Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

In a remarkable turnaround from its recent downturn, the Dow Jones Industrial Average surged 369.54 points to close at a record 38,519.84, buoyed by the Federal Reserve’s decision to keep interest rates unchanged, contrary to speculations of a possible cut in March. This 0.97% increase was mirrored by gains in the S&P 500 and the Nasdaq, climbing 1.25% and 1.3% respectively, propelled by robust earnings from tech giants like Apple and Amazon. The market’s recovery reflects a recalibration of investor expectations following Federal Reserve Chair Jerome Powell’s remarks, which tempered hopes for imminent rate cuts. Despite the upbeat performance, underlying economic concerns persist, with falling bond yields and anticipation building for the upcoming jobs report. Meanwhile, currency markets saw notable movements, with the USD Index dipping and the EUR/USD pair recovering, as investors also monitored other major currencies and commodities, setting the stage for a day rich in economic data releases.

On Thursday, the Dow Jones Industrial Average rebounded, recovering from a recent sell-off as the Federal Reserve opted to maintain interest rates, dispelling expectations of an imminent cut in March. The Dow surged by 369.54 points, or 0.97%, achieving a new record close at 38,519.84. Both the S&P 500 and the Nasdaq Composite also experienced gains, rising by 1.25% to 4,906.19 and 1.3% to 15,361.64, respectively. The positive momentum was attributed to strong earnings reports from major companies such as Apple, whose stock increased over 1%, and Amazon, which climbed 2.6%, contributing to the broader market recovery.

In the aftermath of a challenging session where the Dow recorded its worst day since December, Wednesday’s market decline was triggered by Federal Reserve Chair Jerome Powell’s comments, dashing hopes for a near-term rate cut. The poor performance led to a shift in investor sentiment, prompting a reassessment of expectations regarding the frequency of future rate cuts. Despite the recovery, concerns about the economy linger, with bond yields falling and the 10-year Treasury reaching a one-month low. Investors are now eagerly awaiting the first jobs report of the year, scheduled for release on Friday morning, as they seek further insights into the economic landscape.

Data by Bloomberg

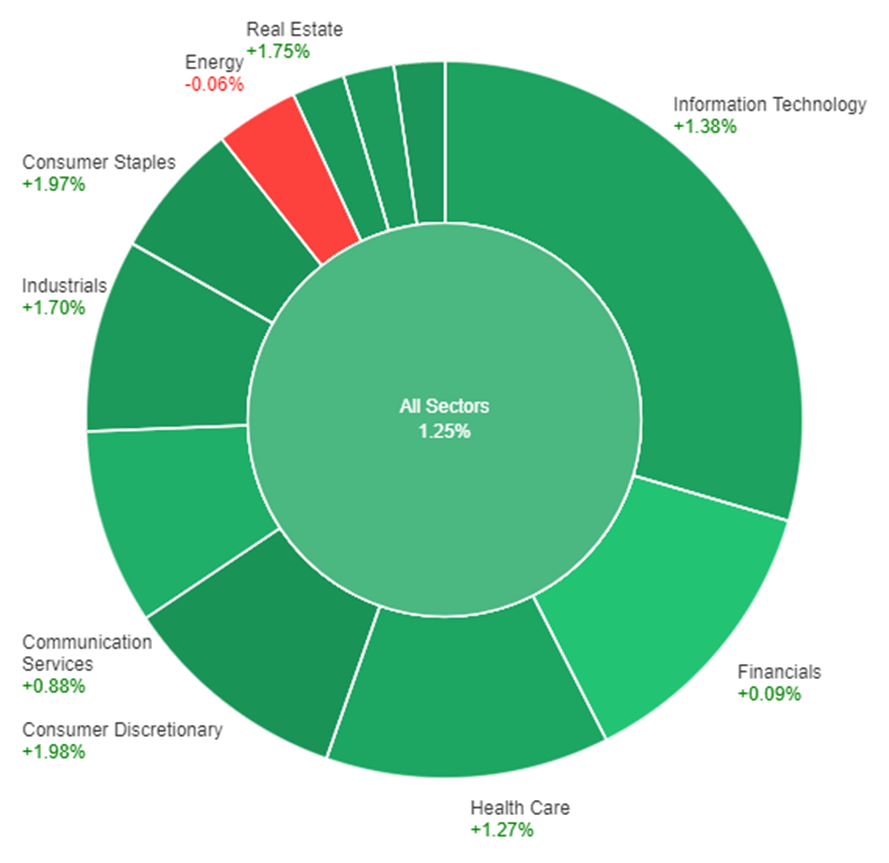

On Thursday, the overall market witnessed a positive trend, with all sectors showing gains. The strongest performers were Consumer Discretionary, Consumer Staples, and Utilities, recording increases of 1.98%, 1.97%, and 1.88%, respectively. Real Estate and Industrials also exhibited notable growth with gains of 1.75% and 1.70%. The Information Technology and Health Care sectors saw moderate increases at 1.38% and 1.27%, while Communication Services showed a more modest gain at 0.88%. However, Financials experienced minimal growth with a mere 0.09% increase. The only sector to register a decline was Energy, which saw a slight decrease of 0.06% on Thursday.

In the currency market updates, the USD Index (DXY) experienced a significant drop, testing the key support level of 103.00 and slipping below the crucial 200-day SMA. The focus for the upcoming Friday centers around the release of key economic indicators, including Nonfarm Payrolls for January, the Unemployment Rate, Factory Orders, and the final print of the Michigan Consumer Sentiment. Meanwhile, the EUR/USD pair rebounded from multi-week lows near 1.0780, supported by the dollar’s lackluster performance and the provisional 100-day SMA. On Friday, attention will turn to the ECB’s Survey of Professional Forecasters (SPF) as a notable release.

In other currency pair movements, GBP/USD showed a robust advance, surpassing the 1.2700 mark after the Bank of England maintained its policy rate. Investors anticipate potential rate reductions around Q3 2024. The USD/JPY pair faced renewed selling pressure, challenging the 146.00 support, driven by weakening US yields. Meanwhile, AUD/USD shrugged off some weekly bearishness, approaching the 0.6580 zone, with upcoming economic releases in Australia, including Home Loans and Investment Lending for Homes on Friday. In the commodities market, crude oil prices extended their decline below the $74.00 mark per barrel, testing the transitory 55-day SMA, while gold prices continued their uptrend, reaching new highs beyond $2060, and silver rebounded from the $22.50 zone after two consecutive sessions of losses.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| USD | Average Hourly Earnings m/m | 21:30 | 0.3% |

| USD | Non-Farm Employment Change | 21:30 | 187K |

| USD | Unemployment Rate | 21:30 | 3.8% |

| USD | Revised UoM Consumer Sentiment | 23:00 | 78.9 |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.