Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

The stock market presented a mixed picture as the S&P 500 closed marginally lower and the Dow Jones hit a record high, while the Nasdaq Composite fell. This cautious trading reflects investor anticipation of the Federal Reserve’s decision on interest rates. In corporate news, General Motors and F5 celebrated stock gains post-earnings, contrasting with declines in Whirlpool and JetBlue stocks. The currency market saw the dollar index dip slightly, influenced by U.S. job openings and consumer confidence data. Attention in the currency market remains focused on the Federal Reserve, with reduced expectations of a March rate cut. Upcoming U.S. labor data and global central bank actions are pivotal in shaping market expectations, impacting various currency pairs, including the EUR/USD and USD/JPY.

In the latest stock market update, the S&P 500 closed almost unchanged, with a slight decrease of 0.06%, ending at 4,924.97, as investors awaited the Federal Reserve’s decision on interest rates. The Dow Jones Industrial Average experienced a modest gain, rising by 133.86 points or 0.35% to close at a record 38,467.31, marking its seventh record closure of the year. Meanwhile, the Nasdaq Composite saw a decline, dropping 0.76% to finish at 15,509.90. The focus is on the Federal Open Market Committee’s two-day policy meeting, with the Fed funds futures market indicating a 97% probability of unchanged interest rates. Investors are particularly keen on any potential shifts in the policy statement concluding the meeting.

On the corporate front, General Motors’ shares surged nearly 8% following better-than-expected earnings, while cybersecurity company F5’s stock increased slightly under 1% after a strong financial report. Sanmina, an electronics manufacturer, saw its shares soar over 28% due to impressive earnings per share and promising guidance for the current quarter. In contrast, Whirlpool’s shares fell 6.6% after the company forecasted a disappointing outlook for the full year. JetBlue also experienced a decline of 4.7% after predicting minimal revenue growth in 2024 and rising costs. These developments come ahead of major tech reports from companies like Microsoft and Alphabet. This earnings season has been positive overall, with about 79% of the 144 companies that have reported, or roughly 29% of the index, surpassing Wall Street estimates.

Data by Bloomberg

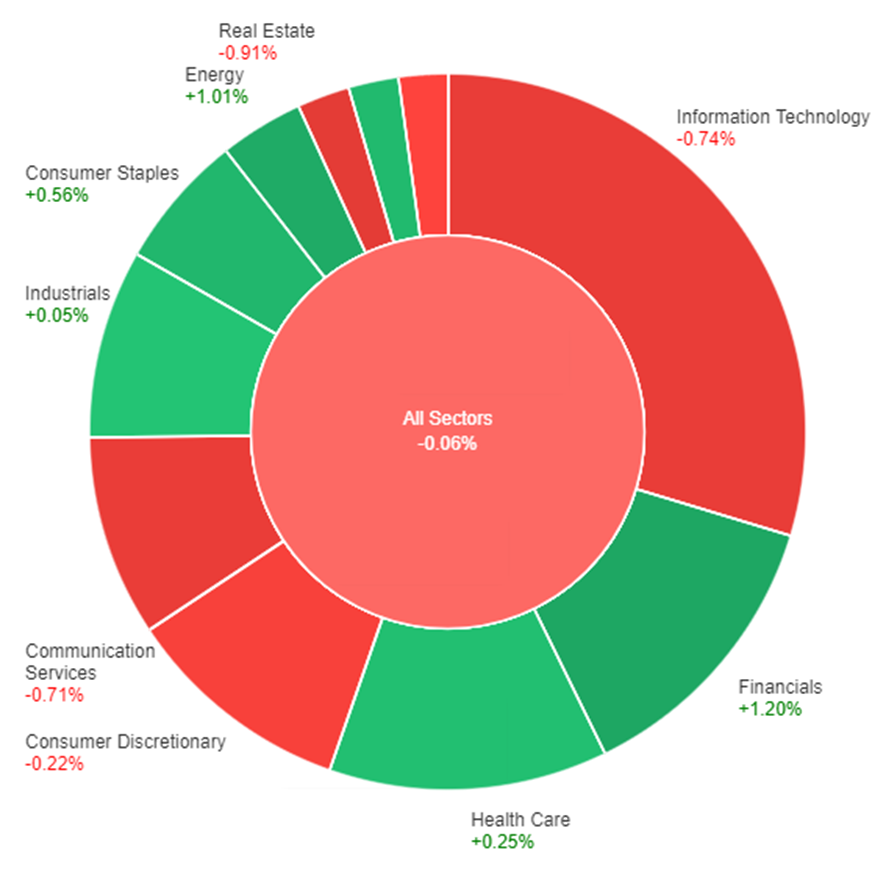

On Tuesday, the overall market experienced a slight decline, with the all-sectors index down by 0.06%. Financials led the gains with a notable increase of 1.20%, followed by Energy and Consumer Staples, which rose by 1.01% and 0.56% respectively. Materials and Health Care sectors also saw modest gains. Industrials barely moved with a slight increase of 0.05%. In contrast, several sectors faced declines, with Real Estate experiencing the most significant drop of 0.91%. Information Technology and Communication Services also struggled, decreasing by 0.74% and 0.71% respectively. Utilities and Consumer Discretionary sectors saw smaller declines. This mixed performance indicates a varied investor sentiment across different sectors.

In recent currency market updates, the dollar index experienced a slight decline of 0.10% during the New York afternoon trade. This movement was influenced by a combination of factors, including month-end selling, stronger-than-expected U.S. job openings, and consumer confidence reaching a two-year high, which met forecasts. Despite these developments, the dollar struggled to maintain its earlier gains, primarily due to concerns arising from the JOLTS data, which indicated an increase in the quits rate alongside higher layoffs and discharges. These factors contributed to a cap on Treasury yields. Regarding the EUR/USD pair, a key component of the dollar index, it remained stable and showed signs of recovery. This rebound followed the pair maintaining support at the 50% Fibonacci retracement level of the October-December rise, marked at 1.0794. Additionally, the Eurozone’s GDP slightly outperformed expectations with a 0.1% increase in Q4, driven by growth in Spain and Italy, although Germany’s GDP results aligned with forecasts, showing a decline.

The currency markets are also closely watching the Federal Reserve’s next moves, with futures markets now indicating a reduced likelihood of a March Fed rate cut, down to 40% from an earlier estimate closer to 50%. This adjustment reflects a market sentiment that aligns more closely with the three rate cuts anticipated in the Fed’s December dot plots. The remainder of this week’s U.S. labor market data, including reports from ADP, jobless claims, Challenger layoffs, and the crucial Friday employment report, will be pivotal in shaping expectations. In the context of the Fed’s favored core PCE inflation gauge falling to the 2% target in the second half of 2023, there is still a significant expectation of a rate cut by March or certainly by May. In comparison, the ECB and BoE are not expected to implement cuts until April and June, respectively, while a modest 10bp hike by the BoJ is anticipated around April or June. In other currency pairs, USD/JPY saw a 0.2% increase following the post-JOLTS rebound in Treasury-JGB yield spreads, while Sterling and the Australian dollar experienced declines amid various economic factors and data releases.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| AUD | Consumer Price Index q/q | 08:30 | 0.6% (Actual) |

| AUD | Consumer Price Index y/y | 08:30 | 3.4% (Actual) |

| EUR | German Prelim CPI q/q | Tentative | 0.1% |

| USD | ADP Non-Farm Employment Change | 21:15 | 148K |

| CAD | Gross Domestic Product m/m | 21:30 | 0.1% |

| USD | Employment Cost Index q/q | 21:30 | 1.0% |

| USD | Federal Funds Rate | 03:00 (1st Feb) | 5.50% |

| USD | FOMC Statement | 03:00 (1st Feb) | |

| USD | FOMC Press Conference | 03:30 (1st Feb) |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.