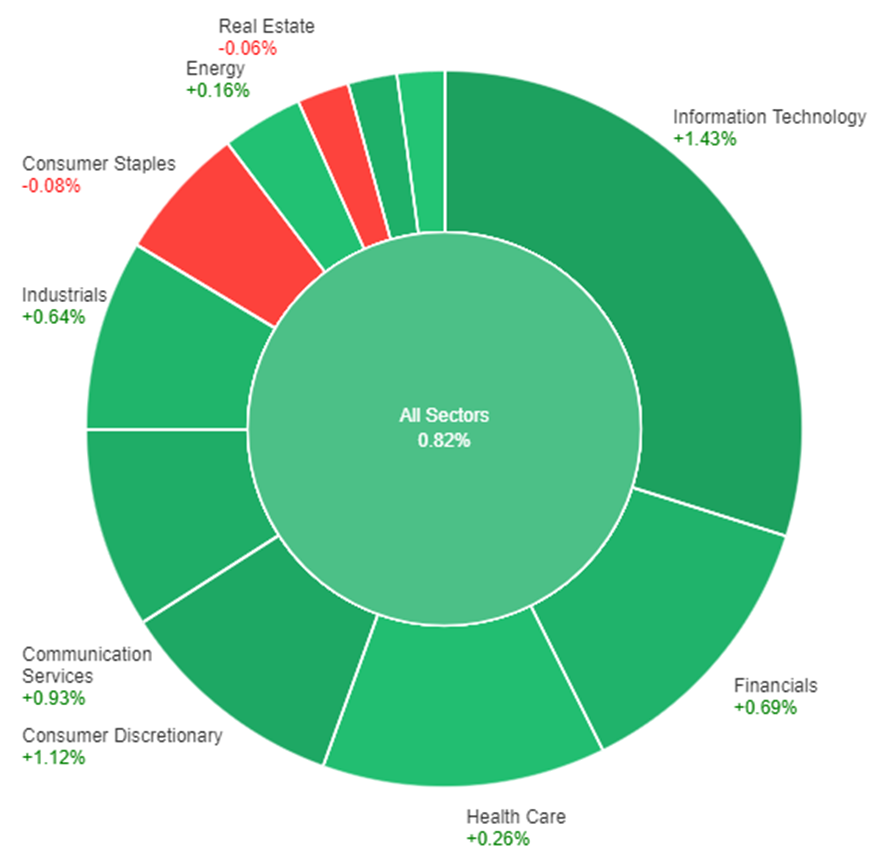

On Wednesday, the stock market showed a positive trend across most sectors, with the overall sectors seeing an increase of 0.82%. Information Technology led the gains with a 1.43% rise, followed closely by Consumer Discretionary and Communication Services, which went up by 1.12% and 0.93%, respectively. Other sectors such as Materials, Financials, Industrials, and Health Care also saw increases, albeit at a slower pace, with gains ranging from 0.26% to 0.81%. The Energy and Utilities sectors experienced minimal growth, with increases of 0.16% and 0.05%, respectively. However, not all sectors fared well; Real Estate and Consumer Staples saw declines of 0.06% and 0.08%, marking them as the only sectors to experience a downturn on Wednesday.

In the currency market, the dollar index saw a minor decline on Wednesday, entering a period of consolidation after experiencing significant gains fueled by robust U.S. employment figures and ISM data. This pause in momentum comes as the market anticipates further disinflationary data before the Federal Reserve considers any rate cuts. The focus now shifts to the upcoming U.S. CPI data scheduled for February 13, which could play a crucial role in shaping future Fed policy decisions. Despite a decrease in the likelihood of a March Fed rate cut, from previously higher probabilities, the market still anticipates substantial easing throughout the year, a scenario that remains more aggressive than the Fed’s own projections.

Currency pairs reacted to these developments, with the EUR/USD pair showing some resilience by posting a modest gain of 0.14%, despite facing resistance at key technical levels. This movement reflects ongoing market adjustments ahead of significant Treasury auctions and amidst mixed signals from Fed officials regarding the pace of future rate cuts. Meanwhile, the USD/JPY pair edged higher, influenced by the dynamics of Treasury yields in comparison to Japan’s relatively stable and low yields. Other currencies, such as the British pound and the Swiss franc, also experienced movements influenced by speculation around monetary policy adjustments and interventions, respectively. As markets brace for the U.S. annual CPI revisions and January’s CPI report, currency traders remain vigilant, gauging the potential impact of these releases on Fed policy and consequently on currency valuations.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| USD | Unemployment Claims | 09:30 | 221K |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.