Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

In a significant market downturn, Federal Reserve chairman Jerome Powell’s indication of no rate cut in March resulted in the Dow Jones Industrial Average’s worst performance since December. Despite this, the Federal Reserve addressed concerns by removing a tightening bias statement. Notable stock movements included Alphabet’s 7% drop due to disappointing ad revenue, while Boeing’s shares climbed over 5%. Despite the overall downturn, January closed positively for major averages. Powell’s as-expected announcement on rate cuts left the dollar index exhibiting volatility, influenced by below-forecast U.S. economic indicators. Specific currency pair movements included USD/JPY rebounding and EUR/USD facing a decline driven by disappointing Eurozone data. Sterling experienced a drop ahead of the BoE meeting, hinting at a probable rate cut in May or June.

Stocks experienced a significant decline as Federal Reserve chairman Jerome Powell indicated that the central bank was unlikely to cut rates in March. The Dow Jones Industrial Average dropped by 317.01 points, marking its worst performance since December, while the S&P 500 and Nasdaq Composite also saw substantial declines, with the former experiencing its worst day since September and the latter since October. Powell’s comments on the lack of confidence for a rate cut in March led to a session low for the major averages.

Despite the overall market downturn, the Federal Reserve did address traders’ concerns by removing the statement signaling a tightening bias, emphasizing that the policy rate might have reached its peak for the tightening cycle. Treasury yields fluctuated, with the 10-year yield trading around 3.9%. Notable stock movements included Alphabet’s over 7% drop, the worst since October 25, driven by disappointing ad revenue, while Boeing’s shares climbed over 5% due to quarterly results beating analyst estimates. Overall, the market’s monthly gains were impacted, but January still closed positively for all three major averages, with the S&P 500 adding 1.6%, the Dow advancing 1.2%, and the Nasdaq gaining 1%.

Data by Bloomberg

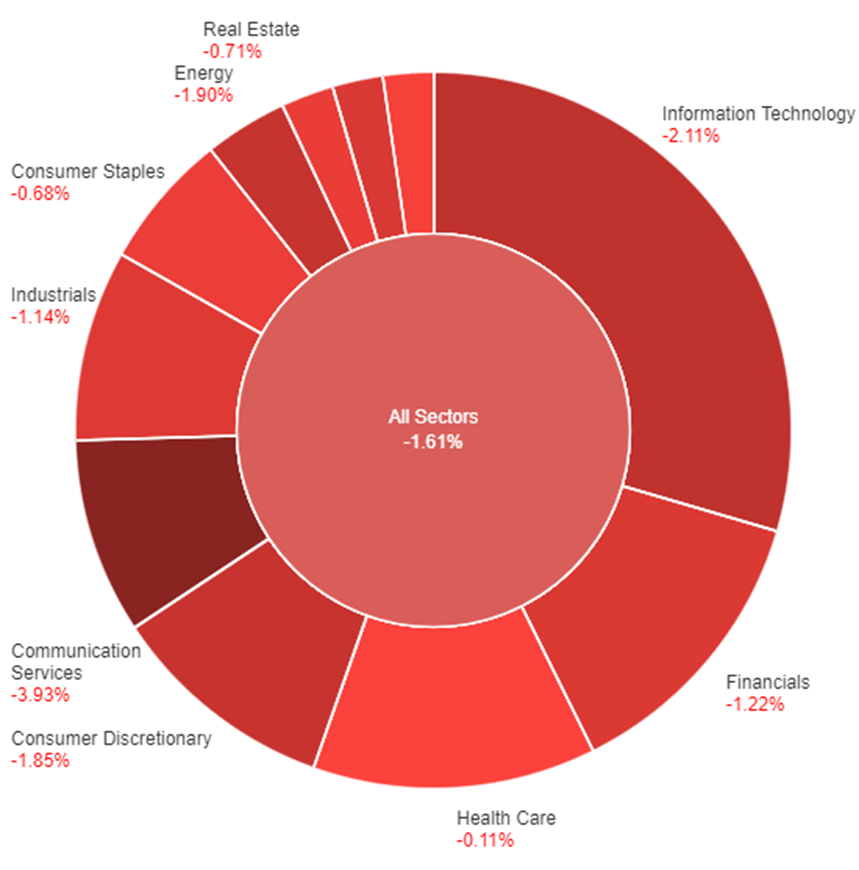

On Wednesday, a broad decline was observed across all sectors, with the overall market experiencing a downturn of -1.61%. Notably, Information Technology and Communication Services were the hardest hit, facing substantial losses of -2.11% and -3.93%, respectively. The negative trend extended to various industries, including Energy (-1.90%), Consumer Discretionary (-1.85%), and Financials (-1.22%). Sectors such as Health Care, Utilities, and Consumer Staples also saw minor decreases, contributing to the day’s overall bearish sentiment. Industrials, Materials, and Real Estate experienced moderate declines, emphasizing a widespread pullback in the market on this particular Wednesday.

In response to an as-expected Fed announcement, the dollar index exhibited volatility in Wednesday’s trade. Fed Chair Jerome Powell refrained from committing to a schedule for rate cuts, leaving markets frustrated as they sought clarity on a potential move in March. Despite ending the FOMC’s tightening bias, Powell emphasized the need for upcoming data to confirm the sustainability of the disinflation trend and determine the timing of any easing. The dollar index strengthened by 0.15%, influenced by below-forecast U.S. economic indicators and fluctuations in risk sentiment tied to declining mega cap and regional banks stocks.

In specific currency pair movements, USD/JPY rebounded after a significant initial fall, spurred by a rise in JGB yields following discussions about exiting negative rates in the December BoJ meeting. EUR/USD faced a 0.36% decline, driven by lower Euro zone yields due to disappointing German data and falling inflation figures. The ECB, expected to wait until April for a cut, aligns with the Fed’s projection of 145bp in cuts for the year. Meanwhile, Sterling experienced a 0.24% drop ahead of the BoE meeting, anticipated as a prelude to a probable rate cut in May or June, maintaining a stagnant range between 1.2600 and 1.2800 since mid-December.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| USD | Federal Funds Rate | 03:00 | 5.50% (Actual) |

| GBP | BOE Monetary Policy Report | 20:00 | |

| GBP | Monetary Policy Summary | 20:00 | |

| GBP | MPC Official Bank Rate Votes | 20:00 | 2 – 0 – 7 |

| GBP | Official Bank Rate | 20:00 | 5.25% |

| GBP | BOE Gov Bailey Speaks | 20:30 | |

| USD | Unemployment Claims | 21:30 | 213K |

| USD | ISM Manufacturing PMI | 23:00 | 47.2 |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.